Step-by-Step Guide to Writing a Simple Business Plan

By Joe Weller | October 11, 2021

- Share on Facebook

- Share on LinkedIn

Link copied

A business plan is the cornerstone of any successful company, regardless of size or industry. This step-by-step guide provides information on writing a business plan for organizations at any stage, complete with free templates and expert advice.

Included on this page, you’ll find a step-by-step guide to writing a business plan and a chart to identify which type of business plan you should write . Plus, find information on how a business plan can help grow a business and expert tips on writing one .

What Is a Business Plan?

A business plan is a document that communicates a company’s goals and ambitions, along with the timeline, finances, and methods needed to achieve them. Additionally, it may include a mission statement and details about the specific products or services offered.

A business plan can highlight varying time periods, depending on the stage of your company and its goals. That said, a typical business plan will include the following benchmarks:

- Product goals and deadlines for each month

- Monthly financials for the first two years

- Profit and loss statements for the first three to five years

- Balance sheet projections for the first three to five years

Startups, entrepreneurs, and small businesses all create business plans to use as a guide as their new company progresses. Larger organizations may also create (and update) a business plan to keep high-level goals, financials, and timelines in check.

While you certainly need to have a formalized outline of your business’s goals and finances, creating a business plan can also help you determine a company’s viability, its profitability (including when it will first turn a profit), and how much money you will need from investors. In turn, a business plan has functional value as well: Not only does outlining goals help keep you accountable on a timeline, it can also attract investors in and of itself and, therefore, act as an effective strategy for growth.

For more information, visit our comprehensive guide to writing a strategic plan or download free strategic plan templates . This page focuses on for-profit business plans, but you can read our article with nonprofit business plan templates .

Business Plan Steps

The specific information in your business plan will vary, depending on the needs and goals of your venture, but a typical plan includes the following ordered elements:

- Executive summary

- Description of business

- Market analysis

- Competitive analysis

- Description of organizational management

- Description of product or services

- Marketing plan

- Sales strategy

- Funding details (or request for funding)

- Financial projections

If your plan is particularly long or complicated, consider adding a table of contents or an appendix for reference. For an in-depth description of each step listed above, read “ How to Write a Business Plan Step by Step ” below.

Broadly speaking, your audience includes anyone with a vested interest in your organization. They can include potential and existing investors, as well as customers, internal team members, suppliers, and vendors.

Do I Need a Simple or Detailed Plan?

Your business’s stage and intended audience dictates the level of detail your plan needs. Corporations require a thorough business plan — up to 100 pages. Small businesses or startups should have a concise plan focusing on financials and strategy.

How to Choose the Right Plan for Your Business

In order to identify which type of business plan you need to create, ask: “What do we want the plan to do?” Identify function first, and form will follow.

Use the chart below as a guide for what type of business plan to create:

Is the Order of Your Business Plan Important?

There is no set order for a business plan, with the exception of the executive summary, which should always come first. Beyond that, simply ensure that you organize the plan in a way that makes sense and flows naturally.

The Difference Between Traditional and Lean Business Plans

A traditional business plan follows the standard structure — because these plans encourage detail, they tend to require more work upfront and can run dozens of pages. A Lean business plan is less common and focuses on summarizing critical points for each section. These plans take much less work and typically run one page in length.

In general, you should use a traditional model for a legacy company, a large company, or any business that does not adhere to Lean (or another Agile method ). Use Lean if you expect the company to pivot quickly or if you already employ a Lean strategy with other business operations. Additionally, a Lean business plan can suffice if the document is for internal use only. Stick to a traditional version for investors, as they may be more sensitive to sudden changes or a high degree of built-in flexibility in the plan.

How to Write a Business Plan Step by Step

Writing a strong business plan requires research and attention to detail for each section. Below, you’ll find a 10-step guide to researching and defining each element in the plan.

Step 1: Executive Summary

The executive summary will always be the first section of your business plan. The goal is to answer the following questions:

- What is the vision and mission of the company?

- What are the company’s short- and long-term goals?

See our roundup of executive summary examples and templates for samples. Read our executive summary guide to learn more about writing one.

Step 2: Description of Business

The goal of this section is to define the realm, scope, and intent of your venture. To do so, answer the following questions as clearly and concisely as possible:

- What business are we in?

- What does our business do?

Step 3: Market Analysis

In this section, provide evidence that you have surveyed and understand the current marketplace, and that your product or service satisfies a niche in the market. To do so, answer these questions:

- Who is our customer?

- What does that customer value?

Step 4: Competitive Analysis

In many cases, a business plan proposes not a brand-new (or even market-disrupting) venture, but a more competitive version — whether via features, pricing, integrations, etc. — than what is currently available. In this section, answer the following questions to show that your product or service stands to outpace competitors:

- Who is the competition?

- What do they do best?

- What is our unique value proposition?

Step 5: Description of Organizational Management

In this section, write an overview of the team members and other key personnel who are integral to success. List roles and responsibilities, and if possible, note the hierarchy or team structure.

Step 6: Description of Products or Services

In this section, clearly define your product or service, as well as all the effort and resources that go into producing it. The strength of your product largely defines the success of your business, so it’s imperative that you take time to test and refine the product before launching into marketing, sales, or funding details.

Questions to answer in this section are as follows:

- What is the product or service?

- How do we produce it, and what resources are necessary for production?

Step 7: Marketing Plan

In this section, define the marketing strategy for your product or service. This doesn’t need to be as fleshed out as a full marketing plan , but it should answer basic questions, such as the following:

- Who is the target market (if different from existing customer base)?

- What channels will you use to reach your target market?

- What resources does your marketing strategy require, and do you have access to them?

- If possible, do you have a rough estimate of timeline and budget?

- How will you measure success?

Step 8: Sales Plan

Write an overview of the sales strategy, including the priorities of each cycle, steps to achieve these goals, and metrics for success. For the purposes of a business plan, this section does not need to be a comprehensive, in-depth sales plan , but can simply outline the high-level objectives and strategies of your sales efforts.

Start by answering the following questions:

- What is the sales strategy?

- What are the tools and tactics you will use to achieve your goals?

- What are the potential obstacles, and how will you overcome them?

- What is the timeline for sales and turning a profit?

- What are the metrics of success?

Step 9: Funding Details (or Request for Funding)

This section is one of the most critical parts of your business plan, particularly if you are sharing it with investors. You do not need to provide a full financial plan, but you should be able to answer the following questions:

- How much capital do you currently have? How much capital do you need?

- How will you grow the team (onboarding, team structure, training and development)?

- What are your physical needs and constraints (space, equipment, etc.)?

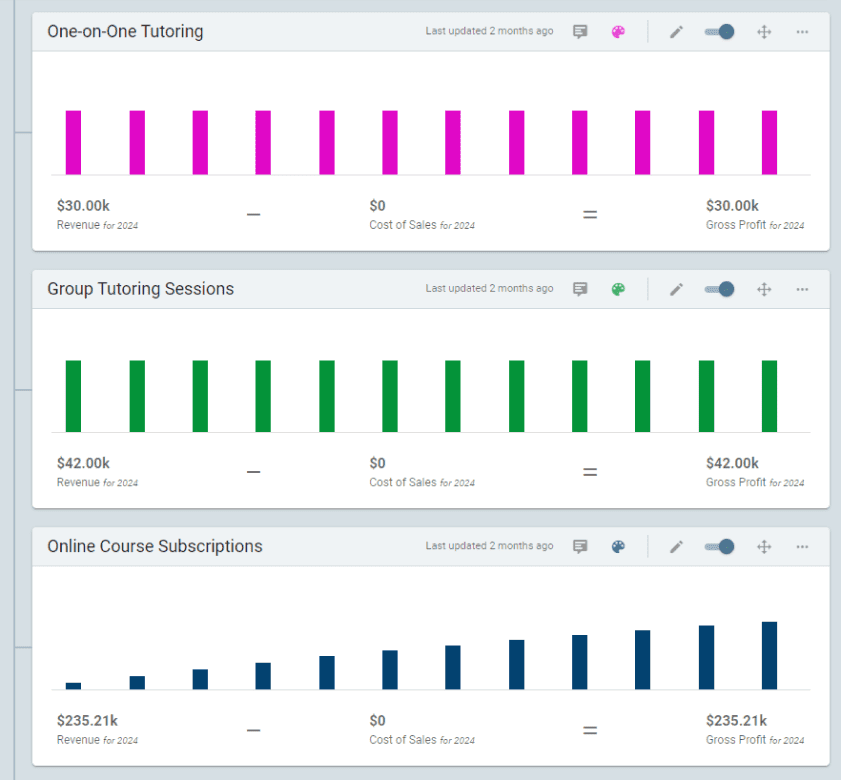

Step 10: Financial Projections

Apart from the fundraising analysis, investors like to see thought-out financial projections for the future. As discussed earlier, depending on the scope and stage of your business, this could be anywhere from one to five years.

While these projections won’t be exact — and will need to be somewhat flexible — you should be able to gauge the following:

- How and when will the company first generate a profit?

- How will the company maintain profit thereafter?

Business Plan Template

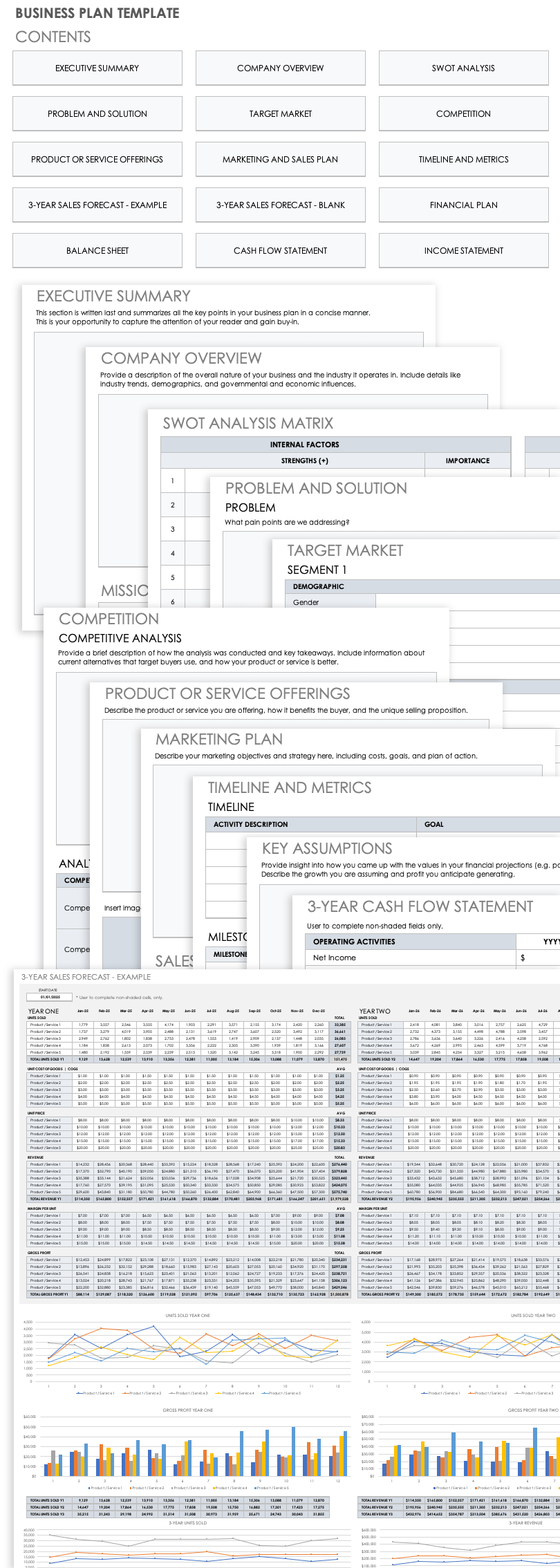

Download Business Plan Template

Microsoft Excel | Smartsheet

This basic business plan template has space for all the traditional elements: an executive summary, product or service details, target audience, marketing and sales strategies, etc. In the finances sections, input your baseline numbers, and the template will automatically calculate projections for sales forecasting, financial statements, and more.

For templates tailored to more specific needs, visit this business plan template roundup or download a fill-in-the-blank business plan template to make things easy.

If you are looking for a particular template by file type, visit our pages dedicated exclusively to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates.

How to Write a Simple Business Plan

A simple business plan is a streamlined, lightweight version of the large, traditional model. As opposed to a one-page business plan , which communicates high-level information for quick overviews (such as a stakeholder presentation), a simple business plan can exceed one page.

Below are the steps for creating a generic simple business plan, which are reflected in the template below .

- Write the Executive Summary This section is the same as in the traditional business plan — simply offer an overview of what’s in the business plan, the prospect or core offering, and the short- and long-term goals of the company.

- Add a Company Overview Document the larger company mission and vision.

- Provide the Problem and Solution In straightforward terms, define the problem you are attempting to solve with your product or service and how your company will attempt to do it. Think of this section as the gap in the market you are attempting to close.

- Identify the Target Market Who is your company (and its products or services) attempting to reach? If possible, briefly define your buyer personas .

- Write About the Competition In this section, demonstrate your knowledge of the market by listing the current competitors and outlining your competitive advantage.

- Describe Your Product or Service Offerings Get down to brass tacks and define your product or service. What exactly are you selling?

- Outline Your Marketing Tactics Without getting into too much detail, describe your planned marketing initiatives.

- Add a Timeline and the Metrics You Will Use to Measure Success Offer a rough timeline, including milestones and key performance indicators (KPIs) that you will use to measure your progress.

- Include Your Financial Forecasts Write an overview of your financial plan that demonstrates you have done your research and adequate modeling. You can also list key assumptions that go into this forecasting.

- Identify Your Financing Needs This section is where you will make your funding request. Based on everything in the business plan, list your proposed sources of funding, as well as how you will use it.

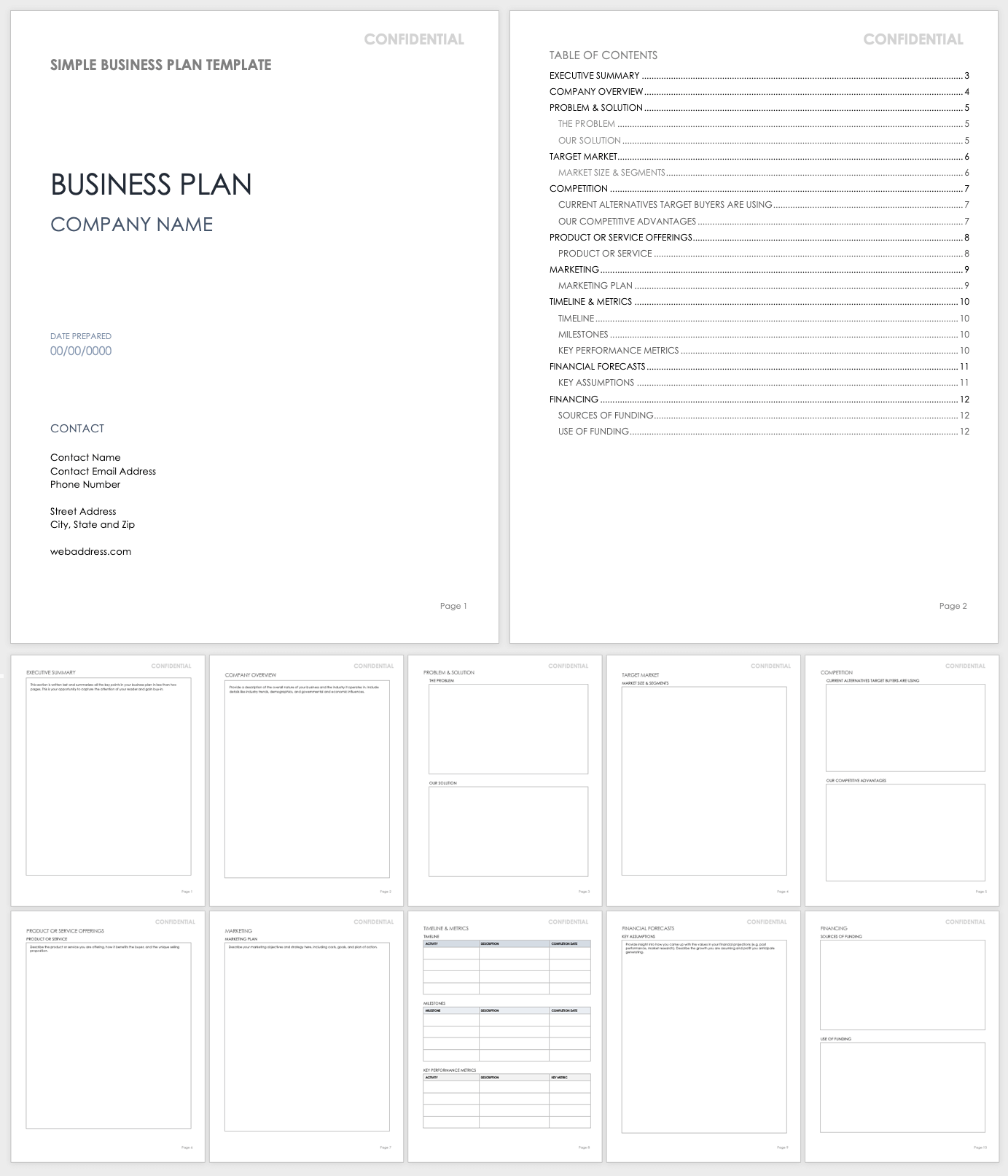

Simple Business Plan Template

Download Simple Business Plan Template

Microsoft Excel | Microsoft Word | Adobe PDF | Smartsheet

Use this simple business plan template to outline each aspect of your organization, including information about financing and opportunities to seek out further funding. This template is completely customizable to fit the needs of any business, whether it’s a startup or large company.

Read our article offering free simple business plan templates or free 30-60-90-day business plan templates to find more tailored options. You can also explore our collection of one page business templates .

How to Write a Business Plan for a Lean Startup

A Lean startup business plan is a more Agile approach to a traditional version. The plan focuses more on activities, processes, and relationships (and maintains flexibility in all aspects), rather than on concrete deliverables and timelines.

While there is some overlap between a traditional and a Lean business plan, you can write a Lean plan by following the steps below:

- Add Your Value Proposition Take a streamlined approach to describing your product or service. What is the unique value your startup aims to deliver to customers? Make sure the team is aligned on the core offering and that you can state it in clear, simple language.

- List Your Key Partners List any other businesses you will work with to realize your vision, including external vendors, suppliers, and partners. This section demonstrates that you have thoughtfully considered the resources you can provide internally, identified areas for external assistance, and conducted research to find alternatives.

- Note the Key Activities Describe the key activities of your business, including sourcing, production, marketing, distribution channels, and customer relationships.

- Include Your Key Resources List the critical resources — including personnel, equipment, space, and intellectual property — that will enable you to deliver your unique value.

- Identify Your Customer Relationships and Channels In this section, document how you will reach and build relationships with customers. Provide a high-level map of the customer experience from start to finish, including the spaces in which you will interact with the customer (online, retail, etc.).

- Detail Your Marketing Channels Describe the marketing methods and communication platforms you will use to identify and nurture your relationships with customers. These could be email, advertising, social media, etc.

- Explain the Cost Structure This section is especially necessary in the early stages of a business. Will you prioritize maximizing value or keeping costs low? List the foundational startup costs and how you will move toward profit over time.

- Share Your Revenue Streams Over time, how will the company make money? Include both the direct product or service purchase, as well as secondary sources of revenue, such as subscriptions, selling advertising space, fundraising, etc.

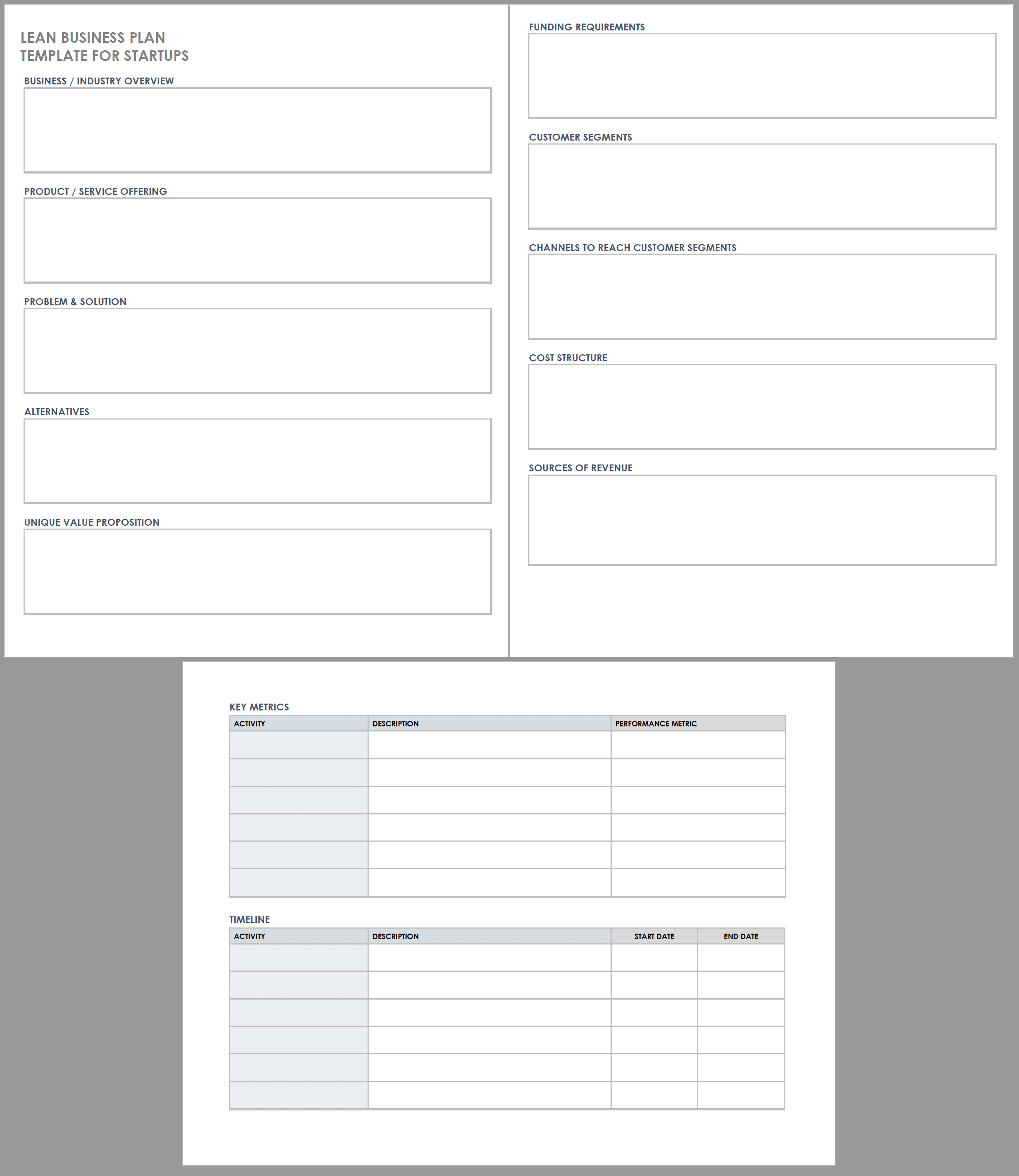

Lean Business Plan Template for Startups

Download Lean Business Plan Template for Startups

Microsoft Word | Adobe PDF

Startup leaders can use this Lean business plan template to relay the most critical information from a traditional plan. You’ll find all the sections listed above, including spaces for industry and product overviews, cost structure and sources of revenue, and key metrics, and a timeline. The template is completely customizable, so you can edit it to suit the objectives of your Lean startups.

See our wide variety of startup business plan templates for more options.

How to Write a Business Plan for a Loan

A business plan for a loan, often called a loan proposal , includes many of the same aspects of a traditional business plan, as well as additional financial documents, such as a credit history, a loan request, and a loan repayment plan.

In addition, you may be asked to include personal and business financial statements, a form of collateral, and equity investment information.

Download free financial templates to support your business plan.

Tips for Writing a Business Plan

Outside of including all the key details in your business plan, you have several options to elevate the document for the highest chance of winning funding and other resources. Follow these tips from experts:.

- Keep It Simple: Avner Brodsky , the Co-Founder and CEO of Lezgo Limited, an online marketing company, uses the acronym KISS (keep it short and simple) as a variation on this idea. “The business plan is not a college thesis,” he says. “Just focus on providing the essential information.”

- Do Adequate Research: Michael Dean, the Co-Founder of Pool Research , encourages business leaders to “invest time in research, both internal and external (market, finance, legal etc.). Avoid being overly ambitious or presumptive. Instead, keep everything objective, balanced, and accurate.” Your plan needs to stand on its own, and you must have the data to back up any claims or forecasting you make. As Brodsky explains, “Your business needs to be grounded on the realities of the market in your chosen location. Get the most recent data from authoritative sources so that the figures are vetted by experts and are reliable.”

- Set Clear Goals: Make sure your plan includes clear, time-based goals. “Short-term goals are key to momentum growth and are especially important to identify for new businesses,” advises Dean.

- Know (and Address) Your Weaknesses: “This awareness sets you up to overcome your weak points much quicker than waiting for them to arise,” shares Dean. Brodsky recommends performing a full SWOT analysis to identify your weaknesses, too. “Your business will fare better with self-knowledge, which will help you better define the mission of your business, as well as the strategies you will choose to achieve your objectives,” he adds.

- Seek Peer or Mentor Review: “Ask for feedback on your drafts and for areas to improve,” advises Brodsky. “When your mind is filled with dreams for your business, sometimes it is an outsider who can tell you what you’re missing and will save your business from being a product of whimsy.”

Outside of these more practical tips, the language you use is also important and may make or break your business plan.

Shaun Heng, VP of Operations at Coin Market Cap , gives the following advice on the writing, “Your business plan is your sales pitch to an investor. And as with any sales pitch, you need to strike the right tone and hit a few emotional chords. This is a little tricky in a business plan, because you also need to be formal and matter-of-fact. But you can still impress by weaving in descriptive language and saying things in a more elegant way.

“A great way to do this is by expanding your vocabulary, avoiding word repetition, and using business language. Instead of saying that something ‘will bring in as many customers as possible,’ try saying ‘will garner the largest possible market segment.’ Elevate your writing with precise descriptive words and you'll impress even the busiest investor.”

Additionally, Dean recommends that you “stay consistent and concise by keeping your tone and style steady throughout, and your language clear and precise. Include only what is 100 percent necessary.”

Resources for Writing a Business Plan

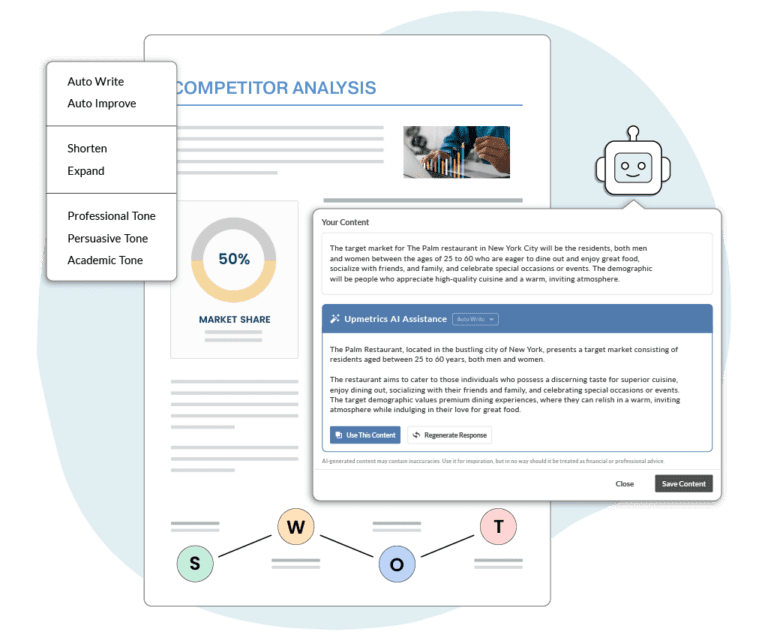

While a template provides a great outline of what to include in a business plan, a live document or more robust program can provide additional functionality, visibility, and real-time updates. The U.S. Small Business Association also curates resources for writing a business plan.

Additionally, you can use business plan software to house data, attach documentation, and share information with stakeholders. Popular options include LivePlan, Enloop, BizPlanner, PlanGuru, and iPlanner.

How a Business Plan Helps to Grow Your Business

A business plan — both the exercise of creating one and the document — can grow your business by helping you to refine your product, target audience, sales plan, identify opportunities, secure funding, and build new partnerships.

Outside of these immediate returns, writing a business plan is a useful exercise in that it forces you to research the market, which prompts you to forge your unique value proposition and identify ways to beat the competition. Doing so will also help you build (and keep you accountable to) attainable financial and product milestones. And down the line, it will serve as a welcome guide as hurdles inevitably arise.

Streamline Your Business Planning Activities with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

How to Write a Business Plan (Plus Examples & Templates)

- 3 years ago

Have you ever wondered how to write a business plan step by step? Mike Andes, told us:

This guide will help you write a business plan to impress investors.

Throughout this process, we’ll get information from Mike Andes, who started Augusta Lawn Care Services when he was 12 and turned it into a franchise with over 90 locations. He has gone on to help others learn how to write business plans and start businesses. He knows a thing or two about writing business plans!

We’ll start by discussing the definition of a business plan. Then we’ll discuss how to come up with the idea, how to do the market research, and then the important elements in the business plan format. Keep reading to start your journey!

What Is a Business Plan?

A business plan is simply a road map of what you are trying to achieve with your business and how you will go about achieving it. It should cover all elements of your business including:

- Finding customers

- Plans for developing a team

- Competition

- Legal structures

- Key milestones you are pursuing

If you aren’t quite ready to create a business plan, consider starting by reading our business startup guide .

Get a Business Idea

Before you can write a business plan, you have to have a business idea. You may see a problem that needs to be solved and have an idea how to solve it, or you might start by evaluating your interests and skills.

Mike told us, “The three things I suggest asking yourself when thinking about starting a business are:

- What am I good at?

- What would I enjoy doing?

- What can I get paid for?”

If all three of these questions don’t lead to at least one common answer, it will probably be a much harder road to success. Either there is not much market for it, you won’t be good at it, or you won’t enjoy doing it.

As Mike told us, “There’s enough stress starting and running a business that if you don’t like it or aren’t good at it, it’s hard to succeed.”

If you’d like to hear more about Mike’s approach to starting a business, check out our YouTube video

Conduct Market Analysis

Market analysis is focused on establishing if there is a target market for your products and services, how large the target market is, and identifying the demographics of people or businesses that would be interested in the product or service. The goal here is to establish how much money your business concept can make.

Product and Service Demand

A search engine is your best friend when trying to figure out if there is demand for your products and services. Personally, I love using presearch.org because it lets you directly search on a ton of different platforms including Google, Youtube, Twitter, and more. Check out the screenshot for the full list of search options.

With quick web searches, you can find out how many competitors you have, look through their reviews, and see if there are common complaints about the competitors. Bad reviews are a great place to find opportunities to offer better products or services.

If there are no similar products or services, you may have stumbled upon something new, or there may just be no demand for it. To find out, go talk to your most honest friend about the idea and see what they think. If they tell you it’s dumb or stare at you vacantly, there’s probably no market for it.

You can also conduct a survey through social media to get public opinion on your idea. Using Facebook Business Manager , you could get a feel for who would be interested in your product or service.

I ran a quick test of how many people between 18-65 you could reach in the U.S. during a week. It returned an estimated 700-2,000 for the total number of leads, which is enough to do a fairly accurate statistical analysis.

Identify Demographics of Target Market

Depending on what type of business you want to run, your target market will be different. The narrower the demographic, the fewer potential customers you’ll have. If you did a survey, you’ll be able to use that data to help define your target audience. Some considerations you’ll want to consider are:

- Other Interests

- Marital Status

- Do they have kids?

Once you have this information, it can help you narrow down your options for location and help define your marketing further. One resource that Mike recommended using is the Census Bureau’s Quick Facts Map . He told us,

“It helps you quickly evaluate what the best areas are for your business to be located.”

How to Write a Business Plan

Now that you’ve developed your idea a little and established there is a market for it, you can begin writing a business plan. Getting started is easier with the business plan template we created for you to download. I strongly recommend using it as it is updated to make it easier to create an action plan.

Each of the following should be a section of your business plan:

- Business Plan Cover Page

- Table of Contents

- Executive Summary

- Company Description

- Description of Products and Services

SWOT Analysis

- Competitor Data

- Competitive Analysis

- Marketing Expenses Strategy

Pricing Strategy

- Distribution Channel Assessment

- Operational Plan

- Management and Organizational Strategy

- Financial Statements and/or Financial Projections

We’ll look into each of these. Don’t forget to download our free business plan template (mentioned just above) so you can follow along as we go.

How to Write a Business Plan Step 1. Create a Cover Page

The first thing investors will see is the cover page for your business plan. Make sure it looks professional. A great cover page shows that you think about first impressions.

A good business plan should have the following elements on a cover page:

- Professionally designed logo

- Company name

- Mission or Vision Statement

- Contact Info

Basically, think of a cover page for your business plan like a giant business card. It is meant to capture people’s attention but be quickly processed.

How to Write a Business Plan Step 2. Create a Table of Contents

Most people are busy enough that they don’t have a lot of time. Providing a table of contents makes it easy for them to find the pages of your plan that are meaningful to them.

A table of contents will be immediately after the cover page, but you can include it after the executive summary. Including the table of contents immediately after the executive summary will help investors know what section of your business plan they want to review more thoroughly.

Check out Canva’s article about creating a table of contents . It has a ton of great information about creating easy access to each section of your business plan. Just remember that you’ll want to use different strategies for digital and hard copy business plans.

How to Write a Business Plan Step 3. Write an Executive Summary

An executive summary is where your business plan should catch the readers interest. It doesn’t need to be long, but should be quick and easy to read.

Mike told us,

How long should an executive summary bein an informal business plan?

For casual use, an executive summary should be similar to an elevator pitch, no more than 150-160 words, just enough to get them interested and wanting more. Indeed has a great article on elevator pitches . This can also be used for the content of emails to get readers’ attention.

It consists of three basic parts:

- An introduction to you and your business.

- What your business is about.

- A call to action

Example of an informal executive summary

One of the best elevator pitches I’ve used is:

So far that pitch has achieved a 100% success rate in getting partnerships for the business.

What should I include in an executive summary for investors?

Investors are going to need a more detailed executive summary if you want to secure financing or sell equity. The executive summary should be a brief overview of your entire business plan and include:

- Introduction of yourself and company.

- An origin story (Recognition of a problem and how you came to solution)

- An introduction to your products or services.

- Your unique value proposition. Make sure to include intellectual property.

- Where you are in the business life cycle

- Request and why you need it.

Successful business plan examples

The owner of Urbanity told us he spent 2 months writing a 75-page business plan and received a $250,000 loan from the bank when he was 23. Make your business plan as detailed as possible when looking for financing. We’ve provided a template to help you prepare the portions of a business plan that banks expect.

Here’s the interview with the owner of Urbanity:

When to write an executive summary?

Even though the summary is near the beginning of a business plan, you should write it after you complete the rest of a business plan. You can’t talk about revenue, profits, and expected expenditures if you haven’t done the market research and created a financial plan.

What mistakes do people make when writing an executive summary?

Business owners commonly go into too much detail about the following items in an executive summary:

- Marketing and sales processes

- Financial statements

- Organizational structure

- Market analysis

These are things that people will want to know later, but they don’t hook the reader. They won’t spark interest in your small business, but they’ll close the deal.

How to Write a Business Plan Step 4. Company Description

Every business plan should include a company description. A great business plan will include the following elements while describing the company:

- Mission statement

- Philosophy and vision

- Company goals

Target market

- Legal structure

Let’s take a look at what each section includes in a good business plan.

Mission Statement

A mission statement is a brief explanation of why you started the company and what the company’s main focus is. It should be no more than one or two sentences. Check out HubSpot’s article 27 Inspiring Mission Statement for a great read on informative and inspiring mission and vision statements.

Company Philosophy and Vision

The company philosophy is what drives your company. You’ll normally hear them called core values. These are the building blocks that make your company different. You want to communicate your values to customers, business owners, and investors as often as possible to build a company culture, but make sure to back them up.

What makes your company different?

Each company is different. Your new business should rise above the standard company lines of honesty, integrity, fun, innovation, and community when communicating your business values. The standard answers are corporate jargon and lack authenticity.

Examples of core values

One of my clients decided to add a core values page to their website. As a tech company they emphasized the values:

- Prioritize communication.

- Never stop learning.

- Be transparent.

- Start small and grow incrementally.

These values communicate how the owner and the rest of the company operate. They also show a value proposition and competitive advantage because they specifically focus on delivering business value from the start. These values also genuinely show what the company is about and customers recognize the sincerity. Indeed has a great blog about how to identify your core values .

What is a vision statement?

A vision statement communicate the long lasting change a business pursues. The vision helps investors and customers understand what your company is trying to accomplish. The vision statement goes beyond a mission statement to provide something meaningful to the community, customer’s lives, or even the world.

Example vision statements

The Alzheimer’s Association is a great example of a vision statement:

A world without Alzheimer’s Disease and other dementia.

It clearly tells how they want to change the world. A world without Alzheimers might be unachievable, but that means they always have room for improvement.

Business Goals

You have to measure success against goals for a business plan to be meaningful. A business plan helps guide a company similar to how your GPS provides a road map to your favorite travel destination. A goal to make as much money as possible is not inspirational and sounds greedy.

Sure, business owners want to increase their profits and improve customer service, but they need to present an overview of what they consider success. The goals should help everyone prioritize their work.

How far in advance should a business plan?

Business planning should be done at least one year in advance, but many banks and investors prefer three to five year business plans. Longer plans show investors that the management team understands the market and knows the business is operating in a constantly shifting market. In addition, a plan helps businesses to adjust to changes because they have already considered how to handle them.

Example of great business goals

My all time-favorite long-term company goals are included in Tesla’s Master Plan, Part Deux . These goals were written in 2016 and drive the company’s decisions through 2026. They are the reason that investors are so forgiving when Elon Musk continually fails to meet his quarterly and annual goals.

If the progress aligns with the business plan investors are likely to continue to believe in the company. Just make sure the goals are reasonable or you’ll be discredited (unless you’re Elon Musk).

You did target market research before creating a business plan. Now it’s time to add it to the plan so others understand what your ideal customer looks like. As a new business owner, you may not be considered an expert in your field yet, so document everything. Make sure the references you use are from respectable sources.

Use information from the specific lender when you are applying for lending. Most lenders provide industry research reports and using their data can strengthen the position of your business plan.

A small business plan should include a section on the external environment. Understanding the industry is crucial because we don’t plan a business in a vacuum. Make sure to research the industry trends, competitors, and forecasts. I personally prefer IBIS World for my business research. Make sure to answer questions like:

- What is the industry outlook long-term and short-term?

- How will your business take advantage of projected industry changes and trends?

- What might happen to your competitors and how will your business successfully compete?

Industry resources

Some helpful resources to help you establish more about your industry are:

- Trade Associations

- Federal Reserve

- Bureau of Labor Statistics

Legal Structure

There are five basic types of legal structures that most people will utilize:

- Sole proprietorships

- Limited Liability Companies (LLC)

Partnerships

Corporations.

- Franchises.

Each business structure has their pros and cons. An LLC is the most common legal structure due to its protection of personal assets and ease of setting up. Make sure to specify how ownership is divided and what roles each owner plays when you have more than one business owner.

You’ll have to decide which structure is best for you, but we’ve gathered information on each to make it easier.

Sole Proprietorship

A sole proprietorship is the easiest legal structure to set up but doesn’t protect the owner’s personal assets from legal issues. That means if something goes wrong, you could lose both your company and your home.

To start a sole proprietorship, fill out a special tax form called a Schedule C . Sole proprietors can also join the American Independent Business Alliance .

Limited Liability Company (LLC)

An LLC is the most common business structure used in the United States because an LLC protects the owner’s personal assets. It’s similar to partnerships and corporations, but can be a single-member LLC in most states. An LLC requires a document called an operating agreement.

Each state has different requirements. Here’s a link to find your state’s requirements . Delaware and Nevada are common states to file an LLC because they are really business-friendly. Here’s a blog on the top 10 states to get an LLC.

Partnerships are typically for legal firms. If you choose to use a partnership choose a Limited Liability Partnership. Alternatively, you can just use an LLC.

Corporations are typically for massive organizations. Corporations have taxes on both corporate and income tax so unless you plan on selling stock, you are better off considering an LLC with S-Corp status . Investopedia has good information corporations here .

There are several opportunities to purchase successful franchises. TopFranchise.com has a list of companies in a variety of industries that offer franchise opportunities. This makes it where an entrepreneur can benefit from the reputation of an established business that has already worked out many of the kinks of starting from scratch.

How to Write a Business Plan Step 5. Products and Services

This section of the business plan should focus on what you sell, how you source it, and how you sell it. You should include:

- Unique features that differentiate your business products from competitors

- Intellectual property

- Your supply chain

- Cost and pricing structure

Questions to answer about your products and services

Mike gave us a list of the most important questions to answer about your product and services:

- How will you be selling the product? (in person, ecommerce, wholesale, direct to consumer)?

- How do you let them know they need a product?

- How do you communicate the message?

- How will you do transactions?

- How much will you be selling it for?

- How many do you think you’ll sell and why?

Make sure to use the worksheet on our business plan template .

How to Write a Business Plan Step 6. Sales and Marketing Plan

The marketing and sales plan is focused on the strategy to bring awareness to your company and guides how you will get the product to the consumer. It should contain the following sections:

SWOT Analysis stands for strengths, weaknesses, opportunities, and threats. Not only do you want to identify them, but you also want to document how the business plans to deal with them.

Business owners need to do a thorough job documenting how their service or product stacks up against the competition.

If proper research isn’t done, investors will be able to tell that the owner hasn’t researched the competition and is less likely to believe that the team can protect its service from threats by the more well-established competition. This is one of the most common parts of a presentation that trips up business owners presenting on Shark Tank .

SWOT Examples

Examples of strengths and weaknesses could be things like the lack of cash flow, intellectual property ownership, high costs of suppliers, and customers’ expectations on shipping times.

Opportunities could be ways to capitalize on your strengths or improve your weaknesses, but may also be gaps in the industry. This includes:

- Adding offerings that fit with your current small business

- Increase sales to current customers

- Reducing costs through bulk ordering

- Finding ways to reduce inventory

- And other areas you can improve

Threats will normally come from outside of the company but could also be things like losing a key member of the team. Threats normally come from competition, regulations, taxes, and unforeseen events.

The management team should use the SWOT analysis to guide other areas of business planning, but it absolutely has to be done before a business owner starts marketing.

Include Competitor Data in Your Business Plan

When you plan a business, taking into consideration the strengths and weaknesses of the competition is key to navigating the field. Providing an overview of your competition and where they are headed shows that you are invested in understanding the industry.

For smaller businesses, you’ll want to search both the company and the owners names to see what they are working on. For publicly held corporations, you can find their quarterly and annual reports on the SEC website .

What another business plans to do can impact your business. Make sure to include things that might make it attractive for bigger companies to outsource to a small business.

Marketing Strategy

The marketing and sales part of business plans should be focused on how you are going to make potential customers aware of your business and then sell to them.

If you haven’t already included it, Mike recommends:

“They’ll want to know about Demographics, ages, and wealth of your target market.”

Make sure to include the Total addressable market . The term refers to the value if you captured 100% of the market.

Advertising Strategy

You’ll explain what formats of advertising you’ll be using. Some possibilities are:

- Online: Facebook and Google are the big names to work with here.

- Print : Print can be used to reach broad groups or targeted markets. Check out this for tips .

- Radio : iHeartMedia is one of the best ways to advertise on the radio

- Cable television : High priced, hard to measure ROI, but here’s an explanation of the process

- Billboards: Attracting customers with billboards can be beneficial in high traffic areas.

You’ll want to define how you’ll be using each including frequency, duration, and cost. If you have the materials already created, including pictures or links to the marketing to show creative assets.

Mike told us “Most businesses are marketing digitally now due to Covid, but that’s not always the right answer.”

Make sure the marketing strategy will help team members or external marketing agencies stay within the brand guidelines .

This section of a business plan should be focused on pricing. There are a ton of pricing strategies that may work for different business plans. Which one will work for you depends on what kind of a business you run.

Some common pricing strategies are:

- Value-based pricing – Commonly used with home buying and selling or other products that are status symbols.

- Skimming pricing – Commonly seen in video game consoles, price starts off high to recoup expenses quickly, then reduces over time.

- Competition-based pricing – Pricing based on competitors’ pricing is commonly seen at gas stations.

- Freemium services – Commonly used for software, where there is a free plan, then purchase options for more functionality.

HubSpot has a great calculator and blog on pricing strategies.

Beyond explaining what strategy your business plans to use, you should include references for how you came to this pricing strategy and how it will impact your cash flow.

Distribution Plan

This part of a business plan is focused on how the product or service is going to go through the supply chain. These may include multiple divisions or multiple companies. Make sure to include any parts of the workflow that are automated so investors can see where cost savings are expected and when.

Supply Chain Examples

For instance, lawn care companies would need to cover aspects such as:

- Suppliers for lawn care equipment and tools

- Any chemicals or treatments needed

- Repair parts for sprinkler systems

- Vehicles to transport equipment and employees

- Insurance to protect the company vehicles and people.

Examples of Supply Chains

These are fairly flat supply chains compared to something like a clothing designer where the clothes would go through multiple vendors. A clothing company might have the following supply chain:

- Raw materials

- Shipping of raw materials

- Converting of raw materials to thread

- Shipping thread to produce garments

- Garment producer

- Shipping to company

- Company storage

- Shipping to retail stores

There have been advances such as print on demand that eliminate many of these steps. If you are designing completely custom clothing, all of this would need to be planned to keep from having business disruptions.

The main thing to include in the business plan is the list of suppliers, the path the supply chain follows, the time from order to the customer’s home, and the costs associated with each step of the process.

According to BizPlanReview , a business plan without this information is likely to get rejected because they have failed to research the key elements necessary to make sales to the customer.

How to Write a Business Plan Step 7. Company Organization and Operational Plan

This part of the business plan is focused on how the business model will function while serving customers. The business plan should provide an overview of how the team will manage the following aspects:

Quality Control

- Legal environment

Let’s look at each for some insight.

Production has already been discussed in previous sections so I won’t go into it much. When writing a business plan for investors, try to avoid repetition as it creates a more simple business plan.

If the organizational plan will be used by the team as an overview of how to perform the best services for the customer, then redundancy makes more sense as it communicates what is important to the business.

Quality control policies help to keep the team focused on how to verify that the company adheres to the business plan and meets or exceeds customer expectations.

Quality control can be anything from a standard that says “all labels on shirts can be no more than 1/16″ off center” to a defined checklist of steps that should be performed and filled out for every customer.

There are a variety of organizations that help define quality control including:

- International Organization for Standardization – Quality standards for energy, technology, food, production environments, and cybersecurity

- AICPA – Standard defined for accounting.

- The Joint Commission – Healthcare

- ASHRAE – HVAC best practices

You can find lists of the organizations that contribute most to the government regulation of industries on Open Secrets . Research what the leaders in your field are doing. Follow their example and implement it in your quality control plan.

For location, you should use information from the market research to establish where the location will be. Make sure to include the following in the location documentation.

- The size of your location

- The type of building (retail, industrial, commercial, etc.)

- Zoning restrictions – Urban Wire has a good map on how zoning works in each state

- Accessibility – Does it meet ADA requirements?

- Costs including rent, maintenance, utilities, insurance and any buildout or remodeling costs

- Utilities – b.e.f. has a good energy calculator .

Legal Environment

The legal requirement section is focused on defining how to meet the legal requirements for your industry. A good business plan should include all of the following:

- Any licenses and/or permits that are needed and whether you’ve obtained them

- Any trademarks, copyrights, or patents that you have or are in the process of applying for

- The insurance coverage your business requires and how much it costs

- Any environmental, health, or workplace regulations affecting your business

- Any special regulations affecting your industry

- Bonding requirements, if applicable

Your local SBA office can help you establish requirements in your area. I strongly recommend using them. They are a great resource.

Your business plan should include a plan for company organization and hiring. While you may be the only person with the company right now, down the road you’ll need more people. Make sure to consider and document the answers to the following questions:

- What is the current leadership structure and what will it look like in the future?

- What types of employees will you have? Are there any licensing or educational requirements?

- How many employees will you need?

- Will you ever hire freelancers or independent contractors?

- What is each position’s job description?

- What is the pay structure (hourly, salaried, base plus commission, etc.)?

- How do you plan to find qualified employees and contractors?

One of the most crucial parts of a business plan is the organizational chart. This simply shows the positions the company will need, who is in charge of them and the relationship of each of them. It will look similar to this:

Our small business plan template has a much more in-depth organizational chart you can edit to include when you include the organizational chart in your business plan.

How to Write a Business Plan Step 8. Financial Statements

No business plan is complete without financial statements or financial projections. The business plan format will be different based on whether you are writing a business plan to expand a business or a startup business plan. Let’s dig deeper into each.

Provide All Financial Income from an Existing Business

An existing business should use their past financial documents including the income statement, balance sheet, and cash flow statement to find trends to estimate the next 3-5 years.

You can create easy trendlines in excel to predict future revenue, profit and loss, cash flow, and other changes in year-over-year performance. This will show your expected performance assuming business continues as normal.

If you are seeking an investment, then the business is probably not going to continue as normal. Depending on the financial plan and the purpose of getting financing, adjustments may be needed to the following:

- Higher Revenue if expanding business

- Lower Cost of Goods Sold if purchasing inventory with bulk discounts

- Adding interest if utilizing financing (not equity deal)

- Changes in expenses

- Addition of financing information to the cash flow statement

- Changes in Earnings per Share on the balance sheet

Financial modeling is a challenging subject, but there are plenty of low-cost courses on the subject. If you need help planning your business financial documentation take some time to watch some of them.

Make it a point to document how you calculated all the changes to the income statement, balance sheet, and cash flow statement in your business plan so that key team members or investors can verify your research.

Financial Projections For A Startup Business Plan

Unlike an existing business, a startup doesn’t have previous success to model its future performance. In this scenario, you need to focus on how to make a business plan realistic through the use of industry research and averages.

Mike gave the following advice in his interview:

Financial Forecasting Mistakes

One of the things a lot of inexperienced people use is the argument, “If I get one percent of the market, it is worth $100 million.” If you use this, investors are likely to file the document under bad business plan examples.

Let’s use custom t-shirts as an example.

Credence Research estimated in 2018 there were 11,334,800,000 custom t-shirts sold for a total of $206.12 Billion, with a 6% compound annual growth rate.

With that data, you can calculate that the industry will grow to $270 Billion in 2023 and that the average shirt sold creates $18.18 in revenue.

Combine that with an IBIS World estimate of 11,094 custom screen printers and that means even if you become an average seller, you’ll get .009% of the market.

Here’s a table for easier viewing of that information.

The point here is to make sure your business proposal examples make sense.

You’ll need to know industry averages such as cost of customer acquisition, revenue per customer, the average cost of goods sold, and admin costs to be able to create accurate estimates.

Our simple business plan templates walk you through most of these processes. If you follow them you’ll have a good idea of how to write a business proposal.

How to Write a Business Plan Step 9. Business Plan Example of Funding Requests

What is a business plan without a plan on how to obtain funding?

The Small Business Administration has an example for a pizza restaurant that theoretically needed nearly $20k to make it through their first month.

In our video, How to Start a $500K/Year T-Shirt Business (Pt. 1 ), Sanford Booth told us he needed about $200,000 to start his franchise and broke even after 4 months.

Freshbooks estimates it takes on average 2-3 years for a business to be profitable, which means the fictitious pizza company from the SBA could need up to $330k to make it through that time and still pay their bills for their home and pizza shop.

Not every business needs that much to start, but realistically it’s a good idea to assume that you need a fairly large cushion.

Ways to get funding for a small business

There are a variety of ways to cover this. the most common are:

- Bootstrapping – Using your savings without external funding.

- Taking out debt – loans, credit cards

- Equity, Seed Funding – Ownership of a percentage of the company in exchange for current funds

- Crowdsourcing – Promising a good for funding to create the product

Keep reading for more tips on how to write a business plan.

How funding will be used

When asking for business financing make sure to include:

- How much to get started?

- What is the minimum viable product and how soon can you make money?

- How will the money be spent?

Mike emphasized two aspects that should be included in every plan,

How to Write a Business Plan Resources

Here are some links to a business plan sample and business plan outline.

- Sample plan

It’s also helpful to follow some of the leading influencers in the business plan writing community. Here’s a list:

- Wise Plans – Shares a lot of information on starting businesses and is a business plan writing company.

- Optimus Business Plans – Another business plan writing company.

- Venture Capital – A venture capital thread that can help give you ideas.

How to Write a Business Plan: What’s Next?

We hope this guide about how to write a simple business plan step by step has been helpful. We’ve covered:

- The definition of a business plan

- Coming up with a business idea

- Performing market research

- The critical components of a business plan

- An example business plan

In addition, we provided you with a simple business plan template to assist you in the process of writing your startup business plan. The startup business plan template also includes a business model template that will be the key to your success.

Don’t forget to check out the rest of our business hub .

Have you written a business plan before? How did it impact your ability to achieve your goals?

Brandon Boushy

Brandon Boushy lives to improve people’s lives by helping them become successful entrepreneurs. His journey started nearly 30 years ago. He consistently excelled at everything he did, but preferred to make the rules rather than follow him. His exploration of self and knowledge has helped him to get an engineering degree, MBA, and countless certifications. When freelancing and rideshare came onto the scene, he recognized the opportunity to play by his own rules. Since 2017, he has helped businesses across all industries achieve more with his research, writing, and marketing strategies. Since 2021, he has been the Lead Writer for UpFlip where he has published over 170 articles on small business success.

Related posts

- September 27, 2023

How to Start a Business: The Ultimate Guide (2024)

- August 3, 2022

Free Business Plan Template (With Examples)

- May 3, 2022

How to Get a Business License (In 3 Steps)

Join the discussion cancel reply.

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

2 thoughts on “How to Write a Business Plan (Plus Examples & Templates)”

My Name is PRETTY NGOMANE. A south African female. Aspiring to do farming. And finding a home away from home for the differently abled persons in their daily needs.

nice work https://binarychemist.com/

Compare listings

Reset Password

Please enter your username or email address. You will receive a link to create a new password via email.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.