- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Highlights of Business Plan

JAN.11, 2013

What is the best business plan?

The business plan is that component of your startup that decides whether the startup would boom or collapse. Considering its far-reaching impacts, it is necessary to make an accurate, detailed, and workable business plan.

There is no fixed criterion for the best business plan. Usually, a business plan is considered best if it covers:

- Financial Highlights

- Management Highlights

- Marketing Highlights

- SMART Business Goals

- Operations & Strategic Plan

To have the best and most promising business plan for your business, you need to have education and experience in the relevant field. If you don’t possess the former or latter, you must consider hiring a professional firm to create a business plan for your business.

If you need an idea of highlights of a business plan, you can visit business plans available free of cost on our website.

What is the most important step in developing a polished business plan?

It is only by thorough and factual research that you can make a polished business plan. It includes research on how the businesses are launched in your locality, what are the registration procedures, and the business climate. Next, you have to explore market analytics via secondary analysis or conducting surveys.

Following this, you have to investigate your likely customers, competitors, and stakeholders. Then, the new procedures, technology, and software available in your area to manage the business operations. Thereafter, you have to decide on the strategy to optimize your production, explore the methods to recruit a talented workforce, and keep them productive, trained, and motivated all the time.

What are the management highlights in the business plan?

Management highlights in the business plan are the policies and strategies that revolve around practically operating your business. Management of a business is a complex task that involves boosting the overall productivity of the business while also maintaining the finances.

A business has several types of operations going along, and hundreds of egos have to collaborate to regulate those operations. It is only by efficient management that the employees, resources, and customers are grouped to coherently achieve the business goals.

Management is always a hierarchical process so that surveillance, performance assessment, and reward allocation can be done most efficiently.

The overall management of a business is divided into the following branches:

- Sales Management

- Production Management

- Program Management

- Human Resource Management

- Strategic Management

- Financial Management

On our website, you can explore highlights and components of business plan for startups in different niches.

What are the financial highlights of the business plan?

Gaining more and more customers is the ultimate goal of every business no matter what the niche is. To ensure that you get the desired target audience, you need to design customer-centric marketing highlights in business plan. Your marketing highlighters in business plan should elaborate on the following aspects.

- Micro and macro trends in the market where you are situated

- Analysis of other businesses that are operating in vicinity

- Criteria on basis of which you will measure and compare your marketing goals. They can be CSAT score, customer retention rate, average ratings, etc.

- Insight into the psychology and purchasing power of your customers

- Your sales strategy and concrete measures to advertise your venture

Sales strategy is extremely important as it pertains to convince a person to spend his hard-earned dollars to procure what you sell. The designing of sales strategy is tricky as you have to convince without overwhelming your target customer with call to action.

What are the marketing accents in the business plan?

Gaining more and more customers is the ultimate goal of every business no matter what the niche is. To ensure that you get the desired target audience, you need to design customer-centric marketing highlights in the business plan. Your marketing highlighters in the business plan should elaborate on the following aspects.

- Analysis of other businesses that are operating in the vicinity

- Criteria on basis of which you will measure and compare your marketing goals. They can be CSAT scores, customer retention rate, average ratings, etc.

Sales strategy is extremely important as it pertains to convincing a person to spend his hard-earned dollars to procure what you sell. The designing of a sales strategy is tricky as you have to convince without overwhelming your target customer with a call to action.

Financial highlights in business plan relate to drawing financial projections for your business from the time you launch it to at least 5 years ahead. It outlines the cash flows i.e. from where the money will come and where it would go. Moreover, it presents a pictorial display of data so that you could assess the brake even point, and set your pricing strategy, discount policies, and budget that is to be spent on different aspects.

While doing financial planning, you have to ensure 100 % accuracy. Otherwise, you might end up with complicated balance sheets and wrong business ratios.

Your financial plan helps you define the trajectory of your business. Any minor glitches can result in making wrong decisions. Therefore, it is recommended to never experiment with making a financial plan and hire a professional for the task.

Via this financial highlights business plan example, you can learn the generic overview of financial highlights. For getting customized tailored to your needs, you can contact us from here .

The components and examples of business plan financial highlights are as follows:

- Important Assumptions

- Break-even Analysis

- Profit Monthly

- Profit Yearly

- Gross Margin Monthly

- Gross Margin Yearly

- Projected Cash Flow

- Projected Balance Sheet

- Business Ratios

How do I prepare a business plan for beginners?

If you want to develop a business plan for your venture but are inexperienced in the field, you have to spend some days learning the process.

In this highlights business plan, we are listing the steps following which you can make a flawless business plan.

Stepwise Guide for Beginners to Prepare a Business Plan

1. Research & Exploration

The first step is to figure out what aspects are in the highlights of a business plan. For that you may consult business plan highlights samples.

2. Understand Legal Constraints

Find the state requirements to launch the business in your preferred area.

3. Consider Taking Online Course

Making a business plan is a systemic process. It is advisable to take an online course to learn how to evaluate the relevant terms and figures.

4. Outline the In-Flows

Know what you have to invest in your venture.

5. Construct Management Plan

Make a concrete management plan with responsibilities and job duties that do not overlap.

6. Know Whom to Recruit

Set criteria for judging candidates and hiring the right ones.

7. Plan for Finances

Decide how much to spend where and at what time.

8. Do Market Research

Know every stakeholder, market statics, and dynamics.

9. Advertise

Reach out to the people to whom you want to sell.

Establish your brand.

Get Flawless Business Plan Made by OGSCapital Experts

If you don’t know how to make a 100% accurate business plan highlights template, let OGS takes care of your worries. Here is why OGS is your promising service provider:

16 Years of Industrial Experience

Throughout the years, we have completed hundreds of projects for designing business plans, feasibility studies, due diligence, compensation plans, financial projections, and more for the following sectors:

- Online Businesses

- Telecom Industry

- Retail & Wholesale

- Manufacturing

- Green Technologies

- Entertainment & Gambling

- Energy & Resources

- And many more!

To gauge our expertise and experience, you may visit OGSCapital from here and read business plan highlights examples.

Acclamation by Reputable Sources

- We enjoy the privilege of being TOP4 in the Clutch Rating of 2020.

- We score 9.5 out of 10 at rank 3 on Trustpilot .

- Our ability is admired by the press and reputable media channels.

At OGSCapital, It’s All About You!

At OGSCapital, our philosophy is to develop workable solutions for you. Customer satisfaction is our topmost priority. Prompt replies, incorporation of revisions, and guidance-centric communication make our work more beneficial to you than us!

Here is what our clients say about us!

- What do business plan highlights mean?

Business plan highlights are the guiding principles and strategies to identify and achieve organizational goals, prepare for potential risks, and capitalize on opportunities and solutions.

- What are the highlights of a good plan?

Highlights for business plan include major strategies related to business operations, management, finance department, marketing, and growth.

- Apart from the business plan, what other factors are relevant when starting a business?

Apart from the business plan, having a clear idea of how you would finance your venture, get investment, earn profits, and spend those profits to earn even more, is a must.

- What is the best business idea plan?

It is a subjective debate that depends on your location, your target audience, your resources, and most importantly your aptitude. To know which business idea plan is best per your interests and specifics, you may explore different startups and their plans.

- What is the right length for a business plan?

There is no fixed criterion. The right length for a business plan is the one that precisely covers financial, management, and growth highlights in a business plan.

Download Sample From Here

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Training and Development

- Beginner Guides

Blog Business

How to Write a Business Plan Outline [Examples + Templates]

By Letícia Fonseca , Aug 11, 2023

When venturing into crafting a business plan, the initial hurdle often lies in taking that first step.

So, how can you evade those prolonged hours of staring at a blank page? Initiate your journey with the aid of a business plan outline.

As with any endeavor, an outline serves as the beacon of clarity, illuminating the path to confront even the most formidable tasks. This holds particularly true when composing pivotal documents vital to your triumph, much like a business plan.

Nonetheless, I understand the enormity of a business plan’s scope, which might make the task of outlining it seem daunting. This is precisely why I’ve compiled all the requisite information to facilitate the creation of a business plan outline. No need to break a sweat!

And if you’re seeking further assistance, a business plan maker and readily available business plan templates can offer valuable support in shaping your comprehensive plan.

Read on for answers to all your business plan outline questions or jump ahead for some handy templates.

Click to jump ahead:

What is a business plan outline (and why do you need one), what format should you choose for your business plan outline, what are the key components of a business plan outline.

- Business plan template examples

- Writing tips to ace your outline

A business plan outline is the backbone of your business plan. It contains all the most important information you’ll want to expand on in your full-length plan.

Think of it this way: your outline is a frame for your plan. It provides a high-level idea of what the final plan should look like, what it will include and how all the information will be organized.

Why would you do this extra step? Beyond saving you from blank page syndrome, an outline ensures you don’t leave any essential information out of your plan — you can see all the most important points at a glance and quickly identify any content gaps.

It also serves as a writing guide. Once you know all the sections you want in your plan, you just need to expand on them. Suddenly, you’re “filling in the blanks” as opposed to writing a plan from scratch!

Incidentally, using a business plan template like this one gives you a running head start, too:

Perhaps most importantly, a business plan outline keeps you focused on the essential parts of your document. (Not to mention what matters most to stakeholders and investors.) With an outline, you’ll spend less time worrying about structure or organization and more time perfecting the actual content of your document.

If you’re looking for more general advice, you can read about how to create a business plan here . But if you’re working on outlining your plan, stick with me.

Return to Table of Contents

Most business plans fit into one of two formats.

The format you choose largely depends on three factors: (1) the stage of your business, (2) if you’re presenting the plan to investors and (3) what you want to achieve with your business plan.

Let’s have a closer look at these two formats and why you might choose one over the other.

Traditional format

Traditional business plans are typically long, detailed documents. In many cases, they take up to 50-60 pages, but it’s not uncommon to see plans spanning 100+ pages.

Traditional plans are long because they cover every aspect of your business. They leave nothing out. You’ll find a traditional business plan template with sections like executive summary, company description, target market, market analysis, marketing plan, financial plan, and more. Basically: the more information the merrier.

This business plan template isn’t of a traditional format, but you could expand it into one by duplicating pages:

Due to their high level of detail, traditional formats are the best way to sell your business. They show you’re reliable and have a clear vision for your business’s future.

If you’re planning on presenting your plan to investors and stakeholders, you’ll want to go with a traditional plan format. The more information you include, the fewer doubts and questions you’ll get when you present your plan, so don’t hold back.

Traditional business plans require more detailed outlines before drafting since there’s a lot of information to cover. You’ll want to list all the sections and include bullet points describing what each section should cover.

It’s also a good idea to include all external resources and visuals in your outline, so you don’t have to gather them later.

Lean format

Lean business plan formats are high level and quick to write. They’re often only one or two pages. Similar to a business plan infographic , they’re scannable and quick to digest, like this template:

This format is often referred to as a “startup” format due to (you guessed it!) many startups using it.

Lean business plans require less detailed outlines. You can include high-level sections and a few lines in each section covering the basics. Since the final plan will only be a page or two, you don’t need to over prepare. Nor will you need a ton of external resources.

Lean plans don’t answer all the questions investors and stakeholders may ask, so if you go this route, make sure it’s the right choice for your business . Companies not yet ready to present to investors will typically use a lean/startup business plan format to get their rough plan on paper and share it internally with their management team.

Here’s another example of a lean business plan format in the form of a financial plan:

Your business plan outline should include all the following sections. The level of detail you choose to go into will depend on your intentions for your plan (sharing with stakeholders vs. internal use), but you’ll want every section to be clear and to the point.

1. Executive summary

The executive summary gives a high-level description of your company, product or service. This section should include a mission statement, your company description, your business’s primary goal, and the problem it aims to solve. You’ll want to state how your business can solve the problem and briefly explain what makes you stand out (your competitive advantage).

Having an executive summary is essential to selling your business to stakeholders , so it should be as clear and concise as possible. Summarize your business in a few sentences in a way that will hook the reader (or audience) and get them invested in what you have to say next. In other words, this is your elevator pitch.

2. Product and services description

This is where you should go into more detail about your product or service. Your product is the heart of your business, so it’s essential this section is easy to grasp. After all, if people don’t know what you’re selling, you’ll have a hard time keeping them engaged!

Expand on your description in the executive summary, going into detail about the problem your customers face and how your product/service will solve it. If you have various products or services, go through all of them in equal detail.

3. Target market and/or Market analysis

A market analysis is crucial for placing your business in a larger context and showing investors you know your industry. This section should include market research on your prospective customer demographic including location, age range, goals and motivations.

You can even include detailed customer personas as a visual aid — these are especially useful if you have several target demographics. You want to showcase your knowledge of your customer, who exactly you’re selling to and how you can fulfill their needs.

Be sure to include information on the overall target market for your product, including direct and indirect competitors and how your industry is performing. If your competitors have strengths you want to mimic or weaknesses you want to exploit, this is the place to record that information.

4. Organization and management

You can think of this as a “meet the team” section — this is where you should go into depth on your business’s structure from management to legal and HR. If there are people bringing unique skills or experience to the table (I’m sure there are!), you should highlight them in this section.

The goal here is to showcase why your team is the best to run your business. Investors want to know you’re unified, organized and reliable. This is also a potential opportunity to bring more humanity to your business plan and showcase the faces behind the ideas and product.

5. Marketing and sales

Now that you’ve introduced your product and team, you need to explain how you’re going to sell it. Give a detailed explanation of your sales and marketing strategy, including pricing, timelines for launching your product and advertising.

This is a major section of your plan and can even live as a separate document for your marketing and sales teams. Here are some marketing plan templates to help you get started .

Make sure you have research or analysis to back up your decisions — if you want to do paid ads on LinkedIn to advertise your product, include a brief explanation as to why that is the best channel for your business.

6. Financial projections and funding request

The end of your plan is where you’ll look to the future and how you think your business will perform financially. Your financial plan should include results from your income statement, balance sheet and cash flow projections.

State your funding requirements and what you need to realize the business. Be extremely clear about how you plan to use the funding and when you expect investors will see returns.

If you aren’t presenting to potential investors, you can skip this part, but it’s something to keep in mind should you seek funding in the future. Covering financial projections and the previous five components is essential at the stage of business formation to ensure everything goes smoothly moving forward.

7. Appendix

Any extra visual aids, receipts, paperwork or charts will live here. Anything that may be relevant to your plan should be included as reference e.g. your cash flow statement (or other financial statements). You can format your appendix in whatever way you think is best — as long as it’s easy for readers to find what they’re looking for, you’ve done your job!

Typically, the best way to start your outline is to list all these high-level sections. Then, you can add bullet points outlining what will go in each section and the resources you’ll need to write them. This should give you a solid starting point for your full-length plan.

Business plan outline templates

Looking for a shortcut? Our business plan templates are basically outlines in a box!

While your outline likely won’t go into as much detail, these templates are great examples of how to organize your sections.

Traditional format templates

A strong template can turn your long, dense business plan into an engaging, easy-to-read document. There are lots to choose from, but here are just a few ideas to inspire you…

You can duplicate pages and use these styles for a traditional outline, or start with a lean outline as you build your business plan out over time:

Lean format templates

For lean format outlines, a simpler ‘ mind map ’ style is a good bet. With this style, you can get ideas down fast and quickly turn them into one or two-page plans. Plus, because they’re shorter, they’re easy to share with your team.

Writing tips to ace your business plan outline

Business plans are complex documents, so if you’re still not sure how to write your outline, don’t worry! Here are some helpful tips to keep in mind when drafting your business plan outline:

- Ask yourself why you’re writing an outline. Having a clear goal for your outline can help keep you on track as you write. Everything you include in your plan should contribute to your goal. If it doesn’t, it probably doesn’t need to be in there.

- Keep it clear and concise. Whether you’re writing a traditional or lean format business plan, your outline should be easy to understand. Choose your words wisely and avoid unnecessary preambles or padding language. The faster you get to the point, the easier your plan will be to read.

- Add visual aids. No one likes reading huge walls of text! Make room in your outline for visuals, data and charts. This keeps your audience engaged and helps those who are more visual learners. Psst, infographics are great for this.

- Make it collaborative. Have someone (or several someones) look it over before finalizing your outline. If you have an established marketing / sales / finance team, have them look it over too. Getting feedback at the outline stage can help you avoid rewrites and wasted time down the line.

If this is your first time writing a business plan outline, don’t be too hard on yourself. You might not get it 100% right on the first try, but with these tips and the key components listed above, you’ll have a strong foundation. Remember, done is better than perfect.

Create a winning business plan by starting with a detailed, actionable outline

The best way to learn is by doing. So go ahead, get started on your business plan outline. As you develop your plan, you’ll no doubt learn more about your business and what’s important for success along the way.

A clean, compelling template is a great way to get a head start on your outline. After all, the sections are already separated and defined for you!

Explore Venngage’s business plan templates for one that suits your needs. Many are free to use and there are premium templates available for a small monthly fee. Happy outlining!

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-14343635291-33bf053f368c43f6a792e94775285bbd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

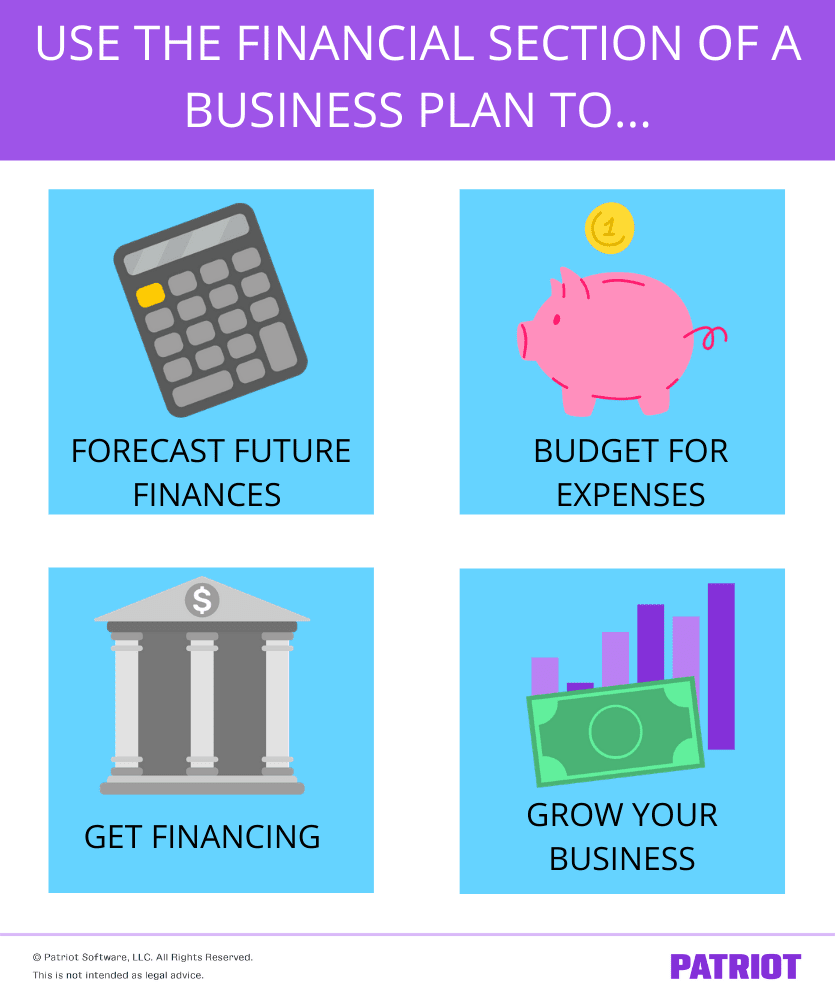

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

- Contact Us / Advertise

Inform. Inspire. Include.

A free way to improve your business.

By Lori Wade

Lori Wade is a freelance content writer who is interested in a wide range of spheres from education and online marketing to entrepreneurship. She is also an aspiring tutor striving to bring education to another level like we all do. If you are interested in writing, you can find her on Twitter or Google+ or find her on other social media.

September 29, 2017

Business plan: How to write the financial summary

The financial summary of a business plan could be regarded as the lifeline of the business. It is what breathes an air of life and practicality into the business. The financial section many times appears at the back of the plan, but this does not downplay its importance. In fact, it is the most scrutinized section of the plan. Investors may actually pay more attention to it than other parts of the plan because the value of a business is in its figures.

The financial summary gives insight into the profitability of the business , aspects of debt and equity estimated operating expenses, financial statement forecasts , future growth projections and business financing. The financial data that’s contained in this section is quite structured and in-depth. You may find charts, formulas, tables, graphs, and spreadsheets. It may require the input of a financial expert such as an accountant in order to write it accurately.

This article will consider how you can go about writing the financial summary of your business plan.

Introduction to the financial summary

The financial summary of a business plan normally starts with the introduction to the financial plan. The format and structure of the introduction is purely left to the drawer of the business plan. The introduction basically gives the reader a basic outline to what is contained in the section.

An example of an introduction is as follows:

“This financial plan gives the forecasted financial statements of Company ABC for a three year projected period. The income statement, cash flow statement and balance sheet have been drawn and the assumptions made have been outlined. The end of each fiscal year has been set for September 2nd. The business capital requirements at startup are valued at $100,000. The business owner will inject $50,000 while the remaining $50,000 will be financed through a bank loan.”

Financial Statements and Analyses

The second part of the financial section will revolve around the forecasted financial statements and analyses. Here, the following financial statement and analyses are laid down:

1. Forecasted income statement

2. Cash flow statement (Forecasted)

3. Forecasted balance sheet

4. Sensitivity analysis

5. Breakeven analysis

6. Ratio analysis

It is best to put each statement and analysis on its own page. It is also time saving to use spreadsheets when drawing these statements and analyses. There are three financial statements that are normally written in business plans. They include:

1) Balance Sheet (Statement of Assets and Liabilities)

This statement shows what the business is worth. It states all the assets that a business has and their respective values; as well as all the liabilities and debt that the business may have. Simply, it adds all that the business owns (assets) and what it owes (liabilities) and the difference between these two forms the business’ net worth.

The net worth of the business is referred to as equity in some circles. The balance sheet normally states the net worth of the business as at a certain date. Most businesses draw it at the end of their fiscal year.

2) Income Statement (Profit and Loss Statement)

This statement shows the earnings of a business over a given period. It adds all the revenues and subtracts all the expenditures to get the net profit or loss in that trading period. When writing the plan, one can use the statistics of other businesses in the industry to get the figures that are useful in drawing the income statement.

3) Cash flow statement

As the name suggests, this statement tracks the flow of cash in a business over a period. It also shows the users of the statement the cash at hand at any given moment in time. The cash flow statement typically analyzes the changes that occur on the balance sheet. The inflow and outflow of cash in the company is captured, and the description of how the cash was spent is given.

The importance of break-even analysis for business plan

This financial tool is used to determine the point of sales that a business should reach for it to get neither profit nor loss from trading. Simply, it is the point at which the difference between the total revenues and total expenses of the business is zero. Important elements that are considered in the break even analysis include:

- The fixed costs

- Variable costs

- Selling price

Also, the items present in the income statements are quite vital when doing the break-even analysis. When calculating the break even points, it is recommended to do them over a three year period for consistency. It also remains your own prerogative to decide whether you will provide readers of the business plan with explanations on the finer details of the analysis.

The sensitivity analysis

This analysis is used to identify the effect that increased and decreased forecasted sales have on the net income of the business. This increase and decrease are usually in percentage form. The reader of the business plan will see how your net income changes when your sales go up or down by say, 15%, 20%, and 30%. The percentage chosen remains in the prerogative of the business plan writer. However, when using the sensitivity analysis , one should know that a forecasted sale is never 100% accurate. Also, values below 14% should be avoided.

Ratio analysis

A ratio analysis is a general tool used by investors to ascertain the performance of a business (existing or potential). Values from the balance sheet are divided with other values from the income statement. This is done mostly under the time frame of three fiscal years. A percentage or decimal is then deduced.

The ratios are then compared to other businesses’ in the industry to gauge performance. Financiers may also use ratio analyses to inform their financing decisions particularly regarding the feasibility and return on equity.

A business plan writer can describe how the ratio has changed over the three years of the forecast.

- Ratios have specific labels, for example:

- Current ratio

- Quick ratio

- Debt to equity ratio

- Return on Equity

In each ratio, the formula used to calculate is given, and the corresponding dollar value is assigned to each item.

Notes to the financial summary

This is the last part of the financial section of the business plan. It summarizes every idea, assumption, and thought-processes that were used to create the forecasted financial statements. It is usually written in the period of three years of the forecast.

These notes are vital to the readers of the business plan as they give the detailed information that aids them to understand the forecasts and projections. The notes should always come after the financial statements and analyses. It beats logic to have them before the statements and analysis. It also serves to avoid confusion and incomprehension by readers.

The notes should also have labels with specific reference to the item being described. For example:

- Net income note to the financial statements

- Accounts payable note to the financial statements

- Accounts receivable note to the financial statements

- Retained earnings note to the financial statements

The positive value that notes to the financial statements in the financial section have is that they make readers of the business plan understand your projections. Hence, the investors and financiers are more certain of your business. Certainty is a motivating factor for financiers and investors to invest in a business.

The financial section of a business plan benefits not only the investors and financiers but also the business owner. It aids them to understand their business better. It is also a vital aid in running the business. Most writers prefer the turabian paper format when writing the financial section and in extension the whole business plan.

The credibility of the financial section will purely rely on how realistic you are when writing it. A good way of doing this is by breaking the figures into components such that they can be analyzed on an individual basis.