- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

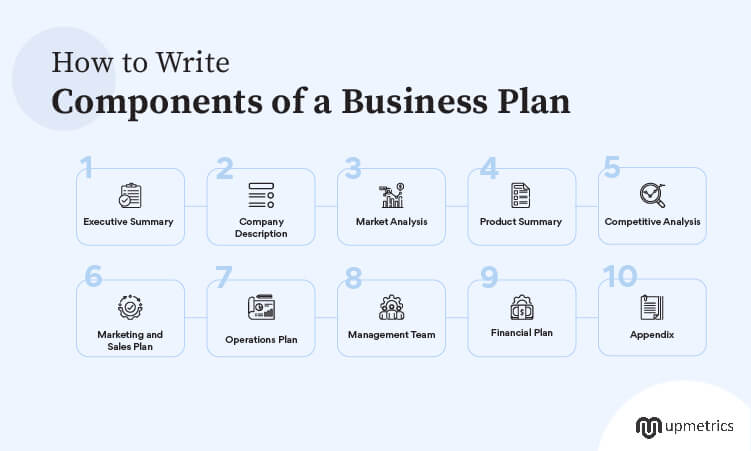

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-14343635291-33bf053f368c43f6a792e94775285bbd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

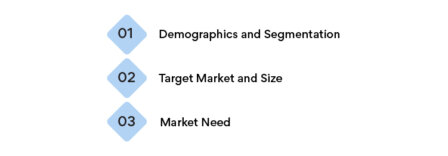

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

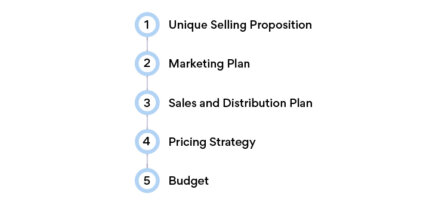

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

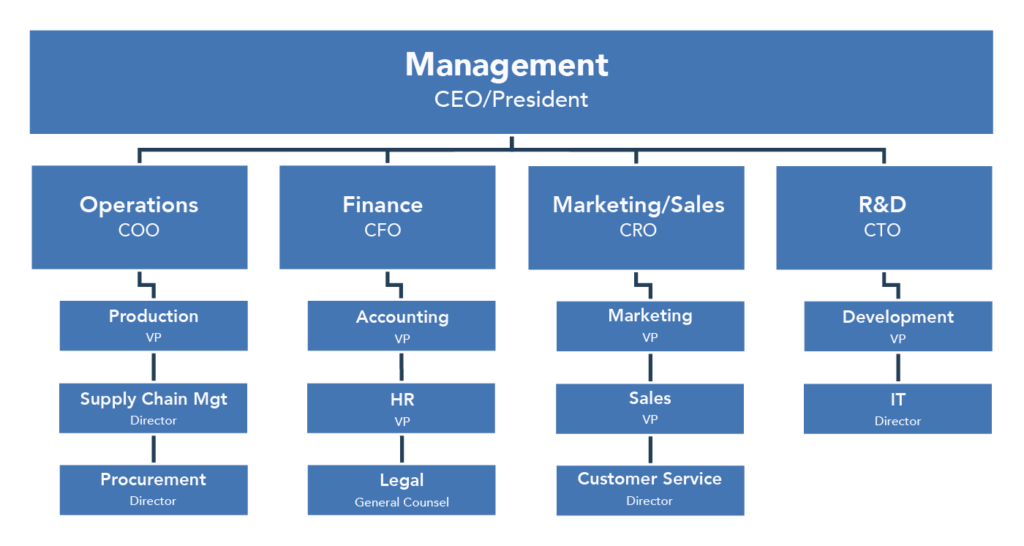

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

10 Essential Components of a Business Plan and How to Write Them

Business Plan Template

Ayush Jalan

- January 4, 2024

12 Min Read

A business plan is an essential document for any business, whether it’s a startup or an established enterprise. It’s the first thing any interested investor will ask for if they like your business idea and want to partner with you.

That’s why it’s important to pay attention when writing your business plan and the components inside it. An incomplete business plan can give the impression that you’re unqualified—discouraging investors and lenders.

A good business plan reduces ambiguity and communicates all essential details such as your financials, market analysis, competitive analysis, and a timeline for implementation of the plan. In this article, we’ll discuss the 10 important business plan components.

10 Important Business Plan Components

A comprehensive and well-thought-out business plan acts as a roadmap that guides you in making sound decisions and taking the right actions at the right times. Here are its key components and what to include in them.

1. Executive summary

The executive summary is one of the most important parts of a business plan. It’s the first thing potential investors will read and should therefore provide a clear overview of your business and its goals.

In other words, it helps the reader get a better idea of what to expect from your company. So, when writing an executive summary of your business, don’t forget to mention your mission and vision statement.

Mission statement

A mission statement is a brief statement that outlines your objectives and what you want to achieve. It acts as a guiding principle that informs decisions and provides a clear direction for the organization to follow.

For instance, Google’s mission is to “organize the world’s information and make it universally accessible and useful.” It’s short, inspiring, and immediately communicates what the company does.

A mission statement should be realistic, and hint towards a goal that is achievable in a reasonable amount of time with the resources you currently have or are going to acquire in the near future.

Vision statement

While a mission statement is more actionable and has an immediate effect on the daily activities of the company, a vision statement is more aspirational and has a much broader scope.

In other words, it highlights where the company aims to go in the future and the positive change it hopes to make in the world within its lifetime.

2. Company description

The second component of your business plan is the company description. Here, you provide a brief overview of your company, its products or services, and its history. You can also add any notable achievements if they are significant enough for an investor to know.

A company overview offers a quick bird’s-eye view of things such as your business model , operational capabilities, financials, business philosophy, size of the team, code of conduct, and short-term and long-term objectives.

Products and services

The products and services part of your company description explains what your business offers to its customers, how it’s delivered, and the costs involved in acquiring new customers and executing a sale.

Company History

Company history is the timeline of events that took place in your business from its origin to the present day. It includes a brief profile of the founder(s) and their background, the date the company was founded, any notable achievements and milestones, and other similar facts and details.

If you’re a startup, you’ll probably not have much of a history to write about. In that case, you can share stories of the challenges your startup faced during its inception and how your team overcame them.

3. Market analysis

The market analysis section of your business plan provides an in-depth analysis of the industry, target market, and competition. It should underline the risks and opportunities associated with your industry, and also comment on the attributes of your target customer.

Demographics and segmentation

Understanding the demographics of your customers plays a big role in how well you’re able to identify their traits and serve them.

By dividing your target audience into smaller and more manageable groups, you can tailor your services and products to better meet their needs.

You can use demographics such as age, gender, income, location, ethnicity, and education level to better understand the preferences and behaviors of each segment, and use that data to create more effective marketing strategies.

Target market and size

Understanding your target market lies at the core of all your marketing endeavors. After all, if you don’t have a clear idea of who you’re serving, you won’t be able to serve well no matter how big your budget is.

For instance, Starbucks’ primary target market includes working professionals and office workers. The company has positioned itself such that many of its customers start their day with its coffee.

Estimating the market size helps you know how much scope there is to scale your business in the future. In other words, you’re trying to determine how much potential revenue exists in this market and if it’s worth the investment.

Market need

The next step is to figure out the market need, i.e., the prevalent pain points that people in that market experience. The easiest way to find these pain points is to read the negative reviews people leave on Amazon for products that are similar to yours.

The better your product solves those pain points, the better your chances of capturing that market. In addition, since your product is solving a problem that your rivals can’t, you can also charge a premium price.

To better identify the needs of your target customers, it helps to take into account things such as local cultural values, industry trends, buying habits, tastes and preferences, price elasticity, and more.

4. Product Summary

The product summary section of your business plan goes into detail about the features and benefits that your products and services offer, and how they differ from your competitors. It also outlines the manufacturing process, pricing, cost of production, inventory, packaging, and capital requirements.

5. Competitive analysis

Unless you’ve discovered an untapped market, you’re probably going to face serious competition and it’s only going to increase as you scale your business later down the line.

This is where the competitive analysis section helps; it gives an overview of the competitive landscape, introduces your immediate rivals, and highlights the current dominant companies and their market share.

In such an environment, it helps to have certain competitive advantages against your rivals so you can stand out in the market. Simply put, a competitive advantage is the additional value you can provide to your customers that your rivals can’t—perhaps via unique product features, excellent customer service, or more.

Want to Perform Competitive Analysis for Your Business?

Discover your competition’s secrets effortlessly with our user-friendly and Free Competitor Analysis Generator!

6. Marketing and sales plan

The marketing and sales plan is one of the most important business plan components. It explains how you plan to penetrate the market, position your brand in the minds of the buyers, build brand loyalty, increase sales, and remain competitive in an ever-changing business environment.

Unique selling proposition

A unique selling proposition (USP) conveys how your products and services differ from those of your competitors, and the added value those differences provide.

A strong USP will stand out in a competitive market and make potential customers more likely to switch to your brand—essentially capturing the market share of your rivals.

Marketing Plan

Your product might be unique, but if people don’t even know that it exists, it won’t sell. That’s where marketing comes in.

A marketing plan outlines strategies for reaching your target market and achieving sales goals. It also outlines the budget required for advertising and promotion.

You may also include data on the target market, target demographics, objectives, strategies, a timeline, budget, and the metrics considered for evaluating success.

Sales and distribution plan

Once people are made aware of your product, the next step is to ensure it reaches them. This means having a competent sales and distribution plan and a strong supply chain.

Lay out strategies for reaching potential customers, such as online marketing, lead generation, retail distribution channels, or direct sales.

Your goal here is to minimize sales costs and address the risks involved with the distribution of your product. If you’re selling ice cream, for example, you would have to account for the costs of refrigeration and cold storage.

Pricing strategy

Pricing is a very sensitive yet important part of any business. When creating a pricing strategy , you need to consider factors such as market demand, cost of production, competitor prices, disposable income of target customers, and profitability goals.

Some businesses have a small profit margin but sell large volumes of their product, while others sell fewer units but with a massive markup. You will have to decide for yourself which approach you want to follow.

Before setting your marketing plans into action, you need a budget for them. This means writing down how much money you’ll need, how it will be used, and the potential return you are estimating on this investment.

A budget should be flexible, meaning that it should be open to changes as the market shifts and customer behavior evolves. The goal here is to make sure that the company is making the best use of its resources by minimizing the wastage of funds.

7. Operations plan

The operations plan section of your business plan provides an overview of how the business is run and its day-to-day operations. This section is especially important for manufacturing businesses.

It includes a description of your business structure, the roles and responsibilities of each team member, the resources needed, and the procedures you will use to ensure the smooth functioning of your business. The goal here is to maximize output whilst minimizing the wastage of raw material or human labor.

8. Management team

At the core of any successful business lies a dedicated, qualified, and experienced management team overlooking key business activities.

This section provides an overview of the key members of your management team including their credentials, professional background, role and responsibilities, experience, and qualifications.

A lot of investors give special attention to this section as it helps them ascertain the competence and work ethic of the members involved.

Organizational structure

An organizational structure defines the roles, responsibilities, decision-making processes, and authority of each individual or department in an organization.

Having a clear organizational structure improves communication, increases efficiency, promotes collaboration, and makes it easier to delegate tasks. Startups usually have a flatter organizational hierarchy whereas established businesses have a more traditional structure of power and authority.

9. Financial Plan

Financials are usually the least fun thing to talk about, but they are important nonetheless as they provide an overview of your current financial position, capital requirements, projections, and plans for repayment of any loans.

Your financial plan should also include an analysis of your startup costs, operating costs, administration costs, and sources of revenue.

Funding requirements

Once an investor has read through your business plan, it’s time to request funding. Investors will want to see an accurate and detailed breakdown of the funds required and an explanation of why the requested funds are necessary for the operation and expansion of your business.

10. Appendix

The appendix is the last section of your business plan and it includes additional supporting documents such as resumes of key team members, market research documents, financial statements, and legal documents.

In other words, anything important or relevant that couldn’t fit in any of the former sections of your business plan goes in the appendix.

Write a Business Plan Worth Reading

Starting a business is never easy, but it’s a little less overwhelming if you have a well-made business plan. It helps you better navigate the industry, reduce risk, stay competitive, and make the best use of your time and money.

Remember, since every business is unique, every business plan is unique too, and must be regularly updated to keep up with changing industry trends. Also, it’s very likely that interested investors will give you feedback, so make sure to implement their recommendations as well.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Ayush is a writer with an academic background in business and marketing. Being a tech-enthusiast, he likes to keep a sharp eye on the latest tech gadgets and innovations. When he's not working, you can find him writing poetry, gaming, playing the ukulele, catching up with friends, and indulging in creative philosophies.

Related Articles

How to Write a Business Plan Complete Guide

How to Write an Operations Plan Section of your Business Plan

How to Prepare a Financial Plan for Small Business?

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Different Parts of a Business Plan

- Small Business

- Business Planning & Strategy

- Elements of Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

6 Types of Business Plans

How do i write a three-year business plan, why is planning an important step in starting a business.

- What Are the Key Elements of a Business Plan?

- How to Counter the Argument From a Potential Investor That Most Small Businesses Fail

A business plan is your chance to tell your story to potential investors and lenders. This is where you bring the vision of having your own business to life. Each section of a business plan interacts with the other sections. They must all come together, like instruments in an orchestra, to create a ballad that lures others to your dreams.

The Executive Summary

The executive summary is the first paragraph investors read. If it doesn't grab the reader's interest, it will be the last paragraph they read. In just a few sentences, describe the business concept, its products and services, the competitive advantages and why the company will be incredibly successful. This opening should intrigue readers and make them want to read more.

The Business Description

The description fills in the details outlined in your summary. It puts together the structure of the business and should include the following:

- What is the name of the business?

- Where is it located?

- What is the business structure: corporation, proprietorship or limited liability company?

- Why is this business unique?

- Why will it succeed?

- What factors will cause the business to grow?

">Description of Products and Services

The descriptions should show why the products and services are innovative, unique and exciting. The reader should believe that you've really come up with an idea or concept that no one else has created. Use the following as an outline:

- What are the products or services you plan to offer?

- What are their features?

- What are their benefits?

- What makes these products and services unique?

- How do they meet the needs of your customers?

- How do they add value to the customers?

Defining the Target Market

Your target market must be clearly defined. You need to show detailed thought about who your customers are and that you have identified their characteristics:

- Who are the likely customers?

- Are they male or female?

- What are their ages?

- Where do they live?

- How many customers are in your target market?

- Is the market growing, shrinking, or is it stable?

- What are the national and local trends that affect your industry?

Outline Your Competitive Advantages

In this section, you have to spell out how you intend to forge a share of the market against more established competitors. This can't be something like just working harder; it needs specific actions and steps that have a chance of succeeding and winning customers. Outline your competitive action plan with answers to these questions:

- Who are your strongest competitors?

- What are their strengths and weaknesses?

- How do they attract customers?

- Why do customers buy from them?

- Are your products price-competitive?

- Are your competitors' businesses increasing or decreasing?

- What will make your company different and better than your competition?

Describe Your Marketing Strategy

After you identify the weaknesses of your competitors, the marketing plan should describe how you plan to exploit those weaknesses.

- How will you position your products against the competition?

- Will you compete on price?

- Can you offer better customer service and quicker response times?

- Do you have a company logo and promotional theme?

- What sales tactics will you use?

- How will your products be distributed?

Financial Projections and Profit Plan

The objective of financial projections is to show that you have worked through the numbers and come up with a plan to make a profit. Great ideas are nice, but you need cash flow to start up a business and stay around long enough to gain market share.

- What are the projections of sales and cash flow for the first year?

- What are the initial operating costs?

- How much do you need for personal expenses, and where will these funds come from?

- How will you finance the startup and growth of the business?

- Do you have a bank loan or line of credit?

- How long will it take to break even and have a positive cash flow?

A word of caution: Take your sales projections for the first few years and cut that number in half. Recalculate your cash flow and profits based on the lowered sales estimates, because these figures will be closer to reality. If your business can survive with these lower projections, then you've done a good job of figuring out how to forge ahead and become successful.

Sell Your Management Team

The real heart of any business is its people. Even the best ideas will fail if a company does not have skilled and aggressive employees. The management portion of the business plan needs to assure investors and lenders that you have a top-notch team lined up to work for your company. Sell your management team with answers to the following questions:

- Who will manage the company and each of its departments?

- What are the managers' experience and qualifications?

- How many employees are needed for full-time and part-time positions?

- What are the jobs and responsibilities of each employee?

- Will the company pay competitive wages and benefits?

- How will employees get training?

A business plan is not just something needed for possible investors and lenders. It forces the aspiring entrepreneur to make a harsh and realistic analysis of his dream business. The would-be owner must address all the different parts of the business if he wants to have a chance at success.

- Northeastern University: The Guide to Writing a Business Plan

- Santa Clara University: The Business Plan

- University of Florida: The Nuts and Bolts of Great Business Plans

- U.S. Small Business Administration: Fill in the Blanks Business Plan

James Woodruff has been a management consultant to more than 1,000 small businesses. As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company's operational, financial and business management issues. James has been writing business and finance related topics for work.chron, bizfluent.com, smallbusiness.chron.com and e-commerce websites since 2007. He graduated from Georgia Tech with a Bachelor of Mechanical Engineering and received an MBA from Columbia University.

Related Articles

What is the overall purpose of a business plan, why is an effective business plan introduction important, basic business plan structure, how to create a business plan as an entrepreneur, what factors make the difference between a good business plan & an excellent one, how to write a comprehensive business plan, how to understand a business plan, how to write a business plan for an equine facility, what is a business plan template, most popular.

- 1 What Is the Overall Purpose of a Business Plan?

- 2 Why Is an Effective Business Plan Introduction Important?

- 3 Basic Business Plan Structure

- 4 How to Create a Business Plan as an Entrepreneur

- Financing & Incentives

- Location & Zoning

- Find a license or permit

Parts of a Business Plan

Whether you are starting a pizza shop or a plumbing business, a flower shop or a factory, you need a solid plan. In fact, your Business Plan will be an essential tool throughout the life of your business – from starting out to cashing in. It will help you to start out on the right foot, stay focused, get financing, manage your growth, and more.

Not every Business Plan will be the exactly same, but every Plan should incorporate several key elements.

The Parts of the Plan

Here are the key pieces to a solid Business Plan.

- The title, or heading, of the plan, and very brief description of the business.

- The name of the owner

- The company name and location

- A copyright or confidentiality notice

Table of Contents

- A list of the individual sections and their page numbers, starting with the Title Page and ending with a section for Special Materials (references, etc.).

Summary/Overview

- A brief, but focused statement (a few sentences or paragraphs) stating why the business will be successful. This is the most important piece of a Business Plan because it brings everything together.

Market Analysis

- Identifies specific knowledge about the business and its industry, and the market (or customers) it serves.

- An analysis that identifies and assesses the competition.

Description of the Company

- Information about the nature of the business and the factors that should make it successful .

- Special business skills and talents that provide the business with a competitive advantage, such as a unique ability to satisfy specific customer needs, special methods of delivering a product or service, and so on.

Organization & Management

- The company’s organizational and legal structure, Is it a sole proprietorship? A partnership? A corporation? (See: “ Ownership Structures “)

- Profiles of the ownership and management team: What is their background, experience and responsibilities?

Marketing & Sales

- The company’s process of identifying and creating a customer base. (See: “ Market Research “)

Description of Product or Service

- How they will benefit from the product or service?

- Specific needs or problems that the business can satisfy or solve, focusing especially on areas where the business has the strongest skills or advantages.

- The amount of current and future funding needed to start or expand the business. Includes the time period that each amount will cover, the type of funding for each (i.e., equity, debt), and the proposed or requested repayment terms.

- How the funds will be used: For equipment and materials? Everyday working capital? Paying off debt?

- Explains or projects how the company is expected to perform financially over the next several years. (Sometimes called a “pro-forma projection.”) Because investors and lenders look closely at this projection as a measure of your company’s growth potential, professional input is strongly recommended.

- Credit histories (personal & business)

- Resumes of key personnel and partners

- Letters of reference

- Details of market studies

- Copies of licenses, permits, patents, leases, contracts, etc.

- A list of business consultants, attorneys, accountants, etc.

These are just the basic essentials to creating a Business Plan. Each plan should be tailored to the specific business. (See: Business Plan Assistance )

5 Chapter 5 – The Business Plan

Developing your strategy.

As mentioned in Chapter 2 , it is critically important for any business organization to be able to accurately understand and identify what constitutes customer value. To do this, one must have a clear idea of who your customers are or will be. However, simply identifying customer value is insufficient. An organization must be able to provide customer value within several important constraints. One of these constraints deals with the competition—what offerings are available and at what price. Also, what additional services might a company provide? A second critically important constraint is the availability of resources to the business organization. Resources consist of factors such as money, facilities, equipment, operational capability, and personnel.

Here is an example: a restaurant identified its prime customer base as being upscale clientele in the business section of a major city. The restaurant recognized that it has numerous competitors that are interested in providing the same clientele with an upscale dining experience. Our example restaurant might provide a five-course, five-star gourmet meal to its customers. It also provides superlative service. If a comparable restaurant failed to provide a comparable meal than the example restaurant, the example restaurant would have a competitive advantage. If the example restaurant offered these sumptuous meals for a relatively low price in comparison to its competitors, it would initially seem to have even more of an advantage. However, if the price charged is significantly less than the cost of providing the meal, the service in this situation could not be maintained. In fact, the restaurant inevitably would have to go out of business. Providing excellent customer service may be a necessary condition for business survival but, in and of itself, it is not a sufficient condition.

So how does one go about balancing the need to provide customer value within the resources available while always maintaining a watchful eye on competitors’ actions? We are going to argue that what is required for that firm is to have a strategy .

The word strategy is derived from the Greek word strategos , which roughly translates into the art of the general, namely a military leader. Generals are responsible for marshaling required resources and organizing the troops and the basic plan of attack. Much in the same way, executives as owners of businesses are expected to have a general idea of the desired outcomes, acquire resources, hire and train personnel, and generate plans to achieve those outcomes. In this sense, all businesses, large and small, have strategies, whether they are clearly written out in formal business plans or reside in the mind of the owner of the business.

There are many different formal definitions of strategy with respect to business. The following is a partial listing of some of the definitions given by key experts in the field:

“A strategy is a pattern of objectives, purposes or goals and the major policies and plans for achieving these goals, stated in such a way as to define what business the company is in or is to be in and the kind of company it is or to be .” [1] “The determination of the long-run goals and objectives of an enterprise, and the adoption of courses of action and the allocation of resources necessary for carrying out these goals .” [2] “What business strategy is all about, in a word, is competitive advantage .” [3]

We define the strategy of a business as follows: A firm’s strategy is the path by which it seeks to provide its customers with value, given the competitive environment and within the constraints of the resources available to the firm.

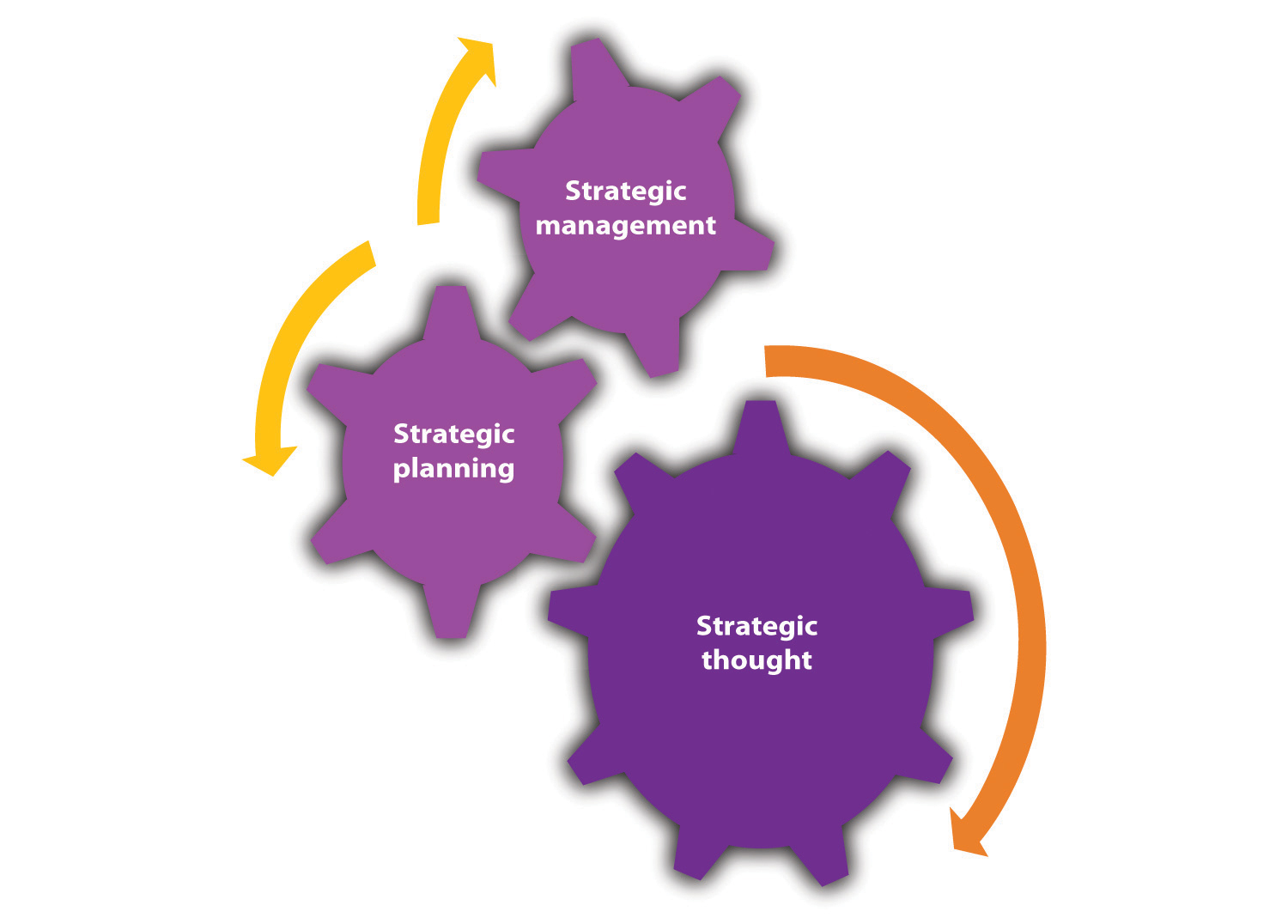

Whatever definition of strategy is used, it is often difficult to separate it from two other terms: strategic planning and strategic management. Both terms are often perceived as being in the domain of large corporations, not necessarily small to midsize businesses. This is somewhat understandable. The origin of strategic planning as a separate discipline occurred over fifty years ago. It was mainly concerned with assisting huge multidivisional or global businesses in coordinating their activities. In the intervening half-century, strategic planning has produced a vast quantity of literature. Mintzberg, Lampel, Ahlstrand, in a highly critical review of the field, identified ten separate schools associated with strategic planning. [4] With that number of different schools, it is clear that the discipline has not arrived at a common consensus. Strategic planning has been seen as a series of techniques and tools that would enable organizations to achieve their specified goals and objectives. Strategic management was seen as the organizational mechanisms by which you would implement the strategic plan. Some of the models and approaches associated with strategic planning and strategic management became quite complex and would prove to be fairly cumbersome to implement in all but the largest businesses. Further, strategic planning often became a bureaucratic exercise where people filled out forms, attended meetings, and went through the motions to produce a document known as the strategic plan. Sometimes what is missed in this discussion was a key element—strategic thinking. Strategic thinking is the creative analysis of the competitive landscape and a deep understanding of customer value. It should be the driver (see “Strategy Troika”) of the entire process. This concept is often forgotten in large bureaucratic organizations.

Strategy Troika

Strategic thinkers often break commonly understood principles to reach their goals. This is most clearly seen among military leaders, such as Alexander the Great or Hannibal. Robert E. Lee often violated basic military principles, such as dividing his forces. General Douglas MacArthur shocked the North Koreans with his bold landings behind enemy lines at Inchon. This mental flexibility also exists in great business leaders.

Solomon and Friedman recounted a prime example of true strategic thinking. [5] Wilson Harrell took a small, closely held, cleaning spray company known as Formula 409 to the point of having national distribution. In 1967, the position that Formula 409 held was threatened by the possible entry of Procter & Gamble into the same spray cleaning market. Procter & Gamble was a huge consumer products producer, noted for its marketing savvy. Procter & Gamble began a program of extensive market research to promote its comparable product they called Cinch. Clearly, the larger firm had a much greater advantage. Harrell knew that Procter & Gamble would perform test market research. He decided to do the unexpected. Rather than directly confront this much larger competitor, he began a program where he reduced advertising expenditures in Denver and stopped promoting his Formula 409. The outcome was that Procter & Gamble had spectacular results, and the company was extremely excited with the potential for Cinch. Procter & Gamble immediately begin a national sales campaign. However, before the company could begin, Harrell introduced a promotion of his own. He took the Formula 409 sixteen-ounce bottle and attached it to a half-gallon size bottle. He then sold both at a significant discount. This quantity of spray cleaner would last the average consumer six to nine months. The market for Procter & Gamble’s Cinch was significantly reduced. Procter & Gamble was confused and confounded by its poor showing after the phenomenal showing in Denver. Confused and uncertain, the company chose to withdraw Cinch from the market. Wilson Harrell’s display of brilliant strategic thinking had bested them. He leveraged his small company’s creative thinking and flexibility against the tremendous resources of an international giant. Through superior strategic thinking, Harrell was able to best Procter & Gamble.

Do You Have a Strategy and What Is It?

We have argued that all businesses have strategies, whether they are explicitly articulated or not. Perry stated that “small business leaders seem to recognize that the ability to formulate and implement an effective strategy has a major influence on the survival and success of small business.” [6]

The extent to which a strategy should be articulated in a formal manner, such as part of a business plan, is highly dependent on the type of business. One might not expect a formally drafted strategy statement for a nonemployee business funded singularly by the owner. One researcher found that formal plans are rare in businesses with fewer than five employees. [7] However, you should clearly have that expectation for any other type of small or midsize business.

Any business with employees should have an articulated strategy that can be conveyed to them so that they might better assist in implementing it. Curtis pointed out that in the absence of such communication, “employees make pragmatic short-term decisions that cumulatively form an ad-hoc strategy.” [8] These ad hoc (realized) strategies may be at odds with the planned (intended) strategies to guide a firm. [9] However, any business that seeks external funding from bankers, venture capitalists, or “angels” must be able to specify its strategy in a formal business plan.

Clearly specifying your strategy should be seen as an end in itself. Requiring a company to specify its strategy forces that company to think about its core issues, such as the following:

- Who are your customers?

- How are you going to provide value to those customers?

- Who are your current and future competitors?

- What are your resources?

- How are you going to use these resources?

One commentator in a blog put it fairly well, “It never ceases to amaze me how many people will use GPS or Google maps for a trip somewhere but when it comes to starting a business they think that they can do it without any strategy, or without any guiding road-map.” Harry Tucci, comment posted to the following blog: [10]

Types of Strategies

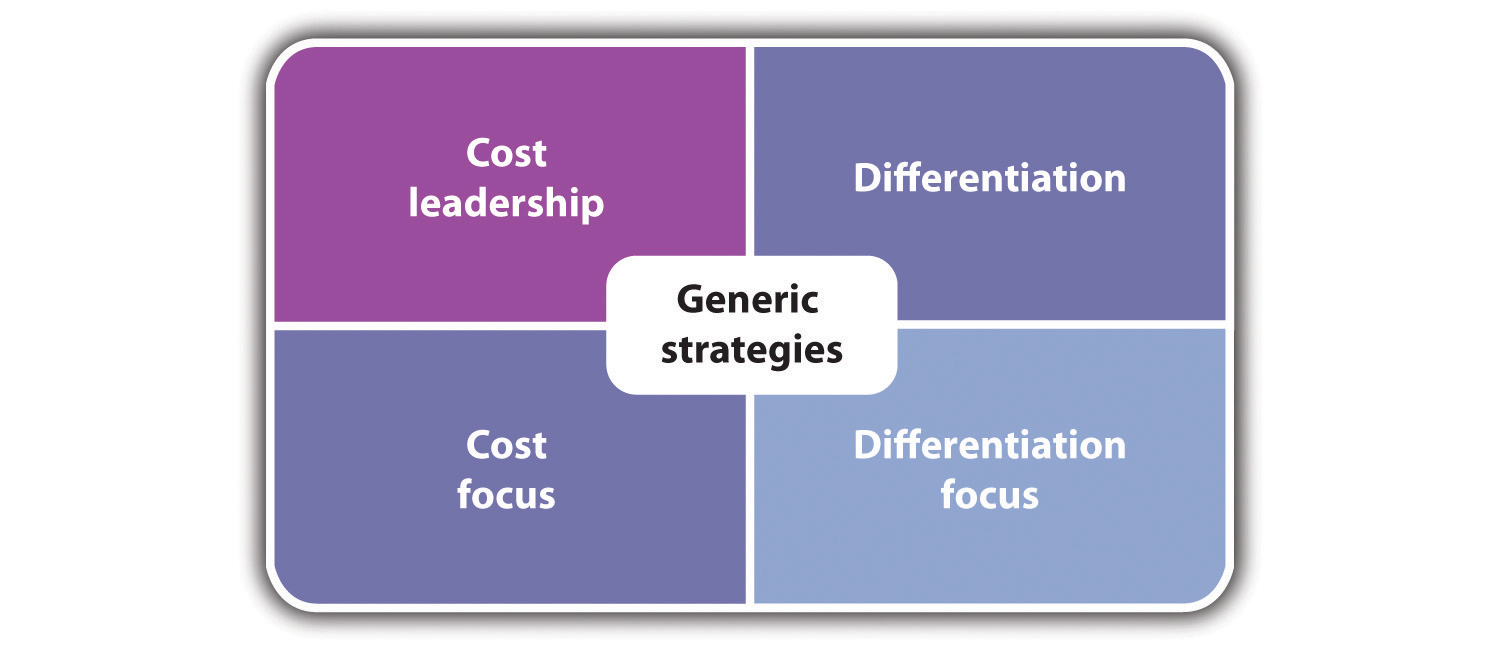

In 1980, Michael Porter a professor at Harvard Business School published a major work in the field of strategic analysis— Competitive Strategy . [11] To simplify Porter’s thesis, while competition is beneficial to customers, it is not always beneficial to those who are competing. Competition may involve lowering prices, increasing research and development (R&D), and increasing advertising and other expenses and activities—all of which can lower profit margins. Porter suggested that firms should carefully examine the industry in which they are operating and apply what he calls the five forces model. These five forces are as follows: the power of suppliers, the power of buyers, the threat of substitution, the threat of new entrants, and rivalry within the industry. We do not need to cover these five forces in any great detail, other than to say that once the analysis has been conducted, a firm should look for ways to minimize the dysfunctional consequences of competition. Porter identified four generic strategies that firms may choose to implement to achieve that end. Actually, he initially identified three generic strategies, but one of them can be bifurcated. These four strategies are as follows (see “Generic Strategies”): cost leadership, differentiation, cost focus, and differentiation focus. These four generic strategies can be applied to small businesses. We will examine each strategy and then discuss what is required to successfully implement them.

Generic Strategies

Low-Cost Advantage

A cost leadership strategy requires that a firm be in the position of being the lowest cost producer in its competitive environment. By being the lowest-cost producer, a firm has several strategic options open to it. It can sell its product or service at a lower price than its competitors. If price is a major driver of customer value, then the firm with the lowest price should sell more. The low-cost producer also has the option of selling its products or services at prices that are comparable to its competitors. However, this would mean that the firm would have a much higher margin than its competitors.

Obviously, following a cost leadership strategy dictates that the business be good at curtailing costs. Perhaps the clearest example of a firm that employs a cost leadership strategy is Walmart. Walmart’s investment in customer relations and inventory control systems plus its huge size enables it to secure the “best” deals from suppliers and drastically reduce costs. It might appear that cost leadership strategies are most suitable for large firms that can exploit economies of scale. This is not necessarily true. Smaller firms can compete on the basis of cost leadership. They can position themselves in low-cost areas, and they can exploit their lower overhead costs. Family businesses can use family members as employees, or they can use a web presence to market and sell their goods and services. A small family-run luncheonette that purchases used equipment and offers a limited menu of standard breakfast and lunch items while not offering dinner might be good example of a small business that has opted for a cost leadership strategy.

Differentiation

A differentiation strategy involves providing products or services that meet customer value in some unique way. This uniqueness may be derived in several ways. A firm may try to build a particular brand image that differentiates itself from its competitors. Many clothing lines, such as Tommy Hilfiger, opt for this approach. Other firms will try to differentiate themselves on the basis of the services that they provide. Dominoes began to distinguish itself from other pizza firms by emphasizing the speed of its delivery. Differentiation also can be achieved by offering a unique design or features in the product or the service. Apple products are known for their user-friendly design features. A firm may wish to differentiate itself on the basis of the quality of its product or service. Kogi barbecue trucks operating in Los Angeles represent such an approach. They offer high-quality food from mobile food trucks.” [12] They further facilitate their differentiation by having their truck routes available on their website and on their Twitter account.

Adopting a differentiation strategy requires significantly different capabilities than those that were outlined for cost leadership. Firms that employ a differentiation strategy must have a complete understanding of what constitutes customer value. Further, they must be able to rapidly respond to changing customer needs. Often, a differentiation strategy involves offering these products and services at a premium price. A differentiation strategy may accept lower sales volumes because a firm is charging higher prices and obtaining higher profit margins. A danger in this approach is that customers may no longer place a premium value on the unique features or quality of the product or the service. This leaves the firm that offers a differentiation strategy open to competition from those that adopt a cost leadership strategy.

Focus—Low Cost or Differentiation

Porter identifies the third strategy—focus. He said that focus strategies can be segmented into a cost focus and a differentiation focus .

In a focus strategy, a firm concentrates on one or more segments of the overall market. Focus can also be described as a niche strategy. Focus strategy entails deciding to some extent that we do not want to have everyone as a customer. There are several ways that a firm can adopt a focus perspective:

- Product line. A firm limits its product line to specific items of only one or more product types. California Cart Builder produces only catering trucks and mobile kitchens.

- Customer. A firm concentrates on serving the needs of a particular type of customer. Weight Watchers concentrates on customers who wish to control their weight or lose weight.

- Geographic area. Many small firms, out of necessity, will limit themselves to a particular geographic region. Microbrewers generally serve a limited geographic region.

- Particular distribution channel. Firms may wish to limit themselves with respect to the means by which they sell their products and services. Amazon began and remains a firm that sells only through the Internet.

Firms adopting focus strategies look for distinct groups that may have been overlooked by their competitors. This group needs to be of sufficiently sustainable size to make it an economically defensible option. One might open a specialty restaurant in a particular geographic location—a small town. However, if the demand is not sufficiently large for this particular type of food, then the restaurant will probably fail. Companies that lack the resources to compete on either a national level or an industry-wide level may adopt focus strategies. Focus strategies enable firms to marshal their limited resources to best serve their customers.

As previously stated, focus strategies can be bifurcated into two directions—cost focus or differentiation focus. IKEA sells low-priced furniture to those customers who are willing to assemble the furniture. It cuts its costs by using a warehouse rather than showroom format and not providing home delivery. Michael Dell began his business out of his college dormitory. He took orders from fellow students and custom-built computers to their specifications. This was a cost focus strategy. By building to order, it almost totally eliminated the need for any incoming, work-in-process, or finished goods inventories.

A focus differentiation strategy concentrates on providing a unique product or service to a segment of the market. This strategy may be best represented by many specialty retail outlets. The Body Shop focuses on customers who want natural ingredients in their makeup. Max and Mina is a kosher specialty ice cream store in New York City. It provides a constantly rotating menu of more than 300 exotic flavors, such as Cajun, beer, lox, corn, and pizza. The store has been written up in the New York Times and People magazine. Given its odd flavors, Max and Mina’s was voted the number one ice cream parlor in America in 2004. [13]

Evaluating Strategies

The selection of a generic strategy by a firm should not be seen as something to be done on a whim. Once a strategy is selected, all aspects of the business must be tied to implementing that strategy. As Porter stated, “Effectively implementing any of these generic strategies usually requires total commitment and supporting organizational arrangements.” [14] The successful implementation of any generic strategy requires that a firm possess particular skills and resources. Further, it must impose particular requirements on its organization (see “Summary of Generic Strategies”).

Even successful generic strategies must recognize that market and economic conditions change along with the needs of consumers. Henry Ford used a cost leadership strategy and was wildly successful until General Motors began to provide different types of automobiles to different customer segments. Likewise, those who follow a differentiation strategy must be cautious that customers may forgo “extras” in a downturn economy in favor of lower costs. This requires businesses to be vigilant, particularly with respect to customer value.

Summary of Generic Strategies

Key Takeaways

- Any firm, regardless of size, needs to know how it will compete; this is the firm’s strategy.

- Strategy identifies how a firm will provide value to its customers within its operational constraints.

- Strategy can be reduced to four major approaches—cost leadership, differentiation, cost focus, and differentiation focus.

- Once a given strategy is selected, all of a firm’s operations should be geared to implementing that strategy.

- No strategy will be successful forever and therefore needs to be constantly evaluated.

The Necessity for a Business Plan

An intelligent plan is the first step to success. The man who plans knows where he is going, knows what progress he is making and has a pretty good idea of when he will arrive. Planning is the open road to your destination. If you don’t know where you’re going, how can you expect to get there? – Basil Walsh