The Mining Business Model

How does the mining industry create value? The answer to that question is provided by the mining business model. But what is a business model?

Here is one definition:

The term “business model” is used to describe how systems and people are organized to create, capture, and deliver value.

Shown below is an illustration of the current business model of Mine Co. Government owns the mineral rights and gives Mine Co a permit to develop and operate a mine. In return royalties and taxes are paid by Mine Co to Government. Mine Co sells products from the mine to buyers. A network of local and international companies supplies Mine Co with the equipment and materials needed to operate the mine. Benefits may arise if there is engagement between Mine Co, Government, and Community. The community determines whether the mining project is granted a “social licence” to operate.

This model has worked well, but has given rise to some notable non-technical risks that suggest some changes are necessary. For example, there could be disagreement between Mine Co and Government about taxes and royalties and unless the disagreement is resolved Government could expropriate the operation. Also, the engagement between Government, Community, and Mine Co should provide benefits to Community resulting from a combination of redistribution of royalties and taxes from Government and initiatives developed by Mine Co. However, there is no guarantee that any part of this combination will happen. A failure to deliver benefits to Community can lead to anti-mining sentiment and disruptions to operations. The common result is that Mine Co becomes subject to high expectations trying to satisfy Government and Community as well as provide value to shareholders.

An alternative model is illustrated below. In this new model, a service company, MaaS Co (Mining as a Service), enters into a contract with a Mineral Rights Owner (MRO) to extract and process minerals which are sold to buyers. The proceeds of the sales are subject to a revenue-sharing agreement between MaaS Co and MRO. Maas Co builds a supply network by means of contracts with both local and remote suppliers. To deliver benefits, MaaS Co and the MRO work with Community to form a local supply chain.

MaaS Co would be in competition with similar companies to be the provider for the MRO. MaaS would achieve competitive advantage through superior application of technology. Further advantage can be achieved by development of innovative engagement schemes with Community and local suppliers, which governments would likely look upon favourably.

This model replaces the non-technical problems with market-based structures. For the model to function over the long-term, the relationship between the MRO and MaaS Co must be a partnership. It cannot be a form of contract mining.

Related People

Scott dunbar.

5 Ways Mining Business Models will Change in the Future

In the past, the mining sector has primarily focused on traditional mining business models to improve productivity. However, trends are now revealing that enabling infrastructure is the central cost in developing new mines. As a result, mining companies now need to look beyond traditional mine development methods (such as geology, mining and processing) and to new strategies to improve productivity and profitability.

Mining IQ has summarized five considerations mining companies should contemplate when creating a mining business model for the future.

1. Cost is only half the equation

Mining companies need to explore how to get better value from the resources they have. While cost is an important element, it’s not everything. Companies should be focusing more on value. The problem with reactive cost-cutting (particularly in the current state of the industry) is it can potentially destroy mine value. A lean and innovative approach to keeping costs down, while focusing on value outputs is needed in order to regain footing.

2. Out with the old, in with the new

The mining industry is currently facing the challenge of using mine development methodology that may have been right for when mines were less remote and less complex, but are now out-dated.

For miners to improve productivity and ROI, they need to get an optimum ‘whole of mine business’ approach, and understand the whole value chain and integrated decisions across that value chain. This can only be achieved effectively by embracing new technologies and innovation.

3. Remove silos across the mining value chain

Like most businesses the mining industry tends to compartmentalize roles and job functions so that manager can control things. As a result silos can be quite common, resulting in bottlenecks in efficiency. Businesses that create integration across the value chain so those managers are removed from their silos and are thinking and being rewarded for the performance across the whole business will make a huge difference to the performance of their mines.

4. Focus on infrastructure and sustainability

In recent years, safety has become the number one important focus across the mining industry, with safety being built into projects. It is now a fundamental part of the way mines are developed and operated. Some might argue that sustainability is the new safety. Having a culture of sustainability will be fundamental to the efficiency of projects, enabling them to be delivered with the best ‘triple bottom line’ outcomes.

5. Embrace new technologies

The emergence of driverless vehicles and remote operating centers has increased efficiencies into the mining sector in terms of being able to manage with fewer resources and costs. Looking towards the future, it will be important for companies to embrace new and emerging technologies and understand how they can impact and improve bottom line efficiencies.

- Brightstar, Eldridge and Claure acquire Ausenco Supply Chain & Operations

- First Quantum contracts with MECS to cut emissions Supply Chain & Operations

- Tin production at Andrada Mining reaches record levels Supply Chain & Operations

- Ternium plans to build US$3.2bn steel plant in Mexico Supply Chain & Operations

Featured Articles

Laws Thwart US Bid to Match China on Lithium Mining

US bid to increase domestic production of lithium in order to reduce reliance on Chinese supplies of critical mineral frustrated by 'confusing' state laws …

Bain: 'Inflation Dampening Mining Leaders' Net Zero Hopes'

Bain & Company’s annual Energy & Natural Resource Executive Survey shows 62% of energy execs say high costs mean net zero goals won't be met by 2060 …

Focus on: Lithium – ‘White Gold’ Driving the EV Revolution

Because of the move to electric vehicles, the metal lithium is rapidly becoming a vitally important part of world’s bid to move away from fossil fuels …

Aluminium Industry Calls for new North America Body

Data-Driven ABB Smart Hoisting Solution 'is Safety Boon'

Deep Sea EV Metals Mining Firm in Greenpeace Clash

- KPMG: Canada Critical Minerals Mining 'Needs tax Breaks'

- Saudi and UAE Oil Companies 'to Produce Lithium for EVs'

- Mining Industry has Long Way to go on Addressing DEI Issue

- KPMG: ESG Chief Worry for Australian Mining Companies

- Exyn Nexys: a 3D Mapping Instrument for Mining Professionals

Developing a Mining Business Case for Investment: Methods

- First Online: 22 November 2019

Cite this chapter

- Michael Seeger 2

503 Accesses

1 Citations

In the current business environment only a strong mining business case will be able to access raised capital. The mining business case, from orebody to market, is fundamental to the success of raising capital for mining project and operations. When the mining business case is strong, large returns can be made for investors, and when it is flawed, large sums of money are lost.

This chapter covers the process of developing a mine, from exploration, feasibility to production and closure, the structure of the business case which is driven by the market and the orebody, the team as an integral part of the success of the business case, legal structuring of the mining business, the financial analysis of the mining business case, valuation methods to enable successful negotiation between the mine developer and the investor, the identification and management of risks in mining, the importance of environmental and social sustainability to attract mining capital against the poor track record of many mining project of the past, the plan and realty of implementing mining projects and importance of questioning and defending the business case to investors.

The business case is summarised in a mining project matrix, which will highlight the strengths to focus on and weaknesses to be addressed, enabling the mine developer to approach the market for capital with confidence.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Mining Journal . The Global Mining Finance Guide 2014.

Google Scholar

Sanderson, H. (2018, August). Coal industry between a rock and a hard place. Financial Times.

Seeger, M. (2007). Development of a strategic and tactical game plan for junior mining companies . PhD thesis, University of the Witwatersrand, South Africa.

Caselli, S., & Gatti, S. (2017). Structured finance: Techniques, products and market (2nd ed.). Cham: Springer.

Book Google Scholar

Course Notes. (2005, August). Wits CEE course: Financing of mining projects . Course held at the University of the Witwatersrand.

https://mrmr.cim.org/en/standards/valuation-guidelines-for-mineral-properties/

http://www.valmin.org/

https://www.samcode.co.za/samcode-ssc/samval

Cooper, D., & Chapman, C. (1987). Risk analysis for large projects – Models, methods and cases . Chichester: Wiley.

Seeger, M. (1999). MSc Eng project report: Identification, quantification and simulation of risks facing Greenfields mining projects in sub-Saharan Africa . Johannesburg, South Africa: University of the Witwatersrand.

https://equator-principles.com/

Download references

Author information

Authors and affiliations.

Munich, Germany

Michael Seeger

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Seeger, M. (2019). Developing a Mining Business Case for Investment: Methods. In: Mining Capital. Springer, Cham. https://doi.org/10.1007/978-3-030-31225-1_2

Download citation

DOI : https://doi.org/10.1007/978-3-030-31225-1_2

Published : 22 November 2019

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-31224-4

Online ISBN : 978-3-030-31225-1

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

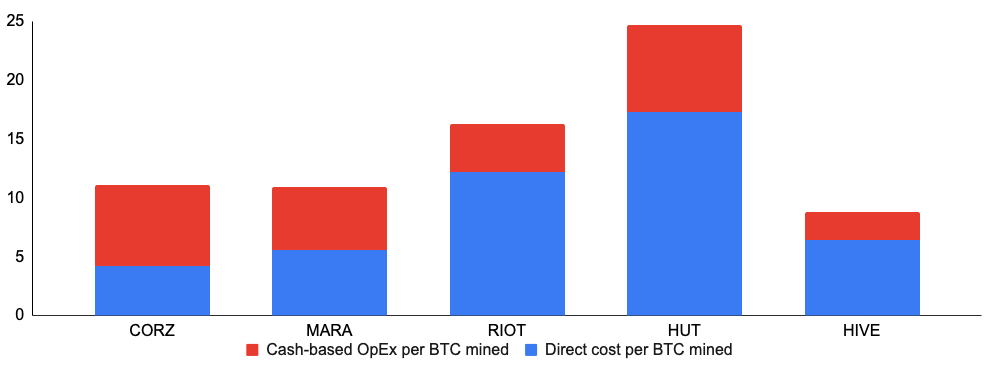

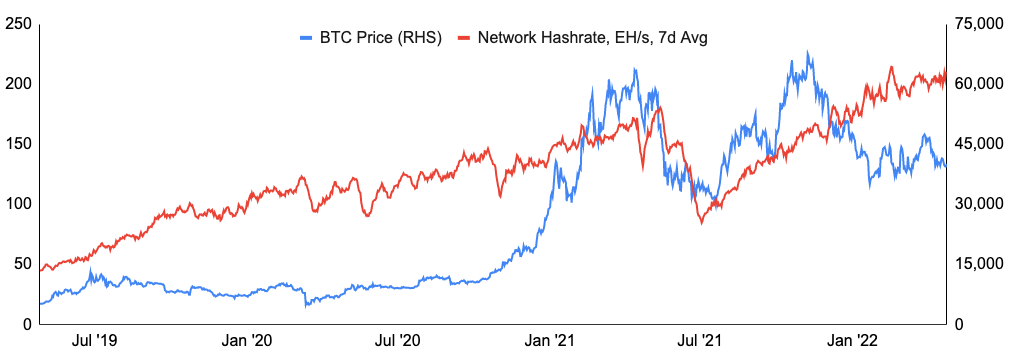

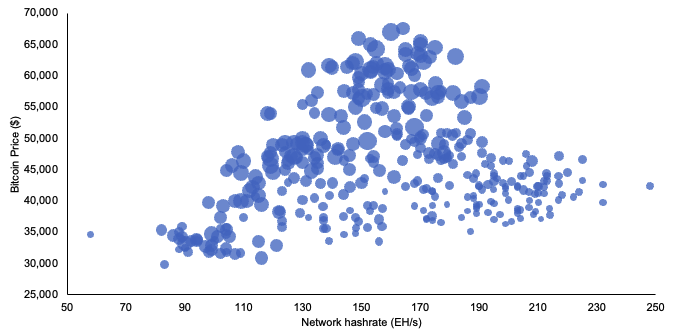

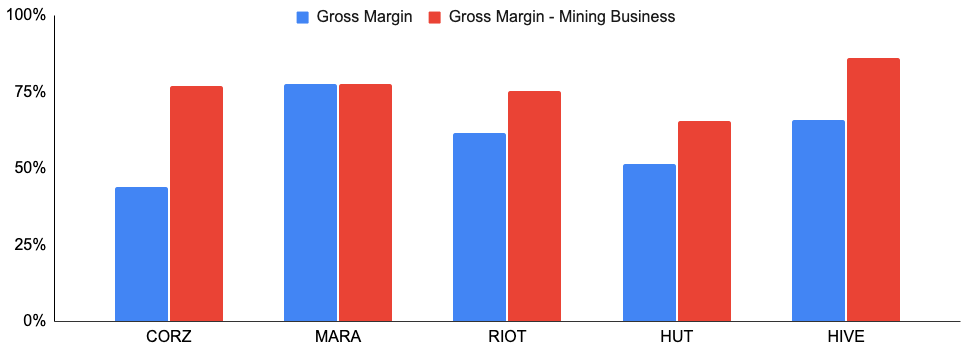

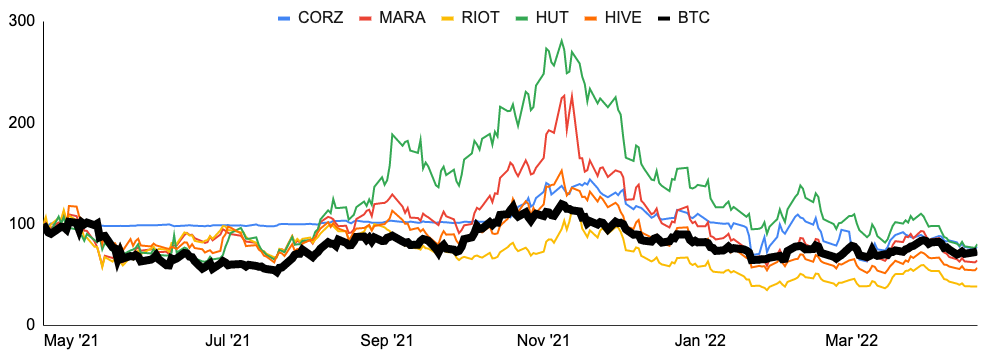

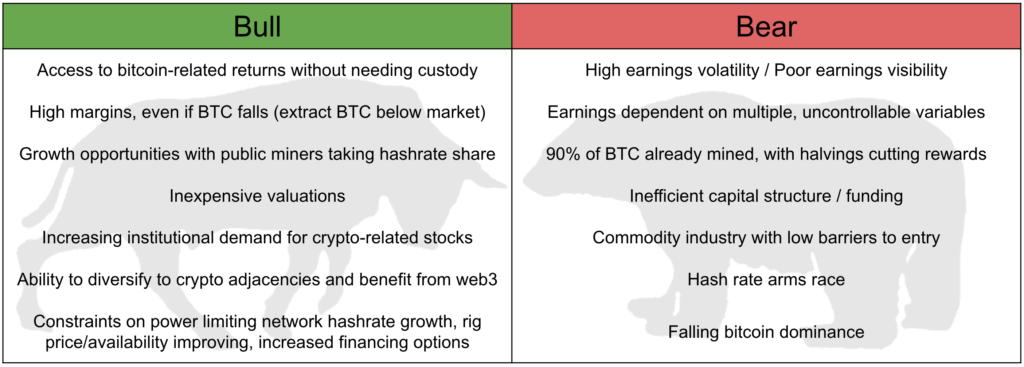

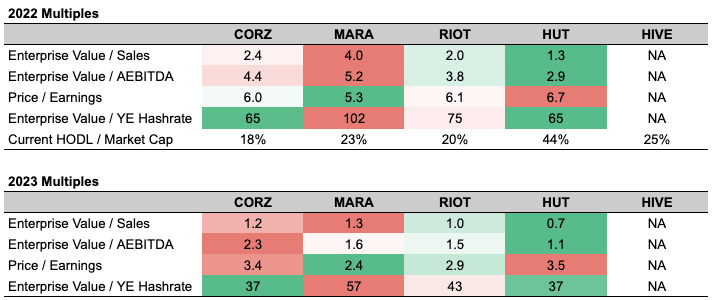

Breaking Down Bitcoin Mining Business Models

What are self-mining, co-location, and vertical integration in bitcoin mining?

September 8, 2022 November 26, 2023

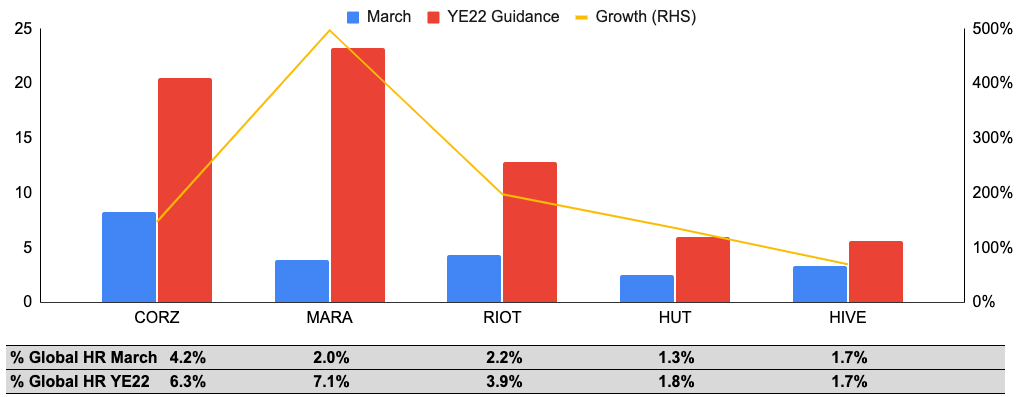

From at-home mining more than a decade ago to industrial-scale activities powered by gigawatts of capacities, bitcoin mining has come a long way since its inception.

An unprecedented level of capital drawn to the industry over the past year has helped form about 20 publicly listed mining companies with various business models.

Over a decade after Bitcoin’s genesis block, one clear thing is that bitcoin mining has become more vertically integrated than ever.

In the past, miners ran operations at home or in small-scale abandoned factories. Gradually, there came more properly built facilities that lured mining customers.

Some of those facility owners later realized the lucrative side of self-mining and embarked on the journey themselves. Power generators then started to notice how self-mining could bolster their balance sheet and decided to have an extra business stream.

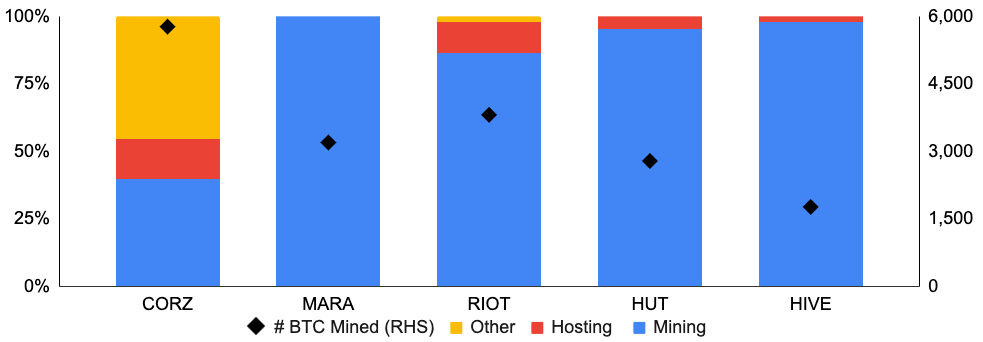

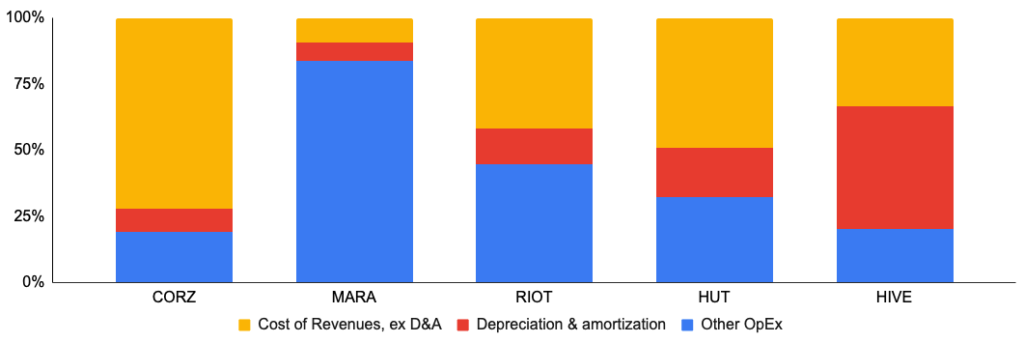

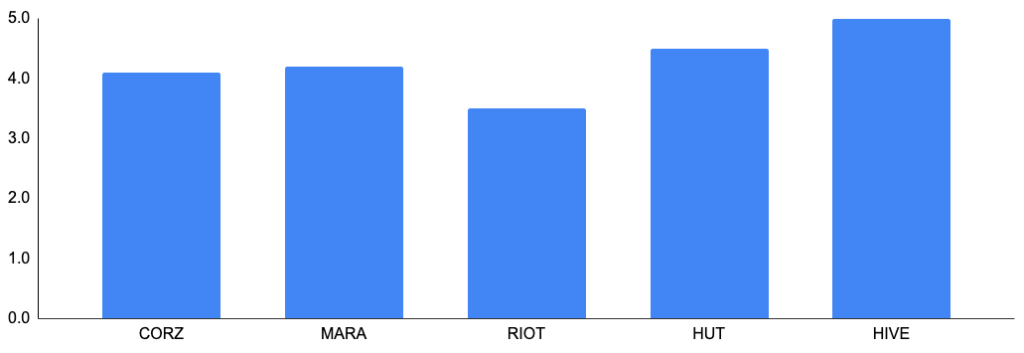

This explainer breaks down mining companies by five business models: Asset-light Mining, Co-location Only, Self-Mining Only, Hybrid Mining, and Vertical Integration.

If you are new to bitcoin mining, we recommend this piece that provides an overview of the bitcoin mining ecosystem .

Asset-Light Mining is a model where a company owns mining equipment but does not fully own mining data centers. They rely on third-party co-location providers to host their equipment and pay hosting fees.

Sometimes, asset-light mining operators may set up a joint venture with a co-location partner or share a portion of their mined bitcoin based on the exact agreements. But the main idea is that they let their hosting partners do the heavy lifting on power sourcing, construction, and maintenance.

Co-location Only refers to a model where a mining data center owner only hosts for customers but does not engage in self-mining. They are responsible for sourcing energy to power their infrastructure and profit from selling such energy capacity to mining customers with markup and charging management fees.

Self-Mining Only, on the other hand, means a mining data center owner completely mines bitcoin for itself and does not allocate any energy capacity to third-party customers. Hence, it solely profits from the production of bitcoin with self-owned mining equipment.

Hybrid Mining is the combination of co-location and self-mining. In such a model, a company typically owns facilities with large power capacities in hundreds of megawatts. To fulfill these capacities with completely proprietary equipment would be extremely expensive. As such, they allocate some energy capacities to host third-party customers while using the remaining capacity for self-mining.

Companies have to rely on credible third-party power producers in any of the four models explained above. But what if a power producer integrates power, infrastructure, and mining equipment? That is what Vertical Integration means in bitcoin mining.

A vertically integrated power producer can be flexible in terms of the utilization of their generated power. They can sell parts of the energy to the grid while self-mining bitcoin with the remaining capacity or provide hosting capacity for customers, or both.

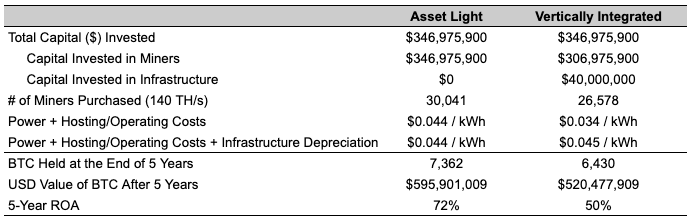

Each business model has unique pros and cons and there are prominent examples in the public market. The table below provides a high-level summary.

- DIGITAL MAGAZINE

- Sign In Log out

- Newsletter signup

- Underground

- Environment

- LATEST HEADLINES

- News Analysis

- Partner Content

- About Mining Magazine

- Frequently Asked Questions

- Terms and Conditions

- Privacy Policy

- Cookie Policy

ENVIRONMENT

Mining's business model 'unviable by 2033'.

Over 40% of mining chief executives believe mining's current business models will become unviable in "10 years or less", according to a survey by PwC.

"Reconfiguring existing supply chains requires enormous levels of new capital."

The findings of PwC's Annual Global CEO Survey suggested that the success of decarbonisation efforts could define mining's future evolution. While 41% of respondents said current business models will...

Already have an account? Sign in here

The definitive guide to mining operations and excellence..

Established in 1909 by Herbert Hoover, Mining Magazine provides comprehensive technical insight into mining operations. It aims to inform and support mine management in decision-making regarding mining techniques, technologies, workforce, logistics, and supply chains.

Standard Subscription

- Global news and analysis

- Exclusive industry columns

- Daily email newsletters

- Monthly digital magazine

Individual, Team and Corporate options available

Premium Subscription

All Standard benefits, plus

- 5x annual Research Reports on key industry topics*

- 4x annual Equities Updates*

*Each valued at £595

RELATED ARTICLES

- Saudi's new law attracts investors as salt flats are put up for grabs

- Does edge computing have a place in a cloud-centric mine?

Spy vs. Spy: US to enlist FBI, CIA in critical minerals race

- Quebec targets pole position in critical minerals circularity race

- NEXT: Mitigating tailings risk with filtering and co-disposal

- PREVIOUS: Mining the top source of environmental conflicts

Get the Mining Magazine Newsletter delivered free each day

From our partners, partner content, integral grinding and crushing solutions that add value, are your pumps putting your production and on-site safety at risk, most popular, msha inspections reveal serious violations at us mines, one every month: tracking the explosion in international critical minerals deals, underground, akobo minerals plans higher gold production in segele's first year, premium subscribers only.

A growing series of reports, each focused on a key discussion point for the mining sector, brought to you by the Mining Magazine Intelligence team.

Mining Magazine Intelligence Future Fleets Report 2024

The report paints a picture of the equipment landscape and includes detailed profiles of mines that are employing these fleets

Mining Magazine Intelligence Digitalisation Report 2023

An in-depth review of operations that use digitalisation technology to drive improvements across all areas of mining production

Mining Magazine Intelligence Automation Report 2023

An in-depth review of operations using autonomous solutions in every region and sector, including analysis of the factors driving investment decisions

Mining Magazine Intelligence Exploration Report 2023 (feat. Opaxe data)

A comprehensive review of current exploration rates, trending exploration technologies, a ranking of top drill intercepts and a catalog of 2022 Initial Resource Estimates and recent discovery successes.

- Newsletter Signup

- Digital Magazine

- Terms And Conditions

THE ASPERMONT BRAND PORTFOLIO

Copyright © 2000-2024 Aspermont Media Ltd. All rights reserved. Aspermont Media is a company registered in England and Wales. Company No. 08096447. VAT No. 136738101. Aspermont Media, WeWork, 1 Poultry, London, England, EC2R 8EJ.

Not a Subscriber?

Subscribe now.

INTEGRATED ANNUAL REPORT

- CORPORATE INFORMATION

- PDF DOWNLOADS

Currently viewing: OUR BUSINESS | Our business model | Next: Material matters

Our business model

Gold Fields has firmly positioned itself as a global diversified gold producer with a quality portfolio of mechanised underground and open-pit mines. Our business model explains how we aim to fulfil our strategic objectives, as well as how we create, preserve or erode value for our stakeholders over time.

- Business Process

OUTCOMES FOR THE BUSINESS AND STAKEHOLDERS DURING 2020

- 5,641 employees

- 12,771 contractors

- Ethical, accountable and transparent leadership

- Attracting and retaining a steady supply of the right skills in a highly competitive environment

- Sourcing the right skills from our host communities

- Increasing the diversity of our leadership teams

- 13,128 TJ of energy consumption

- 21.7 GL water withdrawn

- The impact of climate change on our mines and surrounding communities

- Operating in water-stressed regions

- Security of power supply and cost of energy

- Inclusive Stakeholder Engagement and Relationship Policy

- Sound and transparent working engagements with governments at national, regional and local levels

- Open and honest relationships with our host communities

- The trust gap between mining companies, governments and communities

- US$584m capital expenditure

- US$868m cash generated

- The impact of market sentiment and geopolitical developments on the gold price and foreign exchange rates

- Nine operating mines (including our Asanko JV) and one project

- US$409m sustaining capital and US$175m growth capital

- Strong Mineral Reserves and Resources position

- Ageing infrastructure at our older mines

- Balancing the requirement of modernising our mines with cost reductions

- Innovation and technology that improve cost, safety and productivity

- Modernisation strategy

- Business improvement initiatives

- Developing the right talent to meet the future needs of an increasingly mechanised, modernising and automated mining industry

- Reskilling the existing workforce to ensure we can retain their experience and knowledge

BUSINESS PROCESS

Our active portfolio management approach has enabled us to build a geographically diversified portfolio with nine mines and one project in five countries. We focus on the following elements:

Gold Fields manages its business with the overriding strategic objective to continually improve the quality of its portfolio by lowering All-in costs (AIC), thereby increasing free cash-flow (FCF) margin per ounce of gold produced.

EXPLORATION

Acquiring or developing lower-cost (than Group average), longer-life assets

DEVELOPMENT

Extending the life of current assets through near-mine brownfield exploration

In-country opportunities to leverage off our existing footprint, infrastructure and skills set, and capitalise on the experience we have gained from operating in these jurisdictions

Disposing of higher-cost, shorter-life assets that management believes can be better served by a company that has more time and resources to commit to them

MINE CLOSURE

Environmental stewardship, through which we protect and enhance relationships between our operations and host communities

2.24Moz of attributable gold-eq production 24.8kt of attributable copper production 141Mt mining waste produced

59Mt of tailings waste 10.0Gl of freshwater used 1.942Mt CO 2 e emissions

US$480m paid in salaries and benefits

US$6.8m spent on training and development

One fatal incident

10 deaths among our people (March 2020 – March 2021) due to Covid-19-related illnesses

10 new cases of Silicosis submitted to health authorities

Six serious injuries

20% of our total workforce are women, including women in leadership

Related SDGs

Zero Level 3 – 5 environmental incidents for the second consecutive year

Recycled 71% of water withdrawn and reduced our freshwater intake by 3%

Achieved an A score in the CDP's Water Disclosure Project, demonstrating leadership in water stewardship and reporting transparency

1.97Mt CO 2 e

200Mt of total material moved

All mines, implemented at least 93% of their progressive rehabilitation plans

12 community grievances relating to environmental stewardship

US$17m invested in programmes and projects that benefit our host communities

Employment for 8,752 members of our host communities (53% of our total workforce)

US$536m spent with host community enterprises (29% of total procurement costs)

86% of our employees are from our countries of operation and 96% of all goods and services are procured in-country

US$381m paid to governments in taxes and royalties

139 community grievances

Released our first Report to Stakeholders, providing increased transparency on the impact of our operations on key stakeholders

US$868m in mine cash-flow

US$253m paid in interest and dividends

Net debt decreased to US$1,069m (2019: US$1,664m)

JSE share price up 46%; NYSE share price up 42%

Total dividend of R4.80/ share declared, up 200% from 2019

US$467m in gross mining closure liabilities

US$30m spent on Covid-19-related programmes to assist our employees, communities and governments

US$112m spent on Salares Norte project, with construction ahead of plan

Invested US$50m in near-mine exploration (including Salares Norte)

Damang Reinvestment project in Ghana providing strong returns

South Deep and Cerro Corona closed for a number of days as part of nationwide lockdowns in response to Covid-19

Lost 3.5% of production against original market guidance due to impact of the Covid-19 pandemic

Replaced 103% of depleted Mineral Reserves

Lower production and higher costs at the Cerro Corona mine due to Covid-19-related actions

Continued improvement in production and costs at the South Deep mine amid successful implementation of restructuring initiatives

Completed one of the world’s largest renewable energy microgrids at Agnew and installed a microgrid at Granny Smith

Installed an advanced collision avoidance system in Ghana to reduce worksite accidents and injuries

Continued investment in South Deep, South Africa’s largest bulk, mechanised, underground gold mine

Salares Norte signs contract to instal 26MW microgrid, including 10MW solar

Salares Norte signs contract to use dry-stack tailings, one of the most environmentally responsible tailings solutions

Increased use of real-time data to enable decisions that facilitate safer and more productive mines

Introduction of drones underground for tasks like cavity scanning, remote drill hole surveying and cleaning

Gold Fields Integrated Annual Report 2020

We and our partners use cookies to give you the best online experience, including to personalize content, advertising, and web analytics. You can reject cookies by changing your browser settings. To learn more about the cookies we use see our Cookie Policy .

- Supply Chains

- Manufacturing

- Transportation

- Warehouse Operations

- Rail Logistics

- Ports & Terminals

- Road Traffic

- Passenger Terminals

- Business Processes

- Asset Management

- Social Processes

- Why simulation

- AnyLogic Timeline

- Artificial Intelligence

- Digital Twin

- Enterprise Simulation

- Get started

- White papers

- Case studies

- Training and events

- AnyLogic Conference

- Documentation

- For academia

- Academic articles

- Clients & Testimonials

Mining simulation: business cases and example models

- case studies

In mining, as in any other capital-intensive business, companies need to compare and optimize manufacturing and business processes all the time. For mining companies, a specific challenge increases costs: complex logistics for both raw material handling and mining procurement. Complex logistics are difficult for traditional optimization tools and they can fail to deliver satisfying results. As a result, companies are turning to new solutions.

One of these solutions is mining operation simulation. With it, you can simulate mining or equipment operations. You can also test limits and process changes without substantial costs. In this post, you will find some of the tasks which you can approach using mining simulation.

Extraction volume planning and mine operations analysis

These were the tasks we worked on for one of the largest steel manufacturers. Have a look at the company’s coal mine model: we developed it using standard AnyLogic tools.

This is a typical underground mining model. In it, borers extract ore, which is then transported along a dynamically changing network of conveyors. To develop such a model, we used information on:

- minefield markings

- local geology and drilling

- equipment quantity and performance

- duration and sequence of operations.

We simulated several mine operation scenarios. For each of them, we then estimated potential extraction volumes and possible types of stope formation. Then we calculated equipment load and additional investments to implement the scenarios.

Route planning and logistics scheduling for operations inside and outside mines

With this simulation model, you can optimize vehicle fleet mix and develop the best mine-to-processing-plant ore transportation plan. In the model, you can also reduce delivery costs and increase transportation reliability by recalculating routes in case of truck breakdowns and track blockages.

The model considers production plans, extracted raw materials, and infrastructure facilities, as well as the parameters of all equipment types. With the model, you can test if logistics structures can accommodate raw materials supply. For each structure you can calculate the flow volumes by logistics legs, as well as infrastructure requirements, and equipment and machinery costs. Based on these parameters, the optimal route is calculated.

These are typical tasks that we often solve for our clients in the mining industry and combine into the scenario analysis group.

The group also includes other tasks such as:

- dynamically forecasting ore extraction volumes and reserves;

- synchronizing operations inside and outside mines;

- calculating equipment utilization levels;

- determining the required number of vehicles and renting or equipment leasing period;

- planning equipment maintenance.

We develop all our models in AnyLogic. Its flexibility, integration of GIS maps, agent-based modeling, and advanced 3D animation make it the leading tool for modeling mining operations. You will find examples of such models on our AnyLogic Cloud profile .

More mining simulation case studies >>

We also recommend looking at the underground mine model (see below), which is among the standard AnyLogic examples that you can find in the software. The model simulates drilling, loading, blasting, ore loading with a dump truck, and ore transportation in the mine. One of the goals of the simulation model is to track equipment load and determine the optimal amount for tunneling operations. Another goal is to clearly show how machinery can cause transport route blockage in a mine. Take a look!

The example model will help you get started with mining operations modeling. The source files are available for download in AnyLogic and in AnyLogic Cloud .

Related posts

Mastering simulation techniques: tips and insights from an AnyLogic expert

Gain valuable insights and simulation tips from Dr. Benjamin Schumann's workshop at the AnyLogic Conference 2023, focusing on understanding simulation modelers’ pains and mastering simulation techniques. Dive into the generic model's hierarchy, key components, and dynamics.

Healthcare optimization: Ops Design innovations with simulation modeling

Discover how DaVita is integrating healthcare optimization into dialysis care. By utilizing simulation modeling, the clinic network is enhancing workflow and dialysis patient care technicians’ collaboration, aiming for superior patient outcomes. Check out the Ops Design team’s insights after their first steps in simulation modeling.

Tackling automotive industry challenges: manufacturing digitalization

Explore how automotive industry consultants leverage simulation modeling for industrial manufacturing optimization. Uncover strategies for strategic alignment, ROI evaluation, and future-proofing business success. Stay at the forefront of innovation as you discover the latest advancements shaping the future of the automotive industry.

Creating a custom simulation object – a robotic crane in AnyLogic software

Discover how to design and add unique objects to your simulations in AnyLogic software using our step-by-step guide. In this blog post, we explain how to do it, using the creation of a custom robotic crane as an example. Explore AnyLogic's capabilities to turn your innovative ideas into reality.

Top 5 AnyLogic blog posts of 2023

Last year, we published 32 blog posts, each unique and filled with relevant information for the simulation community. In this post, we would like to share the top 5 pieces published in 2023 that resonated the most with readers.

Workshop on AnyLogic 9: experience the technology

Explore in-browser modeling with AnyLogic 9 and engage in a hands-on pub simulation workshop. Study the core stages with expert guidance. Experience consistent performance and witness AnyLogic 9's status as a novelty in high-capacity simulation modeling. Preview the beta version with an AnyLogic Cloud subscription, seizing a glimpse of the future before its official release.

AnyLogic 2023 in review

As 2023 comes to an end, it's time for us to reflect on the year that was. In this blog post, we have gathered everything that happened this year, from AnyLogic and AnyLogic Cloud releases to the much-anticipated face-to-face AnyLogic Conference 2023. We also discuss blog posts and case studies that you might find interesting. And of course, we haven't forgotten about our events, social media platforms, and newsletter.

Accelerate enterprise digital transformation with unmatched simulation tools

For enterprises, it’s crucial to have tools for forecasting as well as monitoring, analyzing, and optimizing their operations to maintain a competitive edge in the market. Enterprise Simulation is a web-based application that shows data on a set of digital twins and can be used at the operational level. Learn more about this application and the role the AnyLogic ecosystem plays in developing it.

10 Mar The Open Group Exploration & Mining Business Reference Model

The project has produced a standard with two parts, including an Exploration and Mining Business Reference Model (diagram) and a Business Capability Reference Map.

Role of interoperability in this project:

The EMMM standard defines a common reference model and consistent business capabilities that enable mining companies to describe their businesses in a consistent way. This project covers enterprise Architecture and consistent process descriptions and definitions for mining business capabilities. This project covers Enterprise Architecture and consistent process descriptions and definitions for mining business capabilities. It creates a consistent description of mining businesses for enterprise architectures in mining companies, and for business managers.

Many mining companies are using the EMMM standard to describe their businesses.

Stakeholders:

Enterprise architects, business managers, operations, IT

Status: The EMMM standard was published in 2013.

Accessibility Model: The Open Group is membership-based; however, the standard is made freely available for use. Learn more and access the model: https://www.opengroup.org/content/exploration-mining-metals-minerals-emmm-forum-0

Click through the PLOS taxonomy to find articles in your field.

For more information about PLOS Subject Areas, click here .

Loading metrics

Open Access

Peer-reviewed

Research Article

Modeling and Simulation of the Economics of Mining in the Bitcoin Market

* E-mail: [email protected]

Affiliation Department of Electric and Electronic Engineering, University of Cagliari, 09123 Cagliari, Italy

- Luisanna Cocco,

- Michele Marchesi

- Published: October 21, 2016

- https://doi.org/10.1371/journal.pone.0164603

- Reader Comments

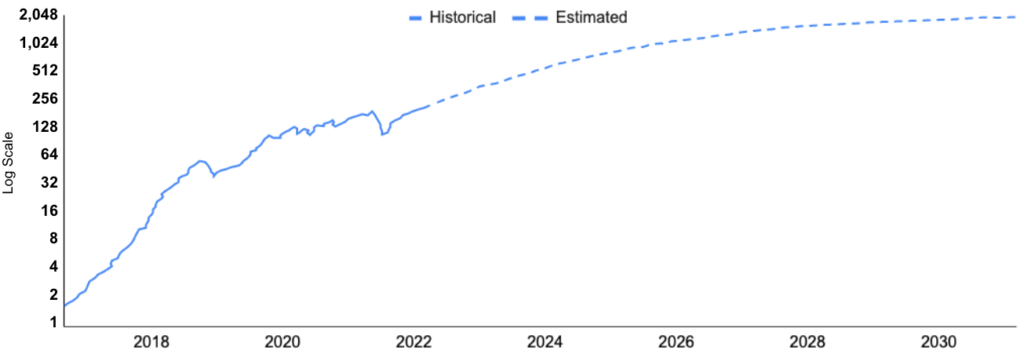

In January 3, 2009, Satoshi Nakamoto gave rise to the “Bitcoin Blockchain”, creating the first block of the chain hashing on his computer’s central processing unit (CPU). Since then, the hash calculations to mine Bitcoin have been getting more and more complex, and consequently the mining hardware evolved to adapt to this increasing difficulty. Three generations of mining hardware have followed the CPU’s generation. They are GPU’s, FPGA’s and ASIC’s generations. This work presents an agent-based artificial market model of the Bitcoin mining process and of the Bitcoin transactions. The goal of this work is to model the economy of the mining process, starting from GPU’s generation, the first with economic significance. The model reproduces some “stylized facts” found in real-time price series and some core aspects of the mining business. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. In addition, under proper assumptions, they can reproduce the generation of Bitcoins, the hashing capability, the power consumption, and the mining hardware and electrical energy expenditures of the Bitcoin network.

Citation: Cocco L, Marchesi M (2016) Modeling and Simulation of the Economics of Mining in the Bitcoin Market. PLoS ONE 11(10): e0164603. https://doi.org/10.1371/journal.pone.0164603

Editor: Nikolaos Georgantzis, University of Reading, UNITED KINGDOM

Received: February 22, 2016; Accepted: September 27, 2016; Published: October 21, 2016

Copyright: © 2016 Cocco, Marchesi. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Data Availability: All relevant data are within the paper and its Supporting Information files.

Funding: This work is supported by Regione Autonoma della Sardegna (RAS), Regional Law No. 7-2007, project CRP-17938 LEAN 2.0. The funding source has no involvement in any of the phases of the research.

Competing interests: The authors have declared that no competing interests exist.

Introduction

Bitcoin is a digital currency alternative to the legal currencies, as any other cryptocurrency. Nowadays, Bitcoin is the most popular cryptocurrency. It was created by a cryptologist known as “Satoshi Nakamoto”, whose real identity is still unknown [ 1 ]. Like other cryptocurrencies, Bitcoin uses cryptographic techniques and, thanks to an open source system, anyone is allowed to inspect and even modify the source code of the Bitcoin software.

The Bitcoin network is a peer-to-peer network that monitors and manages both the generation of new Bitcoins and the consistency verification of transactions in Bitcoins. This network is composed by a high number of computers connected to each other through the Internet. They perform complex cryptographic procedures which generate new Bitcoins (mining) and manage the Bitcoin transactions register, verifying their correctness and truthfulness.

Mining is the process which allows to find the so called “proof of work” that validates a set of transactions and adds them to the massive and transparent ledger of every past Bitcoin transaction known as the “Blockchain”. The generation of Bitcoins is the reward for the validation process of the transactions. The Blockchain was generated starting since January 3, 2009 by the inventor of the Bitcoin system himself, Satoshi Nakamoto. The first block is called “Genesis Block” and contains a single transaction, which generates 50 Bitcoins to the benefit of the creator of the block. The whole system is set up to yield just 21 million Bitcoins by 2040, and over time the process of mining will become less and less profitable. The main source of remuneration for the miners in the future will be the fees on transactions, and not the mining process itself.

In this work, we propose an agent-based artificial cryptocurrency market model with the aim to study and analyze the mining process and the Bitcoin market from September 1, 2010, the approximate date when miners started to buy mining hardware to mine Bitcoins, to September 30, 2015.

The model was validated studying its ability to reproduce some “stylized facts” found in real-time price series and some core aspects of the real mining business. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. To our knowledge, this is the first model based on the heterogeneous agents approach that studies the generation of Bitcoins, the hashing capability, the power consumption, and the mining hardware and electrical energy expenditures of the Bitcoin network.

The paper is organized as follows. In Section Related Work we discuss other works related to this paper, in Section Mining Process we describe briefly the mining process and we give an overview of the mining hardware and of its evolution over time. In Section The Model we present the proposed model in detail. Section Simulation Results presents the values given to several parameters of the model and reports the results of the simulations, including statistical analysis of Bitcoin real prices and simulated Bitcoin price, and sensitivity analysis of the model to some key parameters. The conclusions of the paper are reported in the last Section. Finally, Appendices A, B, C, and D, in S1 Appendix , deal with the calibration to some parameters of the model, while Appendix E, in S1 Appendix , deals with the sensitivity of the model to some model parameters.

Related Work

The study and analysis of the cryptocurrency market is a relatively new field. In the latest years, several papers appeared on this topic, given its potential interest and the many issues related to it. Several papers focus on the de-anonymization of Bitcoin users by introducing clustering heuristics to form a user network (see for instance the works [ 3 – 5 ]); others focus on the promise, perils, risks and issues of digital currencies, [ 6 – 10 ]; others focus on the technical issues about protocols and security, [ 11 , 12 ]. However, very few works were made to model the cryptocurrencies market. Among these, we can cite the works by Luther [ 13 ], who studied why some cryptocurrencies failed to gain widespread acceptance using a simple agent model; by Bornholdt and Steppen [ 14 ], who proposed a model based on a Moran process to study the cryptocurrencies able to emerge; by Garcia et al. [ 15 ], who studied the role of social interactions in the creation of price bubbles; by Kristoufek [ 16 ] who analyzed the main drivers of the Bitcoin price; by Kaminsky and Gloor [ 17 ] who related the Bitcoin market to its sentiment analysis on social networks; and by Donier and Bouchaud [ 18 ] who showed how markets’ crashes are conditioned by market liquidity.

In this paper we propose a complex agent-based artificial cryptocurrency market model in order to reproduce the economy of the mining process, the Bitcoin transactions and the main stylized facts of the Bitcoin price series, following the well known agent-based approach. For reviews about agent-based modelling of the financial markets see the works [ 19 , 20 ] and [ 21 ].

The proposed model simulates the Bitcoin market, studying the impact on the market of three different trader types: Random traders, Chartists and Miners. Random traders trade randomly and are constrained only by their financial resources as in work [ 22 ]. They issue buy or sell orders with the same probability and represent people who are in the market for business or investing, but are not speculators. Our Random traders are not equivalent to the so called “noise traders”, who are irrational traders, able of affecting stock prices with their unpredictable changes in their sentiments (see work by Chiarella et al. [ 23 ] and by Verma et al. [ 24 ]). Chartists represent speculators. They usually issue buy orders when the price is increasing and sell orders when the price is decreasing. Miners are in the Bitcoin market aiming to generate wealth by gaining Bitcoins and are modeled with specific strategies for mining, trading, investing in, and divesting mining hardware. As in the work by Licalzi and Pellizzari [ 25 ]—in which the authors model a market where all traders are fundamentalists—the fat tails, one of the main “stylized facts” of the real financial markets, stem from the market microstructure rather than from sophisticated behavioral assumptions.

Note that in our model no trader uses rules to form expectations on prices or on gains, contrarily to the works by Chiarella et al. [ 23 ] and by Licalzi and Pellizzari [ 25 ], in which traders use rules to form expectations on stock returns. In addition, no trader imitates the expectations of the most successful traders as in the work by Tedeschi et al. [ 26 ].

The proposed model implements a mechanism for the formation of the Bitcoin price based on an order book. In particular, the definition of price follows the approach introduced by Raberto et al. [ 27 ], in which the limit prices have a random component, modelling the different perceptions of the Bitcoin value, whereas the formation of the price is based on the limit order book, similar to that presented by Raberto et al. [ 22 ]. As regards the limit order book, it is constituted by two queues of orders in each instant—sell orders and buy orders. At each simulation step, various new orders are inserted into the respective queues. As soon as a new order enters the book, the first buy order and the first sell order of the lists are inspected to verify if they match. If they match, a transaction occurs. This in contrast with the approach adopted by Chiarella et al. [ 23 ], Licalzi and Pellizzari [ 25 ] and by Tedeschi et al. [ 26 ], in which the agents decide whether to place a buy or a sell order, and choose the size of the order, maximizing their own expected utility function.

The proposed model is, to our knowledge, the first model that aims to study the Bitcoin market and in general a cryptocurrency market– as a whole, including the economics of mining. It was validated by performing several statistical analyses in order to study the stylized facts of Bitcoin price and returns, following the approaches used by Chiarella et al. [ 23 ], Cont [ 28 ], Licalzi and Pellizzari [ 25 ] and Radivojevic et al. [ 29 ], for studying the stylized facts of prices and returns in financial markets.

The Mining Process

Today, every few minutes thousands of people send and receive Bitcoins through the peer-to-peer electronic cash system created by Satoshi Nakamoto. All transactions are public and stored in a distributed database called Blockchain, which is used to confirm transactions and prevent the double-spending problem.

People who confirm transactions of Bitcoins and store them in the Blockchain are called “miners”. As soon as new transactions are notified to the network, miners check their validity and authenticity and collect them into a set of transactions called “block”. Then, they take the information contained in the block, which include a variable number called “nonce”, and run the SHA-256 hashing algorithm on this block, turning the initial information into a sequence of 256 bits, known as Hash [ 30 ].

There is no way of knowing how this sequence will look before calculating it, and the introduction of a minor change in the initial data causes a drastic change in the resulting Hash.

The miners cannot change the data containing the information on transactions, but can change the “nonce” number used to create a different hash. The goal is to find a Hash having a given number of leading zero bits. This number can be varied to change the difficulty of the problem. The first miner who creates a proper Hash with success (he finds the “proof-of-work”), gets a reward in Bitcoins, and the successful Hash is stored with the block of the validated transactions in the Blockchain.

In a nutshell,

“Bitcoin miners make money when they find a 32-bit value which, when hashed together with the data from other transactions with a standard hash function gives a hash with a certain number of 60 or more zeros. This is an extremely rare event”, [ 30 ].

The steps to run the network are as follows:

“New transactions are broadcast to all nodes; each node collects new transactions into a block; each node works on finding a difficult proof-of-work for its block; when a node finds a proof-of-work, it broadcasts the block to all nodes; nodes accept the block only if all transactions in it are valid and not already spent; nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash”, [ 1 ].

Producing a single hash is computationally very easy. Consequently, in order to regulate the generation of Bitcoins, the Bitcoin protocol makes this task more and more difficult over time.

The proof-of-work is implemented by incrementing the nonce in the block until a value is found that gives the block’s hash with the required leading zero bits. If the hash does not match the required format, a new nonce is generated and the Hash calculation starts again [ 1 ]. Countless attempts may be necessary before finding a nonce able to generate a correct Hash (the size of the nonce is only 32 bits, so in practice it is necessary to vary also other information inside the block to be able to get a hash with the required number of leading zeros, which at the time of writing is about 70).

The computational complexity of the process necessary to find the proof-of-work is adjusted over time in such a way that the number of blocks found each day is more or less constant (approximately 2016 blocks in two weeks, one every 10 minutes). In the beginning, each generated block corresponded to the creation of 50 Bitcoins, this number being halved each four years, after 210,000 blocks additions. So, the miners have a reward equal to 50 Bitcoins if the created blocks belong to the first 210,000 blocks of the Blockchain, 25 Bitcoins if the created blocks range from the 210,001st to the 420,000th block in the Blockchain, 12.5 Bitcoins if the created blocks range from the 420,001st to the 630,000th block in the Blockchain, and so on.

Over time, mining Bitcoin is getting more and more complex, due to the increasing number of miners, and the increasing power of their hardware. We have witnessed the succession of four generations of hardware, i.e. CPU’s, GPU’s, FPGA’s and ASIC’s generation, each of them characterized by a specific hash rate (measured in H/sec) and power consumption. With time, the power and the price of the mining hardware has been steadly increasing, though the price of H/sec has been decreasing. To face the increasing costs, miners are pooling together to share resources.

The evolution of the mining hardware

In January 3, 2009, Satoshi Nakamoto created the first block of the Blockchain, called “Genesis Block”, hashing on the central processing unit (CPU) of his computer. Like him, the early miners mined Bitcoin running the software on their personal computers. The CPU’s era represents the first phase of the mining process, the other eras being GPU’s, FPGA’s and ASIC’s eras (see web site https://tradeblock.com/blog/the-evolution-of-mining/ ).

Each era announces the use of a specific typology of mining hardware. In the second era, started about on September 2010, boards based on graphics processing units (GPU) running in parallel entered the market, giving rise to the GPU era.

Around December 2011, the FPGA’s era started, and hardware based on field programmable gate array cards (FPGA) specifically designed to mine Bitcoins was available in the market. Finally, in 2013 fully customized application-specific integrated circuit (ASIC) appeared, substantially increasing the hashing capability of the Bitcoin network and marking the beginning of the fourth era.

Over time, the different mining hardware available was characterized by an increasing hash rate, a decreasing power consumption per hash, and increasing costs. For example, NVIDIA Quadro NVS 3100M, 16 cores, belonging to the GPU generation, has a hash rate equal to 3.6 MH/s and a power consumption equal to 14 W [ 31 ]; ModMiner Quad, belonging to the FPGA generation, has a hash rate equal to 800 MH/s and a power consumption equal to 40 W [ 31 ]; Monarch(300), belonging to the ASIC generation, has a hash rate equal to 300 GH/s and a power consumption equal to 175 W (see web site https://tradeblock.com/mining/ .

Modelling the Mining Hardware Performances

The goal of our work is to model the economy of the mining process, so we neglected the first era, when Bitcoins had no monetary value, and miners used the power available on their PCs, at almost no cost. We simulated only the remaining three generations of mining hardware.

The average hash rate and the average power consumption were computed averaging the real market data at specific times and constructing two fitting curves.

To calculate the hash rate and the power consumption of the mining hardware of the GPU era, that we estimate ranging from September 1st, 2010 to September 29th, 2011, we computed an average for R and P taking into account some representative products in the market during that period, neglecting the costs of the motherboard.

In that era, motherboards with more than one Peripheral Component Interconnect Express (PCIe) slot started to enter the market, allowing to install multiple video cards in only one system, by using adapters, and to mine criptocurrency, thanks to the power of the GPUs. In Table 1 , we describe the features of some GPUs in the market in that period. The data reported are taken from the web site http://coinpolice.com/gpu/ .

- PPT PowerPoint slide

- PNG larger image

- TIFF original image

https://doi.org/10.1371/journal.pone.0164603.t001

As regards the FPGA and ASIC eras, starting around September 2011 and December 2013 respectively, we tracked the history of the mining hardware by following the introduction of Butterfly Labs company’s products into the market. We extracted the data illustrated in Table 2 from the history of the web site http://www.butterflylabs.com/ through the web site web.archive.org . For hardware in the market in 2014 and 2015 we referred to the Bitmain Technologies Ltd company, and in particular, to the mining hardware called AntMiner (see web site https://bitmaintech.com and Table 2 ).

FPGA Hardware from 09/29/2011 to 12/17/2012, ASIC Hardware from 12/17/2012 to December 2013 and AntMiner Hardware produced in 2014 and 2015.

https://doi.org/10.1371/journal.pone.0164603.t002

Starting from the mining products in each period (see Tables 1 and 2 ), we fitted a “best hash rate per $” and a “best power consumption function” (see Table 3 ). We call the fitting curves R ( t ) and P ( t ), respectively.

https://doi.org/10.1371/journal.pone.0164603.t003

Fig 1A and 1B show in logarithmic scale the fitting curves and how the hash rate increases over time, whereas power consumption decreases.

(A) Fitting curve of R(t). (B) fitting curve of P(t).

https://doi.org/10.1371/journal.pone.0164603.g001

We used blockchain.info , a web site which displays detailed information about all transactions and Bitcoin blocks—providing graphs and statistics on different data—for extracting the empirical data used in this work. In particular, we observed the time trend of the Bitcoin price in the market, the total number of Bitcoins, the total hash rate of the Bitcoin network and the total number of Bitcoin transactions.

The proposed model presents an agent-based artificial cryptocurrency market in which agents mine, buy or sell Bitcoins.

We modeled the Bitcoin market starting from September 1st, 2010, because one of our goals is to study the economy of the mining process. It was only around this date that miners started to buy mining hardware to mine Bitcoins, denoting a business interest in mining. Previously, they typically just used the power available on their personal computers.

- there are various kinds of agents active on the BTC market: Miners, Random traders and Chartists;

- the trading mechanism is based on a realistic order book that keeps sorted lists of buy and sell orders, and matches them allowing to fulfill compatible orders and to set the price;

- agents have typically limited financial resources, initially distributed following a power law;

- the number of agents engaged in trading at each moment is a fraction of the total number of agents;

- a number of new traders, endowed only with cash, enter the market; they represent people who decided to start trading or mining Bitcoins;

- Miners belong to mining pools. This means that at each time t they always have a positive probability to mine at least a fraction of Bitcoin. Indeed, since 2010 miners have been pooling together to share resources in order to avoid effort duplication to optimally mine Bitcoins. A consequence of this fact is that gains are smoothly distributed amongst Miners. On July 18th, 2010,

“ArtForz establishes an OpenGL GPU hash farm and generates his first Bitcoin block”

and on September 18th, 2010,

“Bitcoin Pooled Mining (operated by slush), a method by which several users work collectively to mine Bitcoins and share in the benefits, mines its first block”,

(news from the web site http://historyofBitcoin.org/ ).

Since then, the difficulty of the problem of mining increased exponentially, and nowadays it would be almost unthinkable to mine without participating in a pool.

In the next subsections we describe the model simulating the mining, the Bitcoin market and the related mechanism of Bitcoin price formation in detail.

Agents, or traders, are divided into three populations: Miners, Random traders and Chartists.

- r i , u ( t ) is the hashing capability of the hardware units u bought at time t by i – th miner;

- γ i ( t ) = 0 and γ 1, i ( t ) = 0 if no hardware is bought by i – th trader at time t . When a trader decides to buy new hardware, γ 1, i represents the percentage of the miner’s cash allocated to buy it. It is equal to a random variable characterized by a lognormal distribution with average 0.6 and standard deviation 0.15. γ i represents the percentage of the miner’s Bitcoins to be sold for buying the new hardware at time t . It is equal to 0.5* γ 1, i ( t ). The term γ 1, i ( t ) c i ( t ) + γ i ( t ) b i ( t ) p ( t ) expresses the amount of personal wealth that the miner wishes to allocate to buy new mining hardware, meaning that on average the miner will allocate 60% of her cash and 30% of her Bitcoins to this purpose. If γ i > 1 or γ 1, i > 1, they are set equal to one;

- ϵ is the fiat price per Watt and per hour. It is assumed equal to 1.4*10 −4 $, considering the cost of 1 KWh equal to 0.14$, which we assumed to be constant throughout the simulation. This electricity price is computed by making an average of the electricity prices in the countries in which the Bitcoin nodes distribution is higher; see web sites https://getaddr.bitnodes.io and http://en.wikipedia.org/wiki/Electricity_pricing .

Miners active in the simulation since the beginning will take their first decision within 60 days, at random times uniformly distributed. Miners entering the simulation at time t > 1 will immediately take this decision.

Note that, as already described in the section Mining Process , the parameter B decreases over time. At first, each generated block corresponds to the creation of 50 Bitcoins, but after four years, such number is halved. So, until November 27, 2012, 100,800 Bitcoins were mined in 14 days (7200 Bitcoins per day), and then 50,400 Bitcoins in 14 days (3600 per day).

Random Traders.

Random traders represent persons who enter the cryptocurrency market for various reasons, but not for speculative purposes. They issue orders for reasons linked to their needs, for instance they invest in Bitcoins to diversify their portfolio, or they disinvest to satisfy a need for cash. They issue orders in a random way, compatibly with their available resources. In particular, buy and sell orders are always issued with the same probability. The specifics of their behavior are described in section Buy and Sell Orders .

Note that a Chartist will issue an order only when the price variation is above a given threshold. So, in practice, the extent of Chartist activity varies over time.

All Random traders and Chartists entering the market at t = t E > 0, issue a buy order to acquire their initial Bitcoins. Over time, at time t > t E only a fraction of Random traders and Chartists is active, and hence enabled to issue orders. Active traders can issue only one order per time step, which can be a sell order or a buy order.

Orders already placed but not yet satisfied or withdrawn are accounted for when determining the amount of Bitcoins a trader can buy or sell. Details on the percentage of active traders, the number of the traders in the market and on the probability of each trader to belong to a specific traders’ population are described in Appendices B, C, and D, in S1 Appendix .

Buy and Sell Orders

- amount, expressed in $ for buy order and in Bitcoins for sell order: the latter amount is a real number, because Bitcoins can be bought and sold in fractions as small as a “Satoshi”;

- residual amount (Bitcoins or $): used when an order is only partially satisfied by previous transactions;

- limit price (see below), which in turn can be a real number;

- time when the order was issued;

- expiration time: if the order is not (fully) satisfied, it is removed from the book at this time.

The limit price models the price to which a trader desires to conclude their transaction. An order can also be issued with no limit (market order), meaning that its originator wishes to perform the trade at the best price she can find. In this case, the limit price is set to zero. The probability of placing a market order, P lim , is set at the beginning of the simulation and is equal to 1 for Miners, to 0.2 for Random traders and to 0.7 for Chartists. This is because, unlike Random traders, if Miners and Chartists issue orders, they wish to perform the trade at the best available price, the former because they need cash, the latter to be able to profit by following the price trend.

- p ( t ) is the current Bitcoin price;

The limit prices have a random component, modelling the different perception of Bitcoin value, that is the fact that what traders “feel” is the right price to buy or to sell is not constant, and may vary for each single order. In the case of buy orders, we stipulate that a trader wishing to buy must offer a price that is, on average, slightly higher than the market price.

The value of σ i is proportional to the “volatility” σ ( T i ) of the price p ( t ) through the equation σ i = Kσ ( T i ), where K is a constant and σ ( T i ) is the standard deviation of price absolute returns, calculated in the time window T i . σ i is constrained between a minimum value σ min and a maximum value σ max (this is an approach similar to that of [ 27 ]). For buy orders μ = 1.05, K = 2.5, σ min = 0.01 and σ max = 0.003.

An expiration time is associated to each order. For Random traders, the value of the expiration time is equal to the current time plus a number of days (time steps) drawn from a lognormal distribution with average and standard deviation equal to 3 and 1 days, respectively. In this way, most orders will expire within 4 days since they were posted. Chartists, who act in a more dynamic way to follow the market trend, post orders whose expiration time is at the end of the same trading day. Miners issue market orders, so the value of the expiration time is set to infinite.

Price Clearing Mechanism

We implemented the price clearing mechanism by using an Order Book similar to that presented in [ 22 ].

At every time step, the order book holds the list of all the orders received and still to be executed. Buy orders are sorted in descending order with respect to the limit price b i . Sell orders are sorted in ascending order with respect to the limit price s j . Orders with the same limit price are sorted in ascending order with respect to the order issue time.

At each simulation step, various new orders are inserted into the respective lists. As soon as a new order enters the book, the first buy order and the first sell order of the lists are inspected to verify if they match. If they match, a transaction occurs. The order with the smallest residual amount is fully executed, whereas the order with the largest amount is only partially executed, and remains at the head of the list, with its residual amount reduced by the amount of the matching order. Clearly, if both orders have the same residual amount, they are both fully executed.

After the transaction, the next pair of orders at the head of the lists are checked for matching. If they match, they are executed, and so on until they do not match anymore. Hence, before the book can accept new orders, all the matching orders are satisfied.

A sell order of index j matches a buy order of index i , and vice versa, only if s j ≤ b i , or if one of the two limit prices, or both, are equal to zero.

- if b i > 0, then p T = min ( b i , p ( t )),

- if s j > 0, then p T = max ( s j , p ( t )),

- when both orders have limit price equal to zero, p T = p ( t );

Simulation Results

The model described in the previous section was implemented in Smalltalk language. Before the simulation, it had to be calibrated in order to reproduce the real stylized facts and the mining process in the Bitcoin market in the period between September 1st, 2010 and September 30th, 2015. The simulation period was thus set to 1856 steps, a simulation step corresponding to one day. We included also weekends and holidays, because the Bitcoin market is, by its very nature, accessible and working every day.

Some parameter values are taken from the literature, others from empirical data, and others are guessed using common sense, and tested by verifying that the simulation outputs were plausible and consistent. We set the initial value of several key parameters of the model by using data recovered from the Blockchain Web site. The main assumption we made is to size the artificial market at about 1/100 of the real market, to be able to manage the computational load of the simulation. Table 4 shows the values of some parameters and their computation assumptions in detail. Other parameter values are described in the description of the model presented in the Section The Model . In Appendices A-D, in S1 Appendix , other details about the calibration of the model are shown. Specifically, the calibration of the trader wealth endowment, the number of active traders, the total number of traders in the market and the probability of a trader to belong to a specific traders’ population are described in detail.

https://doi.org/10.1371/journal.pone.0164603.t004

The model was run to study the main features of the Bitcoin market and of the traders who operate in it. In order to assess the robustness of our model and the validity of our statistical analysis, we repeated 100 simulations with the same initial conditions, but different seeds of the random number generator. The results of all simulations were consistent, as the following shows.

Bitcoin prices in the real and simulated market

We started studying the real Bitcoin price series between September 1st, 2010 and September 30, 2015, shown in Fig 2 . The figure shows an initial period in which the price trend is relatively constant, until about 950 th day. Then, a period of volatility follows between 950 th and 1150 th day, followed by a period of strong volatility, until the end of the considered interval. The Bitcoin price started to fall at the beginning of 2014, and continued on its downward slope until September 2015.

https://doi.org/10.1371/journal.pone.0164603.g002

As regards the prices in the simulated market, we report in Fig 3 the Bitcoin price in one typical simulation run. It is possible to observe that, as in the case of the real price, the price keeps its value constant at first, but then, after about 1000 simulation steps, contrary to what happens in reality, it grows and continues on its upward slope until the end of the simulation period.

https://doi.org/10.1371/journal.pone.0164603.g003

Fig 4A and 4B report the average and the standard deviation of the price in the simulated market, taken on all 100 simulations. Note that the average value of prices steadily increases with time, except for short periods, in contrast with what happens in reality. Fig 4B shows that the price variations in different simulation runs increase with time, as the number of traders, transactions and the total wealth in the market are increasing.

(A) Average Price and (B) standard deviation computed on the 100 Monte Carlo simulations performed.

https://doi.org/10.1371/journal.pone.0164603.g004

In the proposed model, the upward trend of the price depends on an intrinsic mechanism—the average price tends to the ratio of total available cash to total available Bitcoins. Since new traders bring in more cash than newly mined Bitcoins, the price tends to increase.

In reality, Bitcoin price is also heavily affected by exogenous factors. For instance, in the past the price strongly reacted to reports such as those regarding the Bitcoin ban in China, or the MtGox exchange going bust. Moreover, the total capitalization of the Bitcoin market is of the order of just some billion US$, so if a large hedge fund decided to invest in Bitcoins, or if large amounts of Bitcoins disappeared because of theft, fraud or mismanagement, the effect on price would potentially be very large. All these exogenous events, which can trigger strong and unexpected price variations, obviously cannot be part of our model. However, the validity of these agent-based market models is typically validated by their ability to reproduce the statistical properties of the price series, which is the subject of the next section.

Statistical analysis of Bitcoin prices in the real and simulated markets

Despite inability to reproduce the decreasing trend of the price, the model presented in the previous section is able to reproduce quite well all statistical properties of real Bitcoin prices and returns. The stylized facts, robustly replicated by the proposed model, are the same of a previous work of Cocco et al. [ 2 ].

It is well known that the price series encountered in financial markets typically exhibit some statistical features, also known as “stylized facts” [ 33 , 34 ]. Among these, the three uni-variate properties that appear to be the most important and pervasive of price series, are (i) the unit-root property, (ii) the fat tail phenomenon, and (iii) the Volatility Clustering . We examined daily Bitcoin prices in real and simulated markets, and found that also these prices exhibit these properties as discussed in detail in [ 2 ].

Regarding unit-root property, it amounts to being unable to reject the hypothesis that financial prices follow a random walk. To this purpose, we applied the Augmented Dickey-Fuller test, under the null hypothesis of random walk without drift, to the series of Bitcoin daily prices and to the series of Bitcoin daily price logarithms we considered. The corresponding critical values of the τ 1 statistic for the null hypothesis of random walk without drift at levels 1, 5, and 10% with 1856 observations are −2.58, −1.95 and −1.62 respectively. The τ 1 statistic is -1.2, and 0.5, respectively, for price series and price logarithm series. Consequently, at levels 1, 5, and 10% we cannot reject the null hypothesis.

The second property is the fat-tail phenomenon. Typically, in financial markets the distribution of returns at weekly, daily and higher frequencies displays a heavy tail with positive excess kurtosis.

The Kurtosis value of the real price returns is equal to 125.1 (see Table 5 ), consequently the distribution of returns is more outlier-prone than the normal distribution. The distribution of returns is a leptokurtic distribution, and so we can infer a “fat tail”.

https://doi.org/10.1371/journal.pone.0164603.t005

Fig 5 shows the decumulative distribution function of the absolute returns (DDF), that is the probability of having a chance in price larger than a given return threshold. This is the plot of one minus the cumulative distribution function of the absolute returns and highlights a “fat tail”.

https://doi.org/10.1371/journal.pone.0164603.g005

The index takes a value equal to 2.48, and is in accordance with those of real financial markets, where this index is normally below 4, as stated by Lux [ 37 ]. We also found that the right tail (due to positive changes in returns) of the distribution is fatter than the left tail (due to negative changes in returns). These indexes take values equal to 2.34 and 2.75, respectively. This is in contradiction with the situation in real financial markets, where the tail due to negative returns is fatter than the one due to positive returns [ 37 ].

The third property is Volatility Clustering : periods of quiescence and turbulence tend to cluster together. This can be verified by the presence of highly significant autocorrelation in absolute or squared returns, despite insignificant autocorrelation in raw returns.

Fig 6B and 6C show the autocorrelation functions of the real price returns and absolute returns, at time lags between zero and 20. It is possible to note that the autocorrelation of raw returns Fig 6B is often negative, and is anyway very close to zero, whereas the autocorrelation of absolute returns Fig 6C has values significantly higher than zero. This behavior is typical of financial price return series, and confirms the presence of volatility clustering.

Autocorrelation of (A) raw returns, and (B) absolute returns of Bitcoin prices.

https://doi.org/10.1371/journal.pone.0164603.g006

In conclusion, the Bitcoin price shows all the stylized facts of financial price series, as expected.

As regards the simulated market model, all statistical properties of real prices and returns are reproduced quite well in our model.

Statistics of price logarithm series are in brackets.

https://doi.org/10.1371/journal.pone.0164603.t006

In Table 7 , the 25th, 50th, 75th and 97.5th percentiles pertaining to average, standard deviation, skewness and kurtosis of the price returns across all Monte Carlo simulations are shown. The values of the mean of price returns and of absolute returns, as well as their standard deviations, compare well with the real values. The skewness of simulated prices tends to be lower than the real case but it is always positive. The simulated kurtosis is lower than the real case by more than one order of magnitude, but also for the simulated price returns we can infer a fat tail for their distribution.

https://doi.org/10.1371/journal.pone.0164603.t007

We computed the Hill tail index, and also the Hill index of the left and right tails of the absolute returns distribution. In Table 8 , the 25th, 50th, 75th and 97.5th percentiles pertaining to Hill tail indexes, across all Monte Carlo simulations, are shown.

https://doi.org/10.1371/journal.pone.0164603.t008

Also for the index of the simulated absolute returns distribution we found values around 4 and the right tail of the distribution is fatter than the left tail.

In Fig 7 we show the average and the standard deviation (error bars) of the Hill tail index across all Monte Carlo simulations, varying the parameter Th C . Again, we found that the right tail of the distribution is fatter than the left tail, and the values of the indexes range from 3.3 to 4.6. The average value of these indexes increases slightly when Chartists are in the market.

The vertical spreads depict the error bars (standard deviation) for the Hill exponent, which are evaluated across 100 runs of the simulations with different random seeds.

https://doi.org/10.1371/journal.pone.0164603.g007

Table 9 shows the 25th, 50th, 75th and 97.5th percentiles pertaining to average and standard deviation of the autocorrelation of raw returns, and those of absolute returns, at time lags between 1 and 20, across all Monte Carlo simulations, varying the parameter Th C . The values reported in Table 9 confirm that the autocorrelation of raw returns is lower than that of absolute returns and that there are not significant differences varying Th C from 0.01 to ∞. This confirms the presence of volatility clustering also for the simulated price series, irrespective of the presence of Chartists.

https://doi.org/10.1371/journal.pone.0164603.t009

Traders’ Statistics

Figs 8 – 10 show the average and the standard deviation of the crypto and fiat cash, and of the total wealth, A ( t ), of trader populations, averaged across all 100 simulations. These simulations were carried with Miners buying new hardware using an average percentage of 60% of their wealth, that looks to be reasonable (see Fig 12 and discussion thereof).

(A) Average and (B) standard deviation of Bitcoin held by all trader populations during the simulation period across all Monte Carlo simulations.

https://doi.org/10.1371/journal.pone.0164603.g008

(A) Average and (B) standard deviation of the cash held by all trader populations during the simulation period across all Monte Carlo simulations.

https://doi.org/10.1371/journal.pone.0164603.g009

(A) Average and (B) standard deviation of the total wealth of all trader populations during the simulation period across all Monte Carlo simulations.

https://doi.org/10.1371/journal.pone.0164603.g010

Fig 10A highlights how Miners represent the richest population of traders in the market, from about step 300 onwards. Note that the standard deviation of the total wealth is much more variable than shown in the former two figures. This is due to the fact that wealth is obtained by multiplying the number of Bitcoins by their price, which is very variable across the various simulations, as shown in Fig 4(B) .