An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Library Search

- Commerce Research Library

Company & Industry Research

- Company Research

- Industry Research

- Market Research

Research Tips

Company research can include a lot of different types of Information. This guide focuses on the best databases the Commerce Research Library has to offer for corporate profiles and corporate family research.

If you're looking for where a company or subsidiary is officially registered check their location in one of the database below and then check the official government website for the relevant state to find official documentation. Here is an example of the Delaware website , a popular state where many companies register.

Databases can provide incomplete and conflicting information. Use clues like shared company names, shared executives, and shared websites to determine if two entities are connected even if they do not appear to have a parent/subsidiary relationship.

Best Bets Company Profiles

For access, request an account . Public and private company profiles and research on both domestic and international companies. Users can search by company name, industry (keyword and NAICS or SIC codes), geographical region, employee and revenue size, and corporate family tree.

CourtLink A detailed collection of federal and state court dockets and documents, including relevant briefs, pleadings, and motions.

Nexis Diligence Diligence enables you to conduct thorough due diligence on companies and individuals, going beyond credit scores and watch lists to develop a comprehensive due diligence report utilizing global news sources, sanction lists, company information, legal history, and public records.

Nexis Dossier Take advantage of a broad collection of company financials, industry analysis, hard-to-find contact data and more—from a single interface.

Nexis Gain unique insights from over 40,000 sources, including trusted up-to-date and archived news, company profiles, public records, industry information and social media content – all in one place.

Best Bets for Corporate Family Trees

Other Company Research Resources

As part of the EBSCOhost Business Source Premier database, Company Profiles provide MarketLine/Medtrack Reports, which cover company overview, SWOT analyses, key facts, top competitors, company products and services, subsidiaries, etc.

This directory features listings across the government, corporations, and nonprofit organizations. Find individuals holding high-level positions and their support staff or locate departments, agencies, major offices, and smaller bureaus by subject areas or organization.

ProQuest's ABI/INFORM includes full-text journals and key trade publications, dissertations, market reports, industry reports, business cases, global and trade news, local and regional business information, SSRN working papers, and other industry-focused information, as well as the Wall Street Journal back to 1984.

Training Webinars

Company research: family trees 101.

- Webex Recording

Business News

- << Previous: Vetting

- Next: Industry Research >>

- Last Updated: Mar 8, 2024 2:39 PM

- URL: https://library.doc.gov/company

Contact Info

1401 Constitution Ave, NW Washington, DC 20230

Email: [email protected]

Monday to Friday 8 a.m. to 4:30 p.m.

Closed on Federal Holidays

General Public - by appointment only

library.doc.gov

An official website of the U.S. Department of Commerce

How to Research a Company: The Ultimate Guide

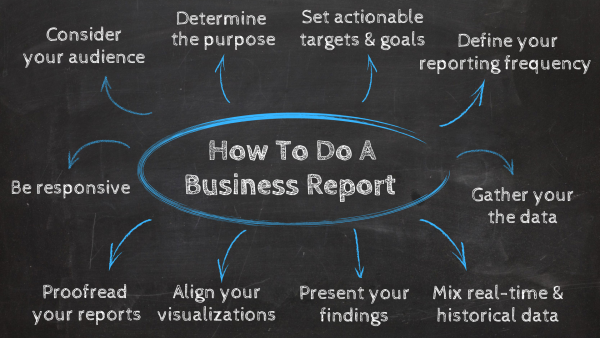

Good company research can take many forms. Depending on your research goals, you might want to look at the strengths, weaknesses, opportunities, and threats of a market, or drill down into key industry leaders and emerging players to unpack their successes.

If you want to beat the competition, you need to know their business as well (if not better) than your own. The more intel you have, the quicker you’ll be able to spot and leverage opportunities, respond to market changes, and grow.

Read on to discover how to research a company online, tear down its strategies, and take over its market share.

What is company research?

Company research gathers and analyzes information about a business and its customers. This means understanding its performance data and target audience so you can optimize your own strategy.

In today’s fiercely competitive markets, doing good company research is a game-changer. In fact, a 2022 report on competitive intelligence found that 98% of businesses believe researching their competitors is vital for success.

If you have the right tools to collect accurate competitive intelligence , you’ll be able to anticipate your competitors’ moves and emerging threats to stay ahead and succeed.

How to do company research in 8 steps

Researching a company is a bit like doing detective work. The deeper you go, the more questions you ask, and the more curious you are, the better the outcome will be.

Here are eight steps to steer you through the process of doing company research.

1. Track top competitors

You want to know exactly what your rivals are doing, where they’re going, and how the competitive landscape is changing. With this data, you can carefully plan your next move and take action when and where it’s needed most. Competitive tracking tools like Similarweb give you the ability to track what your rivals are up to. You can measure each competitor’s digital footprint, and identify any changes or growth over time.

Did someone experience a sudden uptick in website visits? Would you like to know why and how? Perhaps they launched a new feature or ad campaign, or maybe its social channel is driving growth.

With Similarweb Digital Research Intelligence, you get alerts about changes so you can be sure you’ll never miss a beat.

Analyzing the top performers in your industry will give you new ideas and provide targets for what is achievable for you.

Similarweb’s Analyze Industry Leaders tool will tell you who is winning in your industry based on their website performance. A Market Quadrant Analysis graph, or competitive matrix , provides a visual snapshot of the websites in your industry and how they compare based on different metrics. The industry leaders may inspire you to try new things, while the weaker competitors in your industry can provide you with swift opportunities to chip into their market share.

Pro tip: Similarweb’s Similar Sites tool helps you uncover up to 40 domains that are similar to yours. Finding these domains can be infinitely useful when conducting a competitive content analysis . You can audit these domains to learn more about their content strategy and upgrade your own.

2. Benchmark

Now that you have a good view of the market, you need to drill down into your competitors’ performance. You want to understand their metrics and KPIs so you can benchmark them against your own.

A company research and analysis tool can help you understand your competitors’ digital reach and performance. You can look at multiple websites or domains owned by a single company to analyze their aggregated data or look at a specific market. This will give you a good idea of the business’ size and market share .

You’ll also want to look at their engagement metrics and any changes over time. If you see their metrics improving, they are probably investing in a digital strategy . You should look into this to see what has been working for them. We’ll show you how in the next section.

Pro Tip: Don’t forget to look at mobile app intelligence too. There are five key metrics you’ll want to track when benchmarking an app:

- Demographics

3. Compare traffic and engagement

These days, it’s no longer enough to consider website traffic and engagement metrics on their own. The complete digital perspective of any company includes mobile app intelligence, alongside traditional desktop and mobile web metrics. You need to see the full picture before you make any judgments or decisions.

Using Similarweb digital intelligence, I wanted to view the key players in the travel industry –specifically travel booking sites, like booking.com, Expedia, and Airbnb. First, I want my company research to focus on mobile web and desktop traffic alone.

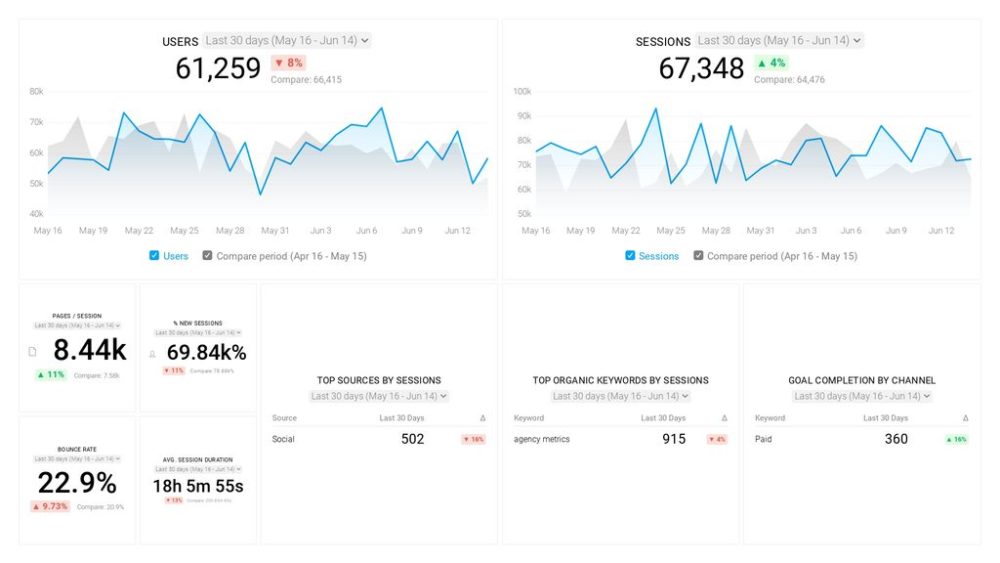

Using Similarweb Digital Research Intelligence , I can see the overall benchmarks for traffic and engagement. This shows metrics like monthly visits, unique visitors, pages per visit, bounce rate, and visit duration.

The top websites include booking.com , Airbnb , Expedia , Agoda , and Hotels.com . So, in essence, these are my industry leaders .

However, knowing how important apps are these days to consumers, I want to consider app intelligence in my company research too. When I add this data into the mix, things look a little different.

On both Android and iOS: Expedia, Airbnb, VRBO, booking.com, and Hopper are my top five.

Now, my view of industry leaders has changed . We’ve got three key players who are leading desktop, mobile web, and app platforms; and four others, who respectively dominate different channels.

Here, you can see a range of engagement metrics that apply to mobile apps on Android. Including active users, number of sessions, and session times; which shows engagement, upturns, downturns, and opportunities at a glance.

So, when you view traffic and engagement metrics, make sure you explore desktop, mobile web, and app intelligence to get an accurate picture of what’s really going on.

4. View audience interests

Understanding cross-browsing behavior tells you what other sites your users are interested in. Maybe they are looking at other products and solutions like yours!

This audience interests tool allows you to evaluate the browsing behavior of your target audience, helping you understand user intent and their purchasing process. You might even discover new markets or a specific niche audience , and come up with new audience acquisition strategies.

5. Pinpoint audience overlap

Who else holds your potential customer’s attention? With Similarweb’s Audience Overlap feature, you can analyze metrics and insights on the overlap of visitors across up to five websites for a selected time period and geographical region. You’ll be able to determine the size of your total addressable audience , evaluate what part of the audience is shared, and pinpoint your unreached audience potential.

This is also a good way to gauge audience loyalty . You’ll see the proportion of monthly active users who look at multiple sites in the same category or just one site.

6. Analyze specific pages

While a company may be your competitor, you may not be competing on every front. You might only want to look at a particular segment of a business when doing your company research. This ensures that your insights are specific and useful, and leave out less relevant information.

Similarweb’s Segment Analysis tool lets you slice the URL of a website to analyze just the parts that are relevant to you. You can deconstruct their website to look at a specific category, topic, brand, or whatever else interests you. This can help you benchmark a specific line of business or individual products.

This analysis is extremely powerful for marketing and sales managers, data analysts, and BI specialists who want to optimize their strategies for specific business segments. For example, if you are a clothing retailer looking to launch a line of kids’ clothes, you can use this tool to analyze your competitors’ kids’ clothing lines.

7. Reveal successful conversion strategies

What makes customers convert? The only way to know for sure is to analyze conversion data across your industry. You need to understand the conversion funnel , which keywords and marketing channels drive traffic, and which trends your potential customers are interested in.

You can get a unique view of your industry’s conversion data with Similarweb’s Conversion Analysis tool. Check out each company’s conversion efficiency and how they scale over time. You can identify efficient marketing channels , go-to-market strategies, and their ROI for marketing spending. You can also benchmark your metrics across the industry average.

Understanding conversion strategies also reveals opportunities for your own growth. You can examine category performance at top retailers such as Amazon, Walmart, and Target, and identify what consumers are searching for at the different retailers and what converts. When you understand the customer journey, you can better position yourself to guide them toward purchasing from you.

8. Research mobile app performance

When you research a business, you need to look at all customer touchpoints. Today, that means analyzing apps alongside web and mobile web traffic. You want to know how well your competitors’ apps rank so you can focus on your own app strategy. With rapid consumer adoption of mobile-first spending ( 46% of people now complete a full purchase via mobile ), app intelligence is a key consideration for any type of company research. In almost every industry, the digital landscape changes when you add app intelligence metrics.

If you’re looking at apps competitively, you want to consider:

- Monthly/Daily Active Users

- No. of sessions/session time

- Sessions per user

- Overall rank

- Category rank

- User retention

- App demographics

Similarweb App Intelligence Premium now provides a few ways to help you view rankings, downloads, engagement, and usage metrics across both Android and iOS. From benchmarking an app to unpacking the successes of those with apps in your market; good company research should include app analysis. By unifying digital insights, you see a truer picture of a company’s successes online.

How to research a company like an expert

Follow these eight steps and you’ll quickly be able to research any company in any niche like a pro. Uncover key insights that tell you more about a market, target audience, or competitors to shape your own strategy for success.

Ready to get growing? Grab a free trial of Similarweb today.

See Similarweb In Action

Don't miss out! Have the latest data at your fingertips.

Why do company research?

Your business doesn’t exist in a vacuum. You’re competing with other companies and operating in an industry that has its own norms and expectations. If you want to succeed, you need to research other companies in your industry to ensure your strategy is aligned, but also positioned to give you a competitive advantage . You won’t be able to do this without researching other companies.

What to look for when researching a company?

You want to review all their company metrics, including traffic and engagement metrics, and look at their strategy, focus, processes, and content. You should search for any interesting ideas and identify where the company excels. All the data you collect will be valuable for you to compete.

What can company research tell you?

Good company research shows you how a market, company, and its target audience’s interests change over time. It can help you develop your own strategy for growth, and shows trends and emerging threats to watch out for.

Related Posts

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Most Popular Messaging Apps Worldwide 2023

Market Sizing: Measuring Your TAM, SAM, and SOM

Wondering what similarweb can do for you.

Here are two ways you can get started with Similarweb today!

- Join the AMA

- Find learning by topic

- Free learning resources for members

- Certification

- Training for teams

- Why learn with the AMA?

- Marketing News

- Academic Journals

- Guides & eBooks

- Marketing Job Board

- Academic Job Board

- AMA Foundation

- Diversity, Equity and Inclusion

- Collegiate Resources

- Awards and Scholarships

- Sponsorship Opportunities

- Strategic Partnerships

We noticed that you are using Internet Explorer 11 or older that is not support any longer. Please consider using an alternative such as Microsoft Edge, Chrome, or Firefox.

2020 Top 50 U.S. Market Research and Data Analytics Companies

Diane Bowers

A full ranking of the top market research and data analytics companies in the U.S. for 2020

The “2020 Top 50 U.S. Report”—formerly known as “The Gold Report”—is developed by Diane Bowers and produced in partnership with the Insights Association and Michigan State University . The report is also sponsored by the AMA, ESOMAR and the Global Research Business Network . The report includes a ranking of the top 50 companies, a breakdown of trends by Bowers , and an analysis of the market research and analytics industry by Michael Brereton, Melanie Courtright and Reg Baker.

50. RTi Research

Founded: 1979 2019 U.S. revenue: $12.9 million Percent change from 2018: -3% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $12.9 million U.S. employees: 45

In a world awash in data, the challenge is to turn data into something meaningful, something that can be communicated simply and acted upon effectively. RTi Research meets that challenge head-on, turning data into meaning through smart research design, flawless execution and innovative storytelling. Everything the company does is aimed at helping its clients move their ideas and insights through their organizations to influence change.

RTi has conducted research in just about every category in the U.S. and globally. Informed by 40 years of experience across categories and cultures, RTi knows what works and what doesn’t, when to leverage new technology and methods, and when traditional approaches are best.

49. Hypothesis

Founded: 2000 2019 U.S. revenue: $18.3 million Percent change from 2018: -4.7% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $18.3 million U.S. employees: 61

Hypothesis uses insights, strategy and design to help important brands do amazing things. The company specializes in tough questions that take creative, multidimensional approaches, thoughtful strategy and a broad business perspective. Hypothesis’ approach combines inventive consumer-centric qualitative research, advanced analytics, strategic thinking and data visualization. Its award-winning design team translates complex information into compelling, easy-to-understand deliverables to socialize learnings and engage teams.

In 2018, Hypothesis added important new capabilities with the launch of Momentum, a strategy that turns insight into application with downstream marketing and implementation planning. The Momentum team has worked alongside Hypothesis consultants on strategic engagements with clients focused on brand strategy, product development, and led dozens of workshops with senior and C-level executives to socialize insights and ideate on next steps.

In 2019, Hypothesis’ focus on growth continued with its expansion to the Midwest and establishment of its Chicago office. From this office, the company will be able to service new and current clients in the Midwest and on the East Coast.

48. Bellomy Research

Founded: 1976 2019 U.S. revenue: $21 million Percent change from 2018: 1.4% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $21 million U.S. employees: 116

Bellomy is a privately held, family-owned, full-service market intelligence company. Bellomy focuses on driving successful business outcomes through the design and delivery of solutions that yield deeper customer understanding. The company surrounds its clients’ business challenges with an unparalleled mix of knowledge and experience, marketing science and proprietary research technology.

Bellomy’s work involves both B2C and B2B environments—with qualitative and quantitative insight solutions spanning market segmentation, customer experience and journeys (including digital user experiences), brand equity, product innovation, shopper insights, marketing optimization, social research platforms and research technology. Bellomy works with clients across a broad range of categories and industries including consumer packaged goods, financial services, automotive, retail, restaurant and hospitality, telecommunications and technology, apparel and textiles, utilities, healthcare, insurance and home improvement.

Bellomy serves as an extension of its clients’ marketing research and customer experience departments by integrating a broad set of capabilities and areas of expertise, including segmentation, customer (and digital experience), shopper insights, social research platforms, brand equity, product innovation and marketing optimization. In addition, Bellomy clients leverage SmartIDEAS, the firm’s enterprise consumer knowledge and insight platform.

47. Edelman Intelligence

Founded: 1999 2019 U.S. revenue: $21 million Percent change from 2018: 12.9% 2019 non-U.S. revenue: $11.5 million Percent from outside U.S.: 35.4% 2019 worldwide revenue: $32.5 million U.S. employees: 131

Edelman Intelligence (EI) is the global research and analytics consultancy of Edelman, the world’s largest global communications firm. Based in New York, with employees in 18 offices internationally, EI houses more than 200 consultants, strategists, researchers, data scientists, data visualization specialists and analysts worldwide. Its specialists are method-agnostic and leverage the best of primary and secondary research, advanced analytics and business science to solve business and communications issues for its clients. EI’s offering spans the full spectrum of client needs, from mapping the current environment and targeting key audiences, to optimizing content and measuring business impact.

EI partners with early-stage start-ups and Fortune 100 companies alike, providing strategic research, analytics, and insights-based marketing and communications counsel for a broad range of stakeholders and scopes, including government and public affairs, corporate reputation and risk strategy, crisis and issues management, employee experience and talent advisory, executive positioning, strategic communications and public relations, marketing and branding strategy, customer experience and insights, mergers, acquisitions and market entry strategy and more.

Key accomplishments in 2019 included advancement of its Edelman Trust Management (ETM) capabilities, including an evolution of its offering focused specifically on providing guidance for measuring and building trust in brands. Developed building from its 20-plus years studying trust through the Edelman Trust Barometer and the initial iteration of ETM (which explores corporate trust), this proprietary model for brand trust measurement was created in partnership with renowned academics from Harvard Business School and INSEAD, Edelman Brand experts and external marketing thought leaders. In recent months, this model has been engineered to consider fundamental transformations to consumer/brand relationship dynamics that the COVID-19 pandemic has accelerated.

46. KS&R

Founded: 1983 2019 U.S. revenue: $21.7 million Percent change from 2018: -1.4% 2019 non-U.S. revenue: $3.6 million Percent from outside U.S.: 14.2% 2019 worldwide revenue: $25.3 million U.S. employees: 100

KS&R is a privately held strategic consultancy and full-service marketing research company. For nine consecutive years, KS&R has received the highest Gold Index composite score of any provider in the Prevision/Inside Research survey of marketing research buyers. This is a testament to the company’s passion for excellence and client-first business philosophy—wherein KS&R empowers its clients with timely, fact-based insights so they can make smarter decisions and be confident in their actions.

KS&R creates and executes global custom market research solutions for some of the best-known corporations in the world in more than 100 countries and 50 languages. It has extensive and diverse industry experience with particular strength in healthcare (pharma and device), technology, entercom, transportation, professional services, and retail and e-commerce. Team members often include business strategists with client-side experience and deep industry knowledge.

In 2019, KS&R leveraged its expansive network of pharmacy panels to build world-class capabilities for pharma inventory measurement and healthcare insights. Its marketing scientists have driven marked advances in pricing decision support, which have now been validated by positive in-market results. KS&R expanded its portfolio to include insights fusion across multiple channels of content (primary research, social media, web-based information, etc.). And finally, it introduced its KS&R Win-Loss program that provides actionable insights for how organizations can improve their value proposition and sales performance to close more deals.

Founded: 1911 2019 U.S. revenue: $22.7 million Percent change from 2018: 12.9% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $22.7 million U.S. employees: 78

NAXION guides strategic business decisions globally in healthcare, information technology, financial services, energy, heavy equipment and other B2B markets, drawing on depth of marketing experience in key verticals and skilled application of sophisticated and inventive methodologies. The firm’s NAscence Group helps life science innovators develop commercialization strategy through clinical trials design and selection of target indications, forecasting, brand planning and other research-based consulting services.

Engagements routinely include market segmentation, opportunity assessment and innovation, demand forecasting and pricing, positioning, brand health, market monitoring and lifecycle management. The firm deploys multiple data streams including primary research (qualitative and quantitative), secondary data, customer databases and other complex datasets to develop an integrative perspective on business problems. The firm also builds custom panels for B2B markets.

Project leaders with sector experience and research proficiency are supported by in-house methodologists and a wide portfolio of advanced analytic tools, including proprietary modeling services and software, all of them highly customized. The firm continues to invest significant resources in intellectual capital to enhance enterprise decision support with cutting-edge methods, including specialized “small data” choice models, new predictive techniques using big data and brand-customized text analytics. Its Farsight suite supports the building of highly dynamic models capable of producing forecasts for complex market scenarios, including paradigm-shift technologies, and gives market monitoring programs a forward-looking perspective that guides timely market interventions. Other services include litigation and regulatory support, often involving expert testimony in cases involving trademark confusion, deceptive advertising and brand equity. NAXION’s strong commitment to operational excellence is reflected in ISO certification and in-house operations capabilities to deliver exceptional levels of quality control.

Founded: 1991 2019 U.S. revenue: $24.2 million Percent change from 2018: -3.6% 2019 non-U.S. revenue: $1.2 million Percent from outside U.S.: 4.7% 2019 worldwide revenue: $25.4 million U.S. employees: 144

Gongos is a consultative agency that places customers at the heart of business strategy. Partnering with insights, analytics, marketing, strategy and customer experience groups, Gongos operationalizes customer centricity by helping companies both understand their customer needs and deliver on them better than anyone else.

From product innovation to portfolio management, customer experience to consumer journeys, pricing strategies to marketing optimization, and trend analysis to predictive modeling, Gongos provides both outside-in and inside-out approaches across organizations to drive greater customer attraction, retention and lifetime value.

Gongos further serves as a translator to help cross-functional teams fuel the competency to gain and apply consumer wisdom, transform decisions into action and navigate organizational change. Coalescing enterprise data with primary research and curating insights for multiple audiences further empowers stakeholders to achieve greater ROI by ensuring information is designed to influence actions and behaviors from executives to the frontline.

Gongos’ consultative tools stem from change management principles that help organizations navigate the transformation often necessary to create a more outside-in perspective as they reorient around the customer. Gongos’ approaches to engage multiple audiences include communication strategies and tactics grounded in frameworks such as its adoption-to-advocacy model and human-centered design.

43. Maru/Matchbox **

Founded: 2016 2019 U.S. revenue: $28 million Percent change from 2018: 3.7% 2019 non-U.S. revenue: $14 million Percent from outside U.S.: 33.3% 2019 worldwide revenue: $42 million U.S. employees: 150

Maru/Matchbox began disrupting the market research industry in 2000. Powered by proprietary technology, its expert teams are deeply invested in key sectors of the economy, including consumer goods and services, financial services, retail, technology, healthcare, public services, and media and entertainment. Maru/Marchbox provides organizations with the tools and insights to connect with the people that matter most, so they can build and maintain a competitive advantage.

In 2019, Maru/Matchbox released a series of innovative research solutions.

- Digital Media Measurement is a campaign evaluation approach that enables clients to better understand how content, channels and brands interact to deliver effective communication.

- Creative Insight measures people’s implicit and explicit responses to advertising, giving clients a complete picture of how their ad is working. It is designed to evaluate any type of ad or brand communication, across all channels, with best-in-class benchmarks.

- Lissted analyzes how members of communities relevant to clients react to content, tweets and even websites.

- Brand Emotion utilizes visual semiotics to identify and leverage the emotional profile of a brand.

Maru/Matchbox continues to demonstrate innovation and thought leadership through relentless publication of articles and whitepapers.

42. Chadwick Martin Bailey (CMB)

Founded: 1984 2019 U.S. revenue: $28.7 million Percent change from 2018: 20.6% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $28.7 million U.S. employees: 90

CMB is a research and strategy firm, helping the world’s leading brands engage, innovate and grow amid deep disruption. The company leverages the best of advanced analytics, consumer psychology and market strategy to tackle critical business initiatives, including market identification, segmentation, brand health, loyalty and advocacy, and product and service development.

For more than 35 years, CMB has helped the most successful brands and their executives give voice to their market through a relentless business decision focus, creative problem-solving and storytelling, deeply consultative approach and flawless execution. With dedicated financial services, media and entertainment, tech and telecom, retail and healthcare practices, CMB’s expert teams understand the complex and evolving technological, social, cultural and economic forces that drive disruption and create opportunity.

In 2020, CMB continued its growth trajectory, including building expertise in gaming and digital platforms and expanding its qualitative and advanced analytics teams. A thought leader in the application of consumer psychology to real world business issues, CMB conducted self-funded research among tens of thousands of consumers to capture the four core benefits that motivate decision-making—identity, emotion, social and functional—providing an in-depth look at more than 80 global brands. Further self-funded research explored the accelerating journey and path to purchase of today’s gamers.

41. Screen Engine/ASI

Founded: 2010 2019 U.S. revenue: $33 million Percent change from 2018: 10% 2019 non-U.S. revenue: $1.9 million Percent from outside U.S.: 5.4% 2019 worldwide revenue: $34.9 million U.S. employees: 132

Screen Engine/ASI is a research-based consumer insights firm that stands for delivering its entertainment and media clients actionable insights and recommendations, not simply data. SE/ASI strives to help clients mitigate risk and maximize the potential for success. Through its Motion Picture and TV Groups, SE/ASI works across all distribution platforms for both domestic and internationally produced content.

The company is centered on assessing the “abilities” of content as it migrates from the earliest stages of development through multi-channel distribution. The Motion Picture Group is the leader in traditional and digital in theater and online recruited audience screenings. Offerings also include PostTrak, a syndicated domestic and international in-theater exit poll, and ScreenExperts, an early assessment of critical response, creative ad testing, positioning and brand studies, custom work, and location-based and online focus group research. A cross-platform team within this group works with home entertainment, over-the-top and gaming clients.

The TV group is the leader in location-based ViewTrac dial testing of pilots, programs and ongoing series and conducts online dial testing as well. Other offerings include location-based and online focus groups, promo testing, positioning and brand studies, and a variety of custom studies including custom trackers. SE/ASI syndicates Tracktion trackers including a TV tracker, a theatrical movie tracker, a home entertainment tracker and a premium video-on-demand tracker. All groups work in the company’s media lab equipped for biometric and new technology research. When appropriate, SE/ASI engages in advanced analytics techniques including, but not limited to, segmentation, conjoint, maxdiff and TURF analysis.

40. MarketVision Research

Founded: 1983 2019 U.S. revenue: $33.2 million Percent change from 2018: 2.5% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $33.2 million U.S. employees: 140

MarketVision Research is a full-service marketing research firm, providing clients with actionable insights about their markets, customers, brands and products. Research areas of focus include product and portfolio development, pricing, branding, segmentation and customer experience. The company offers a full suite of quantitative and qualitative research capabilities and works across industry groups. These include:

- Optimization and discrete choice modeling as it applies to product and service development, branding, packaging and pricing.

- Online communities that are managed and developed entirely in-house with a focus on improving participant engagement and with additional support for mobile participation.

- Hybrid research, which uses 20 in-house moderators, along with marketing science professionals and global project managers, to facilitate qualitative and quantitative research seamlessly.

39. The Link Group

Founded: 1994 2019 U.S. revenue: $34.2 million Percent change from 2018: 23.9% 2019 non-U.S. revenue: $0.3 million Percent from outside U.S.: 0.9% 2019 worldwide revenue: $34.5 million U.S. employees: 85

The Link Group executes research for Fortune 500 firms in the healthcare, retail, CPG and finance industries across both qualitative and quantitative methodologies and around the globe. TLG attributes its success to its core business philosophy: smarter research and better service. Its commitment to smarter research has allowed the company to take a creative, custom approach to its clients’ business needs that results in actionable and insightful reports. TLG delivers better service by maintaining a consistent research team across projects, allowing the team to anticipate and respond to client needs. This business philosophy has resulted in 99% of revenue coming from repeat clients.

This past year, TLG has continued to hone its research approaches to help elevate traditional research methods. For its messaging and positioning work, TLG developed a framework that triangulates quantitative survey data to determine how well messaging concepts will activate, communicate and engage the customer. In its segmentation studies, TLG blends science and art to create models that align with the client’s brand strategic vision by creating differences that are meaningful and actionable from a marketing perspective. TLG has leveraged its knowledge of behavioral economics to develop a validated, proprietary quantitative methodology—LinkEQ—that allows the company to reveal latent emotional associations.

Founded: 1983 2019 U.S. revenue: $34.3 million Percent change from 2018: -1.2% 2019 non-U.S. revenue: $1.2 million Percent from outside U.S.: 3.4% 2019 worldwide revenue: $35.5 million U.S. employees: 233

SSRS is a full-service market and survey research firm led by a core of dedicated professionals with advanced degrees in the social sciences.

SSRS surveys support numerous media and academic partners looking to report on public attitudes and beliefs about a wide range of salient issues such as elections and public policy. SSRS is the polling partner for CNN, and conducts public opinion polling for ABC News, The Washington Post, Politico and CBS News.

Beyond national polls, SSRS regularly conducts research at a state level, and among subpopulations such as Latinos and political partisans, and specializes in reaching hard-to-reach and low-incidence populations. SSRS has extensive experience in public policy, public affairs and health policy research. Since the Affordable Care Act was signed into law, SSRS has completed numerous studies surrounding its implementation and assessing Americans’ attitudes and experiences with the law.

Since 2016, SSRS conducts the monthly Kaiser Family Foundation Health Tracking Poll. SSRS is well-known for its weekly telephone Omnibus poll. The firm also offers the SSRS Opinion Panel, which allows clients to conduct probabilistic surveys quickly at low cost. The SSRS/Luker on Trends Sports Poll is the first and longest-running tracking study focusing on sports in the U.S.

37. BVA Group **

Founded: 1970 2019 U.S. revenue: $36 million Percent change from 2018: 2.6% 2019 non-U.S. revenue: $147 million Percent from outside U.S.: 80.3% 2019 worldwide revenue: $183 million U.S. employees: 120

BVA Group is a fast-growing research and consulting firm, an expert in behavioral science, ranked in the top 20 worldwide agencies. BVA brings data to life and converts deep understanding of customers and citizens into behavior change strategies. BVA operates both for public and private clients with methodologies fueled by data science and behavioral science.

Its FMCG specialist—PRS IN VIVO—is a global leader in packaging and shopper research. PRS IN VIVO helps consumer marketers to succeed through:

- In-store and online studies to better understand shopper behavior, in both physical and e-commerce shopping contexts.

- Qualitative studies to develop, screen and refine new product, packaging and merchandising concepts.

- Quantitative studies to pre-test and quantify new packaging, merchandising and display systems (for physical stores and e-commerce).

- Volume forecasting and product testing for both innovations and brand restages.

- “Nudge” initiatives to facilitate behavioral change, create new consumer habits and drive category growth.

BVA Group is a European leader in customer experience research. More than 100 leading brands use BVA’s behavioral insights to provide seamless shopper journeys and design successful new products and services, including solutions from its multi-awarded Global Nudge-Unit.

36. radius | illumination

Founded: 1960 2019 U.S. revenue: $42 million Percent change from 2018: — 2019 non-U.S. revenue: $1 million Percent from outside U.S.: 2.3% 2019 worldwide revenue: $43 million U.S. employees: 127

Radius│illumination is the product of a merger between Radius Global Market Research and Illumination Research in 2018. Together, it’s one of the largest independent custom insights providers in the world. Its focus is on guiding brands at critical points along their growth journey, tackling issues such as identifying compelling innovations, creating relevant customer segmentations and developing strategies for deeper loyalty and engagement.

Radius | illumination partners with Fortune 500 leaders as well as challenger, disruptor and emerging brands in the U.S., Europe, Asia and the Middle East. Its top sectors include financial services, personal care, healthcare and pharmaceuticals, technology, home improvement and durables, media and entertainment, packaged foods, beverage, retail and transportation.

Its 2020 initiatives to fuel brand growth for its clients include:

- Provide agile and robust solutions such as InnovationSprint to accelerate new product and service development.

- Increase its information design capabilities so clients can easily take action on the results.

- Focus on driving deeper insights by combining its advanced analytics strength with immersive customer understanding in its designs.

- Expand solutions through the integration of new technologies and behavioral approaches.

35. Market Force **

Founded: 2005 2019 U.S. revenue: $50 million Percent change from 2018: 2% 2019 non-U.S. revenue: $7 million Percent from outside U.S.: 12.3% 2019 worldwide revenue: $57 million U.S. employees: 375

Market Force Information provides location-level customer experience management solutions to protect clients’ brand reputation, delight their customers and make them more money.

Market Force operates at scale across the globe. Each month, the company:

- Completes more than 100,000 mystery shops.

- Collects, processes and analyzes millions of employee and customer experience surveys.

- Manages more than 100,000 inbound calls to its contact center.

- Hosts more than 1 million user logins on its KnowledgeForce reporting platform.

Market Force’s multi-location solutions provide a robust framework for measuring and improving operational excellence, customer experience and financial KPIs. Measurement channels include mystery shopping, customer experience surveys, contact center calls, social media and employee engagement surveys via the KnowledgeForce technology platform and Eyes:On mobile app. Market Force employs predictive analytics to determine what matters most and the ROI for investing in improvements. The firm takes a dual-headed approach to market research services (e.g., customer segmentation, attitude trial and usage studies and custom research projects) and strategic advisory services to design and implement effective measurement systems and improve performance.

Founded: 1991 2019 U.S. revenue: $52 million Percent change from 2018: 4% 2019 non-U.S. revenue: $6 million Percent from outside U.S.: 10.3% 2019 worldwide revenue: $58 million U.S. employees: 400

As a leading customer experience management firm, SMG helps clients get smarter about their customers and employees to drive changes that boost customer loyalty and improve business performance. SMG combines technology and services to collect, analyze and share feedback and behavioral data, so it’s easier for clients to deliver and activate customer insights across their enterprise.

SMG partners with more than 350 brands around the globe to create better customer and employee experiences, which drive loyalty and performance. SMG uniquely combines technology and insights to help clients listen better, act faster and outperform competitors. SMG is a technology-enabled research firm with a global footprint—evaluating more than 150 million surveys annually, in 50 languages across 125 countries.

Strategic solutions include omniCXTM, Brand Research and Employee Engagement. SMG’s omniCX solution uses multiple research methodologies in capturing solicited and unsolicited consumer feedback across in-store, online, contact center and social channels. Results are aggregated and reported via smg360TM—a real-time, role-based reporting platform providing access to all customer and related data.

SMG’s research professionals partner with clients to derive business-changing insights. Within Brand Research, SMG offers traditional brand tracking as well as access to dynamic customer and competitor data through market intelligence tool BrandGeek. Fueled by SurveyMini—SMG’s location-based mobile research app—BrandGeek contains consumer feedback and behavioral data relating to more than 4,500 brands across more than 500,000 locations.

33. Hanover Research

Founded: 2003 2019 U.S. revenue: $52.7 million Percent change from 2018: 14.1% 2019 non-U.S. revenue: $2.6 million Percent from outside U.S.: 4.7% 2019 worldwide revenue: $55.3 million U.S. employees: 358

Hanover Research is a brain trust designed to level the information playing field. Hanover is made up of hundreds of researchers who support thousands of organizational decisions every year. One of the industry’s fastest-growing companies, Hanover attributes this market success to its unique positioning as the only firm that provides tailored research through an annual, fixed-fee model.

Hanover serves more than 1,000 organizations and companies worldwide from established global organizations, to emerging companies to educational institutions. Hanover’s research informs decisions at any level and across any department capitalizing on the exposure to myriad industries and challenges.

Founded in 2003, Hanover operates on an annual fixed-fee model, and partnership provides its clients with access to a team of high-caliber researchers, survey experts, analysts and statisticians with diverse skills in market research, information services and analytics. There is no limit on the type of challenge that can be asked for on the quantitative and qualitative approaches Hanover uses to deliver solutions—most of which are very difficult to replicate internally.

Hanover’s custom research services include:

- Secondary research: market segmentation and evaluation; labor and demographic trends and forecasts; vendor and product reviews; best practices reports.

- Survey: survey design, administration and analysis; open-ended response coding.

- Qualitative primary research: focus group design and administration; in-depth interview design, outreach, administration and analysis.

- Data analysis: data segmentation and mining; conjoint analysis; linear regression; descriptive and predictive analytics; data forecasting and modeling.

32. Directions Research

Founded: 1988 2019 U.S. revenue: $54.2 million Percent change from 2018: 17.8% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $54.2 million U.S. employees: 181

Independently recognized as one of the leading business decision insight firms in the nation, Directions Research combines a highly experienced staff with a unique mix of innovative and proven approaches to answer pressing business issues. Directions and SEEK routinely combine primary and connected data from multiple sources to create holistic and actionable analytic stories for their clients. Through digital dashboards, infographics, written reports and other unique visualizations, the firm communicates its knowledge in a manner that is right for today’s leaders.

Directions and SEEK excel in innovation, optimization, customer and brand experience, brand strategy, strategic business intelligence and visualization across a wide range of industries. The firm offers B2C and B2B services globally, surveying audiences using a broad selection of data collection techniques and combining those insights with existing client knowledge. Directions’ and SEEK’s staff have an excellent mix of client- and supplier-side experience. The organization allows senior researchers to work with clients on a day-to-day basis.

SEEK (acquired in 2018) is a qualitative insight and innovation consultancy, operating as an independent but connected division of Directions. SEEK empathically connects brands with the humans they serve, transforming the brand-to-consumer relationship into a human-to-human one. The SEEK approach builds brand advocacy for clients with the human-centric approach to innovation, activating empathy as an innate problem-solving capability.

31. Fors Marsh Group (FMG) *

Founded: 2002 2019 U.S. revenue: $57.5 million Percent change from 2018: 22.1% 2019 non-U.S. revenue: — Percent from outside U.S.: — 2019 worldwide revenue: $57.5 million U.S. employees: 263

FMG applies behavioral and data science to improve organizational processes, business solutions and customer experiences. This work is conducted within seven core U.S. markets: health, defense, technology, finance, homeland security, policy and consumer.

FMG’s work for its clients wins industry and federal awards. FMG has been named as a top market research company by GreenBook and the American Advertising Federation and has been named to the American Marketing Association’s list of top market research companies in the U.S. for five consecutive years. FMG was also a finalist for the American Council for Technology and Industry Advisory Council’s Igniting Innovation 2018 award for creating an innovative e-learning program that improved program awareness and usability for the General Services Administration’s Center for Acquisition Professional Excellence.

For 2019 and beyond, FMG is focused on continuing this momentum and expanding in important areas. In its human capital practice, FMG is furthering its work in the cybersecurity industry to help the Department of Defense attract top cyber talent and to protect the nation’s infrastructure. FMG is also expanding its efforts in public service recruiting through new partnerships with the U.S. Army, U.S. National Guard and AmeriCorps. The company is proud that its partnership with these institutions will help shape the future of the U.S. For its health division, FMG is leveraging its deep experience in health communications to fight the opioid crisis by reducing stigma and removing barriers that victims face in receiving help—potentially one of the biggest challenges facing America today.

30. National Research Group (NRG) **

Founded: 1978 2019 U.S. revenue: $59 million Percent change from 2018: 1.7% 2019 non-U.S. revenue: $4 million Percent from outside U.S.: 6.3% 2019 worldwide revenue: $63 million U.S. employees: 200

National Research Group, acquired by Stagwell Media from Nielsen in 2015, is a leading global insights and strategy firm at the intersection of entertainment and technology. Rooted in four decades of industry expertise, the world’s leading marketers turn to NRG for insights into growth and strategy for any content, anywhere, on any device. Working at the confluence of content, culture and technology, NRG offers bold insights for storytellers everywhere.

Some agencies specialize in qual, others focus on quant—but NRG connects the two disciplines with hybrid teams expert in both modalities. The company is a one-stop, custom consultancy that tailors its approach to solve clients’ biggest challenges.

The foundation of NRG’s qualitative work is a team of passionate, subject matter experts who connect deeply with consumers in any environment. NRG uses qual to discover the subconscious drivers that fuel our quantitative truths. Its quantitative work is anchored in sophisticated techniques with a focus on agility, creativity and rigor. NRG is method-agnostic and works collaboratively with its clients to solve complex problems in a simple way.

29. Cello Health * **

Founded: 2004 2019 U.S. revenue: $64.5 million Percent change from 2018: 23.3% 2019 non-U.S. revenue: $58.5 million Percent from outside U.S.: 47.6% 2019 worldwide revenue: $123 million U.S. employees: 260

Cello Health consists of four global capabilities that enable the company to offer best-in-class services and an integrated partnership approach to its clients. This unique mix of capabilities, combined with its collaborative approach, results in a unique fusion of expertise, providing powerful advisory and implementation solutions.

- Cello Health Insight is a global marketing research company, providing business intelligence to the healthcare and pharmaceutical sectors. Cello Health Insight specializes in getting to the heart of its clients’ questions, using a large pool of creative and academic resources and providing design of materials and deliverables through a hand-picked project team—selected to best meet the needs of each individual project.

- Cello Health Consulting is the strategic consulting arm of Cello Health, focused on delivering business results by unlocking the potential within organizations, people, assets and brands. Cello Health Consulting works alongside clients to create practical solutions that ensure buy-in and build relationships.

- Cello Health Communications combines science, strategy and creativity to unlock the potential of brands and assets. Its services underpin differentiated positioning and deliver brand optimization, focusing on multiple areas of development and launch, through commercial maturity.

- Cello Signal is a full-service digital capability bringing impactful messages alive in communications campaigns, content and film.

28. Macromill Group **

Founded: 2000 2019 U.S. revenue: $68.5 million Percent change from 2018: 2.2% 2019 non-U.S. revenue: $260 million Percent from outside U.S.: 79.1% 2019 worldwide revenue: $328.5 million U.S. employees: 275

Macromill Group is a rapidly growing global market research and digital marketing solutions provider bringing together the collective power of its specialist companies to provide innovative data and insights that drive clients’ smarter decisions. Macromill’s industry-leading digital research solutions deliver rapid and cost-effective solutions to the challenges businesses face today.

The group’s leading business units are Macromill and MetrixLab. Macromill stands at the forefront of innovation, delivering unique marketing solutions. It offers exclusive access to the highest-quality online panels with more than 2 million members. Using its self-developed platform AIRs, Macromill provides full-service online research including automated survey creation and completion, data tabulation and analysis. Today, its business portfolio includes services such as offline quantitative research, mobile research, point-of-service database research (QPR), digital marketing (Accessmill), a DIY survey platform (Questant) and more.

Metrixlab turns data from online surveys, social media, mobile devices and enterprise systems into valuable business information and actionable consumer insights. This helps leading companies drive product innovation, brand engagement and customer value. Owned and group panels provide expansive access to global respondents in mature and emerging markets. Its teams deliver strategic and tactical decision support by pushing the boundaries of data analysis innovation, combining cutting-edge technology with data science and proven marketing research methodologies. Clients across the globe rely on the company’s hyper-efficient data and insights ecosystem to deliver fast and affordable results.

27. C Space **

Founded: 1999 2019 U.S. revenue: $70 million Percent change from 2018: 2.9% 2019 non-U.S. revenue: $18 million Percent from outside U.S.: 20.5% 2019 worldwide revenue: $88 million U.S. employees: 354

C Space, part of the Interbrand Group, is a global customer agency that marries art and science to create rapid customer insight and business change.

C Space works with some of the world’s best-known brands—such as Walmart, Samsung, IKEA and more—to build customers into the ways companies work and deliver on customer-inspired growth. By building real, ongoing relationships with customers—online and in-person—brands can stay relevant, deliver superior experiences, launch successful products and build loyalty. Through its “customer as a service” approach of research, consulting and communications, C Space helps businesses minimize risk and maximize growth.

The company integrates customers into the ways its clients work. By bringing stakeholders together around the customer, C Space’s clients create greater clarity and alignment in the actions that will most effectively drive customer growth.

C Space’s customized programs are tailored based on specific business needs and include private online communities, immersive storytelling, data and analytics, activation events, innovation projects and business consulting. C Space continues to invest in its people, existing capabilities like data and analytics, as well as new initiatives.

26. Engine Insights**

Founded: 2004 2019 U.S. revenue: $71 million Percent change from 2018: 4.4% 2019 non-U.S. revenue: $44 million Percent from outside U.S.: 38.3% 2019 worldwide revenue: $115 million U.S. employees: 240

Engine is a new kind of data-driven marketing solutions company. Powered by data, driven by results and guided by people, Engine helps its clients make connections that count—leading to bottom-line growth, an inspired workplace and business transformation.

Engine Insights (formerly ORC International) connects traditional market research with cutting-edge products to deliver clients a 360-degree view of their customers, employees and markets. Engine’s extended suite of solutions and products are designed to support business growth, from helping clients understand and outperform the competition to operationalizing both survey and behavioral data to identify, attract, engage and retain their audiences.

Engine Insights’ client services and products include custom research and omnibus surveys; customer experience, customer retention and brand engagement studies; and data management and data analytics.

These services help clients:

- Think beyond products and services to drive business revenue.

- Use insights to inform more relevant messaging and creative.

- Get a complete 360-degree view of their customers.

- Segment audiences for better targeting.

- Develop the perfect product and take it to market.

- Create unique experiences that engage their customers and keep them loyal for a lifetime.

- Build an internal culture that attracts, retains and engages the best talent.

Founded: 1931 2019 U.S. revenue: $71.1 million Percent change from 2018: 9% 2019 non-U.S. revenue: $6.9 million Percent from outside U.S.: 8.8% 2019 worldwide revenue: $78 million U.S. employees: 253

Since 1931, Burke has consistently redefined expectations in the marketing research industry. From segmentation to customer engagement programs, product innovation and brand tracking, Burke prides itself on designing and executing objectives-driven quantitative and qualitative research. Working across a variety of industries, Burke helps its clients gain actionable perspective on their most critical business challenges, providing a range of solutions from agile to integrated strategic decision support.

Today, Burke continues to push the boundaries of what marketing research can be, seamlessly uniting research, strategy and education. Backed by Seed Strategy—its strategic consulting subsidiary—Burke has the capabilities to support its clients throughout every phase of the product or service life cycle, with expertise in strategy, innovation, branding and marketing. In addition, Burke provides comprehensive training on research fundamentals and best practices through the Burke Institute—its dedicated education division and the industry’s leader in research and insights training. Wherever its clients find themselves on the path to success, Burke is uniquely equipped to help them move forward with clarity, confidence and purpose.

Continuing its long tradition of research innovation, Burke recently unveiled two new offerings: Geode|AI, an integrated insights system that analyzes multiple data sources to uncover patterns, relationships and critical insights that are often hidden; and Quantiment, a robust machine-learning solution that jointly extracts richer insights from structured and unstructured data.

24. YouGov *

Founded: 2000 2019 U.S. revenue: $76.8 million Percent change from 2018: 11.8% 2019 non-U.S. revenue: $107.5 million Percent from outside U.S.: 58.3% 2019 worldwide revenue: $184.3 million U.S. employees: 212

YouGov is a global provider of analysis and data generated by consumer panels in 42 markets. Its core offering of opinion data is derived from the proprietary YouGov Global Panel of more than 9 million people. The YouGov Global Panel provides the company with thousands of data points on consumer attitudes, opinions and behavior. YouGov captures these streams of data in the YouGov Cube, its unique connected data library that holds more than 10 years of historic single-source data. In 2019, YouGov panelists completed more than 25 million surveys.

YouGov’s data-led offering supports and improves a wide spectrum of marketing activities of a customer base, including media owners, brands and media agencies. YouGov works with some of the world’s most recognized brands.

Its syndicated data products include the daily brand perception tracker, YouGov BrandIndex and the media planning and segmentation tool YouGov Profiles. Its market-leading YouGov RealTime service provides a fast and cost-effective solution for reaching nationally representative and specialist samples. YouGov’s Custom Research division offers a wide range of quantitative and qualitative research, tailored by sector specialist teams to meet users’ specific requirements. YouGov data is delivered through Crunch, the most advanced analytics tool for research data, combining fast processing with drag-and-drop simplicity. YouGov has a strong record for data accuracy and innovation.

23. Phoenix Marketing International

Founded: 1999 2019 U.S. revenue: $77 million Percent change from 2018: -3.8% 2019 non-U.S. revenue: $4.5 million Percent from outside U.S.: 5.5% 2019 worldwide revenue: $81.5 million U.S. employees: 343

Global advertising and brand specialist Phoenix Marketing International operates in all major industries, utilizing modern technology, innovative research techniques and customized approaches to help clients elevate their brand, refine their communications and optimize their customer experience.

With the launch of Phoenix’s AdPi Brand Effect Platform, clients now have access to continuous advertising measurement and performance improvement insights through a single platform, providing the ability to analyze their campaigns at any stage in the advertising life cycle, and the flexibility to draw upon each piece as needed. Through more than 20 years of experience and testing thousands of ads per month, Phoenix developed 19 category-specific ad measurement models that uncover the drivers and creative attributes that explain the “whys” behind an ad’s creative performance, with forward-looking estimates for ad memorability and brand linkage.

Phoenix continues to evolve its CX solution, launching Competitive Customer Experience, a measurement of how consumers perceive their overall experience with a brand, including key touchpoints along the journey. Grounding recent experiences with a client’s brand, competitor brands and non-categorical benchmarking, Phoenix is able to evaluate brand opinion, understand what drives great CX outside of the category, focus on emotional drivers of brand CX, and provide an external view of culture, consistency and brand promises.

22. Concentrix **

Founded: 1983 2019 U.S. revenue: $95 million Percent change from 2018: 11.8% 2019 non-U.S. revenue: $130 million Percent from outside U.S.: 57.8% 2019 worldwide revenue: $225 million U.S. employees: 253

Concentrix is a wholly owned subsidiary of SYNNEX Corp., specializing in technology-enabled customer engagement and improving business performance for clients around the world. With more than 225,000 staff in more than 40 countries, Concentrix provides services to clients in 10 industry verticals: automotive, banking and financial services, insurance, healthcare, technology, consumer electronics, media and communications, retail and e-commerce, travel and transportation, energy and the public sector.

The Concentrix Voice of the Customer solution combines technology with experience management services provided by its in-house team of hundreds of CX professionals.

Powered by analytic tools and artificial intelligence, its customer feedback platform ConcentrixCX helps companies listen, analyze and act on omnichannel customer feedback at any point in the customer journey, at scale. Features include data capture and integration, real-time reporting and analytics, and coaching and employee engagement tools. Concentrix continues to invest in enhanced platform functionality—for example, multi-source data expansion of its proprietary text analytics engine, including structured and unstructured customer feedback sources such as surveys, social, messaging, complaints and email. New digital data collection capabilities include a conversational feedback bot and embedded micro-journey surveys.

Concentrix experience management services range from program management to strategic advisory services and are custom tailored to free clients’ internal teams to focus on transformational impact. Its CX experts specialize in quantitative and qualitative techniques, delivering data-driven insights through solutions such as survey design, relational loyalty research, CX journey analytics, digital channel optimization, customer segmentation, customer effort assessment and integrated CX analytics.

21. Escalent

Founded: 1975 2019 U.S. revenue: $97.1 million Percent change from 2018: -3.4% 2019 non-U.S. revenue: $5.5 million Percent from outside U.S.: 5.4% 2019 worldwide revenue: $102.6 million U.S. employees: 352

Escalent is a human behavior and analytics firm specializing in industries facing disruption. The company transforms data and insights into an understanding of what drives human behavior, and it helps businesses turn those drivers into actions that build brands, enhance customer experiences and inspire product innovation.

Escalent specializes in automotive and mobility, consumer and retail, energy, financial services, health, technology and telecommunications. Focusing on select industries allows Escalent to function as a trusted business partner who knows the challenges its clients face and understands how to engage their most valuable audiences.

Escalent has three centers of excellence: Qualitative Research combines emerging technologies, anthropology and ethnography to tap into human insights that reveal real needs and potential; Marketing & Data Sciences combine survey, behavioral, transactional and third-party data to solve tough research challenges; and Insight Communities provides private, online platforms for brands to engage with groups of stakeholders to quickly and easily draw insights.

20. dunnhumby **

Founded: 2001 2019 U.S. revenue: $100 million Percent change from 2018: -3.8% 2019 non-U.S. revenue: $335 million Percent from outside U.S.: 77% 2019 worldwide revenue: $435 million U.S. employees: 230

Dunnhumby is a customer science company that analyzes data and applies insights for almost 1 billion shoppers across the globe to create personalized customer experiences in digital, mobile and retail environments. Its strategic process, proprietary insights and multichannel media capabilities build loyalty with customers to drive competitive advantage and sustained growth for clients. Dunnhumby uses data and science to understand customers, then applies that insight to create personalized experiences that build lasting emotional connections with retailers and brands. It’s a strategy that demonstrates when companies know and treat their customers better than the competition, they earn more than their loyalty—they earn a competitive advantage.

Dunnhumby was established in the U.S. to help retailers and manufacturers put the customer at the heart of their business decisions. Analyzing data from millions of customers across the country, dunnhumby enables clients to use this insight to deliver a better shopping experiences and more relevant marketing to their customers.

By putting best customers at the center of every decision, dunnhumby’s approach delivers measurable value, competitive edge and even more customer data to fuel ongoing optimization, setting clients up for long-term success.

Dunnhumby serves a prestigious list of retailers and manufacturers in grocery, consumer goods, health, beauty, personal care, food service, apparel and advertising, among others. Clients include Tesco, Procter & Gamble, Coca-Cola, Macy’s and PepsiCo.

19. Informa Financial Intelligence**

Founded: 2016 2019 U.S. revenue: $107 million Percent change from 2018: 1.9% 2019 non-U.S. revenue: $36 million Percent from outside U.S.: 25.2% 2019 worldwide revenue: $143 million U.S. employees: 500

Informa Financial Intelligence is a leading provider of business intelligence, market research and expert analysis to the financial industry. The world’s top global financial institutions and banks look to Informa Financial Intelligence for its authority, precision and forward-focused analysis.

Informa Financial Intelligence consists of key research, analysis and industry experts, such as Informa Research Services, EPFR Global, Informa Global Markets, iMoneyNet, Informa Investment Solutions, eBenchmarkers and Mapa Research.

Informa Financial Intelligence provides fund and wealth managers, traders, insurers, analysts, and investment and retail bankers with the intelligent advantage to make informed decisions, understand past trends, forecast future performance, drive profitability and increase returns.

Because of their strong background in the financial industry, the research teams of Informa Financial Intelligence are highly qualified to help financial institutions with their market research needs. Informa’s researchers are experts in benchmarking studies, competitive intelligence, new product development and usability testing, customer and member satisfaction and loyalty research, brand and advertising awareness research, and mystery shopping services for sales and service quality evaluation, legal and match pair testing, compliance, discrimination and misleading sales practices testing. Informa is considered a leader in the use of market research to limit the risk associated with allegations of discrimination, UDAAP (unfair, deceptive, or abusive acts or practices), predatory lending and misleading sales practices.

18. NRC Health

Founded: 1991 2019 U.S. revenue: $113 million Percent change from 2018: 10.8% 2019 non-U.S. revenue: $3.6 million Percent from outside U.S.: 3.1% 2019 worldwide revenue: $128 million U.S. employees: 448

NRC Health (formerly National Research Corp.) has helped healthcare organizations illuminate and improve the moments that matter to patients, residents, physicians, nurses and staff for more than 38 years. The company offers performance measurement and improvement services to hospitals, healthcare systems, physicians, health plans, senior care organizations, home health agencies and other healthcare organizations.

NRC Health solutions help organizations stay at the forefront of healthcare by understanding the totality of healthcare consumer and staff experiences. Primary solutions include:

- Experience solutions capture personal experiences, while delivering insights to power a new benchmark: n=1. Developing a longitudinal profile of customers’ healthcare wants and needs allows for organizational improvement, increased provider and staff engagement, loyal relationships and personal well-being.

- The Loyalty Index, composed of seven aspects that combine to provide a 360-degree view of healthcare consumer loyalty—a single, trackable metric to identify emerging trends in consumer behavior and benchmark against peers.

- Market Insights is a large U.S. consumer database that gives partners access to the opinions of 310,000 healthcare consumers in 300 markets, and access to resources to better understand target audiences and gauge consumer response to communications.

- The Transparency solution calculates star ratings from existing patient, resident and family survey data, and publishes those ratings to organizations’ websites.

- The Governance Institute supports the efforts of healthcare boards across the nation—to lead stronger organizations and build healthier communities. NRC Health partners with organizations to improve governance efficiency and effective decision-making by providing trusted, independent information, tools and resources to board members, executives and physician leaders.

17. MaritzCX **

Founded: 1973 2019 U.S. revenue: $118 million Percent change from 2018: — 2019 non-U.S. revenue: $44 million Percent from outside U.S.: 27.2% 2019 worldwide revenue: $162 million U.S. employees: 600

MaritzCX is a software and research company that focuses on customer experience management for big business. The company offers a unique combination of award-winning CX software, industry-leading data and research science, deep vertical market expertise and managed program services. MaritzCX provides a full-service professional CX approach designed to continuously improve the customer experience across an enterprise’s customers, employees, prospects and partners.

MaritzCX’s research insights include its leading CXStandards competitive benchmarking research that delivers quarterly benchmarks for 55 CX categories across 16 industries. Its CXEvolution study of more than 10,000 practitioners’ feedback informed large enterprises of their CX gaps.

The company’s focus is to leverage the MaritzCX platform, its industry-leading studies and research services to drive more meaningful experiences between its clients and their customers by adding product and research services and continued thought leadership in the CX market. In addition, MaritzCX has received CMS-certification for HCAHPS surveys, becoming the industry’s first CX platform company to offer an inclusive CX-based patient experience platform.

MaritzCX specializes in solutions for key industries, including automotive, financial services, retail, technology, B2B and more. Its global reach includes more than 900 full-time employees and 800-plus part-time or contract employees in 19 offices around the world. MaritzCX provides solutions to more than 500 clients and 1.6 million users who speak 72 languages in 100 countries. MaritzCX is committed to being its clients’ customer experience research partners.

In March 2020, InMoment acquired MaritzCX.

16. DRG (Decision Resources Group) **

Founded: 1990 2019 U.S. revenue: $140 million Percent change from 2018: 2.2% 2019 non-U.S. revenue: $53 million Percent from outside U.S.: 27.5% 2019 worldwide revenue: $193 million U.S. employees: 399

DRG, the Health Science & Analytics Division of Piramal Enterprises, is a global information and technology services company that provides proprietary data and solutions to the healthcare industry. DRG has brought together best-in-class companies to provide end-to-end solutions to complex challenges in healthcare. DRG reframes these challenges, enabling its customers to see the opportunities. Pharmaceutical, biotechnology, medical technology and managed care companies rely on this analysis and data to make informed decisions critical to their success.

Framing the current status and future trends in target healthcare markets using data, primary research and secondary research is a core competency of DRG. Product offerings include high‐value analytics, syndicated research, proprietary databases, decision support tools and advisory services.

DRG has a number of key specialties, including syndicated research focused on new therapeutic opportunities; portfolio planning, changing industry dynamics and global treatment patterns; insights and data on physician and consumer healthcare e‐marketing; and proprietary databases and analytics covering more than 90% of the U.S. managed care markets.

15. Wood Mackenzie **

Founded: 1973 2019 U.S. revenue: $150 million Percent change from 2018: 3.4% 2019 non-U.S. revenue: $335 million Percent from outside U.S.: 69.1% 2019 worldwide revenue: $485 million U.S. employees: 337

Wood Mackenzie, a Verisk business, is a leading research and consultancy business for the global energy, chemicals, metals and mining industries. Wood Mackenzie launched in 1923 as a small, relatively unknown, Edinburgh, Scotland-based stockbroker. By the 1970s, it had become one of the top three stockbrokers in the UK, renowned for the quality of its equity research.

Its success has always been underpinned by the clear and simple principle of providing trusted research and advice that would make a difference to clients. This was true when the first oil report was published by its equity analysts in 1973 and remains just as relevant to it today. So much so that, over the past four decades, Wood Mackenzie has drawn upon its heritage to create a global research and consultancy business that has grown alongside the needs of its clients.