Interactive Business Plan Builder

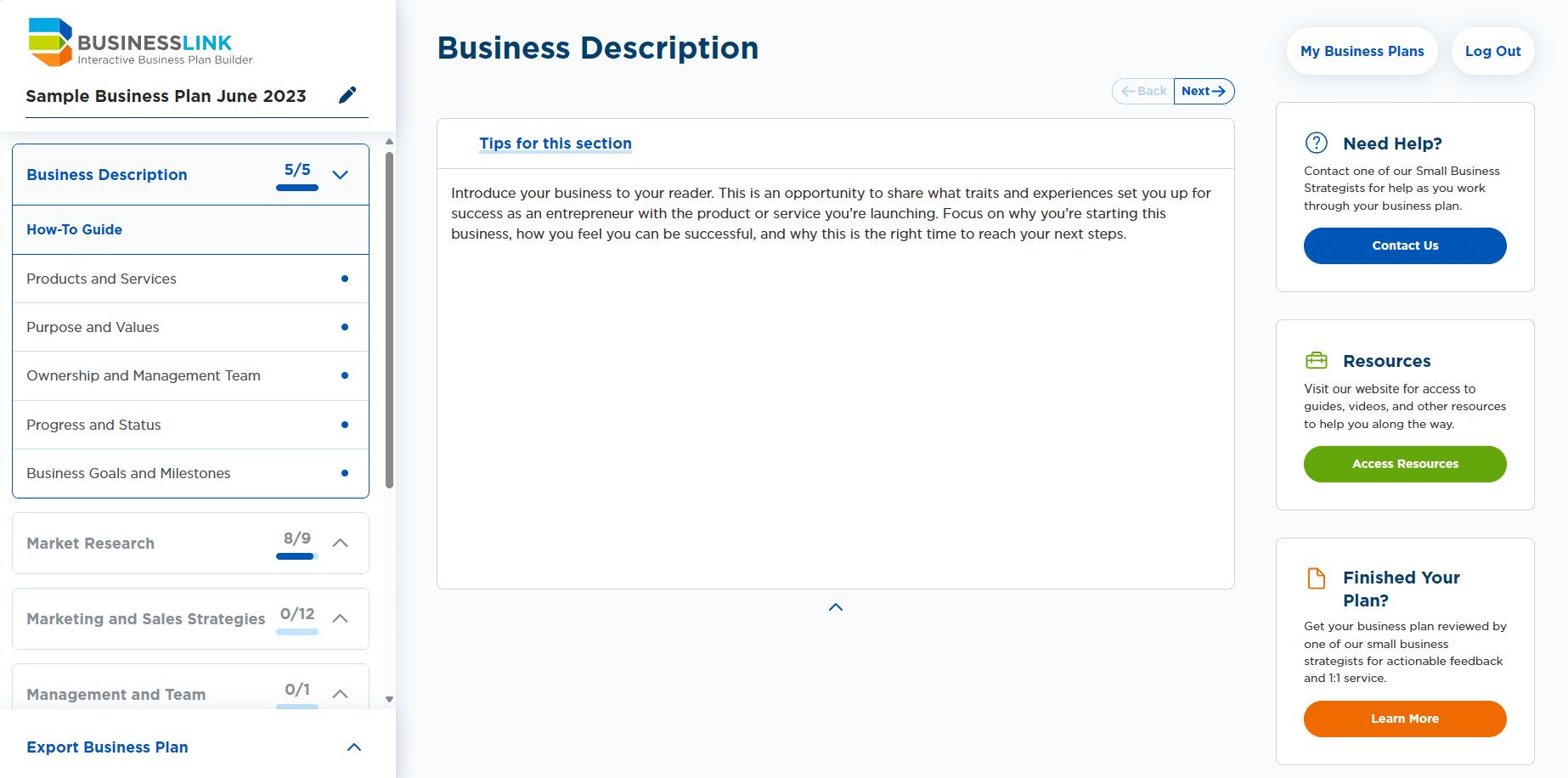

We understand that creating a business plan might be a new territory, our Interactive Business Plan Builder helps streamline the writing process and offers aspiring entrepreneurs and established business owners the guidance and support they need from the beginning to the end of the planning process.

What is a Business Plan?

A business plan is a strategic document that provides a detailed overview of a company’s goals, objectives, business structure, and strategies it will implement to achieve them. A business plan is crucial and beneficial to both startups and established small businesses.

Why is a Business Plan Important for Small Businesses?

Make informed business decisions

Set clear goals & strategy

Understand your customers & target market

Identify potential risks & mitigation

Secure funding & manage cash flow

Build & enhance credibility

What is Included in the Business Plan Builder?

The Business Plan Builder tool simplifies the process of developing your plan by breaking it down into essential topics and providing reference examples for each section

Executive summary & business description

Market research

Sales & marketing

Financial projections

Team structure

Why Use the Business Plan Builder?

Create a new business idea

Shift your existing business model

Develop a detailed business plan

Secure funding

Ready to Write a Compelling Business Plan?

Receive dedicated support from our Business Strategists as you go through each section.

Look Inside

Frequently Asked Questions:

Is there a time commitment to complete my business plan.

No, there is no specific time commitment. Take the time you need to conduct thorough research and complete your business plan at your own pace. The Interactive Business Plan Builder allows you to save your work at any point, allowing you the flexibility to complete it at your convenience.

Should I complete all sections in chronological order?

While the business plan is structured to guide you through the process, you have the flexibility to work on the sections in any order that suits you.

Can I create a copy of my business plan?

Certainly! Navigate to “My Business Plans,” locate the desired plan, and click on the “Duplicate” button to create a copy. You can then rename the duplicated business plan.

Can I invite another user or my business partner to be a collaborator on my business plan?

Unfortunately, the current tool doesn’t support this feature. However, you can export your plan as a Microsoft Word, PDF, or Google Drive and collaborate with others outside the platform if needed.

What if I need some help writing my business plan?

Business Link offers various resources and supports to assist you in crafting a business plan:

- Within each business plan section of the Business Plan Builder, you’ll find tips and examples to guide you.

- Check the right-hand side navigation bar for additional resources to help in your business plan development, including the option to download our Cashflow Template .

- If you need personalized assistance or have specific questions, our experienced business strategists, many of whom have entrepreneurial backgrounds, are available for one-on-one support. Feel free to reach out to us for assistance if needed!

Am I able to customize my business plan, such as adding a logo?

Absolutely! Export your business plan as a Word Doc or Google Doc to begin further customization, including the addition of a logo.

Will my business plan be shared with anyone?

Rest assured that your business plan is treated as your intellectual property (IP), and confidentiality is a priority. We will never share your data or business plan without explicit permission.

Did you have a business plan in our old Business Plan Builder? As of September 30th, 2023, access to your Business Link user account for exporting previous business plans has been discontinued due to the removal of this function. For copies of any plans created in the original builder, please contact our team, and we’ll gladly assist you.

Cash Flow Templates

Do you plan on asking for funding for your small business? Access the cash flow template you need to go with your funding request.

Have your business plan reviewed

Our small business strategists can review your business plan and provide you with feedback and coaching to get it to where it needs to be – whether you’re looking for financing, or just need to work out the details of your business idea.

Don’t have a business plan yet? Get started with our free interactive Business Plan Builder . The tool will walk you through the business planning process with details on what to include in each section, helpful tips, and examples. When you’re done, export your plan and submit it for review!

Business Link acknowledges and respects that we are on traditional land, meeting grounds, territories, gathering places, and travelling routes of Treaty 4, 6, 7, 8, and 10 and the home to many First Nations, Métis, and Inuit people. In the spirit of reconciliation, we acknowledge the lands of those who have come before us, reside here now and in the future.

Privacy Policy | Terms and Conditions | Cancellation and Refund Policy | Service Standards

© 2024 Business Link. All Rights Reserved. Website Hosted by YEG Digital .

Subscribe to our Newsletter

- Tools & Resources

How to write a business plan

How to write a business plan | cfib.

A business plan is an indispensable road map for your business’ success. While many entrepreneurs only write a plan in hopes of securing financing, smart entrepreneurs invest the time to create a plan that can take their business into the future.

A business plan is a living document, generally planning 3-5 years ahead. It outlines the direction a business intends to take to establish a customer base and start earning profits.

The key elements of a strong business plan include:

- Company Profile: What is your business’s mission? What product or service do you offer? What is your competitive advantage in the market?

- Market Research: What are the current trends in your industry? What are the characteristics and traits of your target market and what is the market share opportunity for your business?

- Sales & Marketing: What channels will you use to distribute your product? How are you going to reach your customers? Will the web and social media play a role in promoting your goods?

- Operations: What will you need to run your business (equipment, space, staff, etc)? Will you handle your own books or hire an accountant? How will the business be structured – incorporated or sole proprietor?

- Financials: How much money will you need to get your business off the ground? How will that money be allocated? When do you expect to start earning money?

Need help developing your business plan - We have the resources to help.

Business Planning Resources

Futurprenuer

Business Plan Essentials: A quick overview of what’s needed

Business Plan Writer : An interactive tool created by Futurpreneur, the Business Plan Writer has been designed to simplify the business planning process. Not only is this tool dynamic, allowing you to customize your plan, it also provides tips & tricks and plenty of examples to guide you as you write.

Mentoring : Futurpreneur Canada matches entrepreneurs (18 to 39) with a business mentor for six months and provides access to start-up resources, but without the financing. Mentors offer personalized support to help you launch and grow your business.

Other Resources :

- Scotiabank: Interactive Business Plan Writer

- Business Development Bank of Canada: Business Plan Template

- RBC Planning Your Business Site

- TD Online Business Planning Guide

- Share on Facebook

- Share on LinkedIn

Topics and Location:

- My Business – From Startup to Retirement

- Starting a Business

Want More? Become a Member

Join thousands of businesses that are set up for success.

Related Articles you might like.

Entrepreneurship manitoba offers a tax credit for business succession planning, summer vacation rules and scheduling - how to enjoy a stress-free holiday season, looking for free resources canada business new brunswick has free business plans, looking for free resources.

Choose your settings This dialog box is displayed the first time you visit the site. You can change your province or state and language in the page header or in the menu at any time afterwards.

Online services.

- Learn more about AccèsD

- Learn more about AccèsD Affaires

Home and auto insurance

Online brokerage, full service brokerage, see other desjardins sites.

Your browser settings have JavaScript disabled. Some features of the site are not available or will not work correctly without JavaScript . See How to enable JavaScript .

Your browser is configured to not accept cookies . Some features of the site are not available or will not work correctly without cookies . Also, some information presented might not apply to your situation. See How to enable cookies .

Your browser is not supported by our website. Some features of the site are not available or will not work correctly. See the procedure to update your browser .

Write up a business plan

You're about to make one of your biggest dreams a reality by starting or expanding your own business. A business plan will help you tackle your entrepreneurial project with confidence. Use it to plan your approach, put your ideas on paper and identify your options. Having a plan also makes it easier to find business partners, investors and lenders.

Drafting your business plan

We have created an interactive tool to show you how to put together your business plan. It's best to complete each section in order, but feel free to move sections around or add sections as needed afterwards. It's your business idea.

Throughout this process, you can:

- Think through your plans in greater detail

- Get clarification on concepts

- Get practical advice

- Access additional resources

- View tip sheets

Information that you enter in the interactive business plan remains your exclusive property. No information is sent to us.

Need help starting your business?

To help you create, finance and launch your business, we have plenty of tools and partnerships to get you started. Check them out to see how you can build up your business idea.

Once you've drawn up your business plan, you can get started on your financing request. Potential investors will need both these documents to assess your idea.

Useful links

- Open a business account

- Interactive business plan

- Are you ready to go global?

- See all tools

Suggested links

- Tip sheets for your business

- Find out about our full range of products and services for small businesses

- Test out your business plan and idea in the field

- Plan your start-up

WxT Language switcher

Dropdown language (interface text).

- Português, Brasil

- Canada.ca |

- Services |

- Departments

- Business plan guide

What is a business plan and why do I need one?

A business plan is a written document that describes your business, its objectives and strategies, the market you are targeting and your financial forecast. It is important to have a business plan because it helps you set realistic goals, secure external funding, measure your success, clarify operational requirements and establish reasonable financial forecasts. Preparing your plan will also help you focus on how to operate your new business and give it the best chance for success.

Securing financial assistance to start your new business will be directly related to the strength of your business plan. To be considered a viable candidate to receive funds from a financial institution or investors, you must demonstrate that you understand every aspect of your business and its ability to generate profit.

A business plan is more than just something to show lenders and investors, it is also necessary to help you plan for the growth and progress of your business. Your business’s success can depend on your plans for the future.

Listed below are examples of questions to ask yourself when writing your business plan:

- How will I generate a profit?

- How will I run the business if sales are low or if profits are down?

- Who is my competition, and how will we coexist?

- Who is my target market?

What should be included in a business plan?

Although business plans can vary in length and scope, all successful business plans contain common elements. The following points should be included in any business plan:

- Executive summary (business description)

Identifying your business opportunity

Marketing and sales strategy of a business plan, financial forecasts of a business plan, other useful documentation, the executive summary (business description).

The executive summary is an overview of the main points in your business plan and is often considered the most important section. It is positioned at the front of the plan and is usually the first section that a potential investor or lender will read. The summary should:

- Include the main points from each of the other sections to explain the basics of your business

- Be sufficiently interesting to motivate the reader to continue reading the rest of your business plan

- Be brief and concise – no more than two pages long

Although the executive summary is the first section of the plan, it is a good idea to write it last – after the other parts of the plan have been finalized.

In this section of your business plan, you will describe what your business is about – its products and/or services – and your plans for the business. This section usually includes:

- Who you are

- What you do

- What you have to offer

- What market you want to target

Remember that the person reading the plan may not understand your business and its products and services as well as you do, so try to avoid using complicated terms. It is also a good idea to get someone who is not involved in the business to read this section of your plan to make sure that anyone can understand it.

Some of the things you should explain in your plan include:

- Whether it is a new business venture, a purchase of an existing business or the expansion of an existing business

- The industry sector your business is in

- The uniqueness of your product or service

- The advantages that your business has over your competition

- The main objectives of your business

- Your legal business structure (sole proprietorship, partnership, corporation)

You can also include the date the business was registered/incorporated, the name of the business, its address and all contact information.

A strong business plan will include a section that describes specific activities that you will use to promote and sell your products or services. A strong sales and marketing section demonstrates that you have a clear idea of how you will get your product or service into market and can answer the following questions for the reader:

- Who are your customers? Do some research and include details of the types of customers who have shown an interest in your product or service. You can describe how you are going to promote yourself to potential customers.

- How are you going to reach your customers? You should know your customers and the best methods to reach them. Research will help you identify the most effective way to connect with your selected audience, whether it is through the Internet, over the telephone or by in-person contact.

- Who is your competition? Once you understand this, you need to research their strengths and weaknesses and use this information to assess potential opportunities and threats to your business.

- How are you going to position your product or service? Describe what makes your product or service unique to the market you are trying to target.

- How are you going to price your product or service? This information will outline your pricing strategy, including incentives, bulk pricing and/or group sales.

Don't underestimate the importance of this part of your plan. Investors need to know that you and your staff have the necessary balance of skills, motivation and experience to succeed. This section describes the people working in your business and how you plan to manage your activities. Information in this section can include:

- A brief organizational layout or chart of the business

- Biographies of the managers (including yourself)

- Who does what, with a brief job description of each position

- The needed skills of each position

- Any other relevant information related to personnel

It is also a good idea to outline any recruitment or training plans, including the cost and the amount of time required.

The operations section of your business plan will outline your daily operational requirements, facility requirements, management information systems, information technology requirements and any improvements you may have planned. This section usually includes information like:

- Daily operations – descriptions of hours of operation, seasonality of business, suppliers and their credit terms, etc.

- Facility requirements – this includes things like size and location, information on lease agreements, supplier quotations and any licensing documentation

- Management information systems – inventory control, management of accounts, quality control and customer tracking

- Information technology (IT) requirements – your IT systems, any consultants or support service and an outline of any planned IT developments

Your financial forecast turns your plan into numbers. As part of any good business plan, you need to include financial projections for the business that provide a forecast for the next three to five years. The first 12 months of forecasts will have the most details about costs and revenues, so investors can understand your strategy.

Your financial forecasts should include:

- Cash flow statements – cash balance and the cash flow pattern for the first 12-18 months, including working capital, salaries and sales

- Profit and loss forecast – projected level of profit based on your projected sales, the costs of providing goods and services and your overhead costs

- Sales forecast – the money you expect to make from sales of your product or service

Some other things to consider include:

- How much capital do you need (if you are seeking external funding)?

- What security can you offer to lenders?

- How do you plan to repay your debts?

- What are your sources of revenue and income?

- Forecasts should be covering a range of scenarios

- Reviewing risks and developing contingency plans to offset the risks

- Reviewing industry benchmarks/averages for your type of business

It is important to do your research to find out how your business compares to other small businesses in your industry.

The following sections are not always required, but can enhance any business plan:

- Implementation plan – this section lists estimated dates of completion for different aspects of your business plan, targets for your business and accomplishments. Appendices – these should include supporting material, such as licences and permits, agreements, contracts and other documentation that support your business plan.

Who should write my business plan?

Your business plan should be prepared by you, the entrepreneur. It is your business and your plan, but do not hesitate to ask for help from your management team, consultants, accountants, bookkeepers, copy editors or other experienced people.

1-888-576-4444

Contact us by email

Related Topics

- Business planning success

- Sample business plans and templates

Top business essentials

- Business regulations guide

- Employment regulations: Hiring

- Financing a business guide

- Marketing plan outline

- Starting a business

- Taxation guide

Multilingual documents

- Developing a company brochure

- Consulting a lawyer for your business

- Setting up a pay system

- Managing a family-owned business

- Determining your profit

- Business structure: Which one is right for you?

- Naming your business

- Understanding your business lease

- Home-based business

- Choosing and setting up a location

- Franchising

- Buying a business

- Buy a business or start your own

- Developing your ideas

- Introduction to market research

Learn how Microsoft uses ads to create a more customized online experience tailored for you. About our ads

How to Write a Business Plan for Your Small Business

Your business plan is the most important document you’ll ever write for your business. Whether you’re opening a suburban coffee shop or starting up a tech company, you need a business plan.

At a minimum, writing a business plan helps you formalize your project and state your business purpose, goals, strategy, competitive strengths and financial forecasts and funding.

The federal government’s Business Development Bank of Canada (BDC) is devoted to helping Canadian entrepreneurs. BDC.ca’s business plan resources offer an exhaustive collection of articles on building business plans, including examples and templates. You’ll also find expert advice on every aspect of starting, buying and running a business, as well as consulting services and expert advice.

What is a business plan?

A basic business plan should explain a business’s strategy and direction. It should cover which customers you want to sell to and which needs you’ll address, the size of the market you want to target and what your marketing strategy is. It also includes your financial data and forecasts, including revenue and cost estimates for the 2 years and any funding you’ll need to ramp up.

A good business plan should include:

- Your business name and an overview of what it does.

- An analysis of your target market, its size, who your competitors are and how much market share you think you can gain.

- Your product’s key differentiators that make you stand out from your competitors.

- A marketing plan, covering which customers you want to target first and how you will get them to buy.

- Your estimated 12-24 month cash and working capital needs for equipment, office space, supplies, materials, staffing, etc.

- Your sources of funding, including your own money and business loans, lines of credit and money from investors.

- Your business’s form of ownership (corporation, sole proprietorship) and staffing plan.

How to write a business plan

To get started, have a look at BDC’s free business plan template and kit . The kit includes a Word template, an example business plan and financial presentation, and a financials Excel file that you can plug your numbers into. The spreadsheet is set up to calculate your pro-forma numbers (forecasts). The kit includes a link to BDC’s How to write a business plan page and a user guide.

Here are some tips to help you write a winning business plan:

- Be brief, concise and simple, but thorough. Your business plan doesn’t have to be long, but it should communicate your drive, commitment and expertise.

- You should cover all the basic information that a lender needs to evaluate your project.

- Start by describing your business; what you offer, who your customer is, how fast you hope to grow and how.

- Explain what’s unique about you, your business and most importantly, what it offers customers that your competitors don’t.

- You should have a section describing your competitors and your strengths and weaknesses. How are you going to take market share from competitors, or is the market you’re targeting big enough for several competitors? What is the total potential market?

- Summarize your marketing plan and costs.

- Describe your business type, your staffing needs for the next 12 months, and your expected capital and fixed costs, such as equipment and computers, rent and utilities, etc.

- Present your detailed financial information, sources of funding and personal assets, plus any funding or investments you’ve already secured. Investors are interested in costs and margins. Higher margins are more appealing.

- Include a one-page executive summary, your background and a mission statement.

- Be conservative and transparent with your estimates and project timeframe and milestones. UPOD (under-promise, over-deliver) makes everyone happy. If your plan and financials suggest you can ramp up with less revenue and lower costs than you conservatively expect, then your nominal and best-case scenarios should get an enthusiastic response.

- Check and recheck your plan. Make sure it’s complete and well-written. Don’t exaggerate and make sure you know your numbers and plan by heart before meeting with a lender.

There are hundreds of online resources to help you write a great business plan. Small Business BC has a simple recap and links to other resources. Scotiabank has an automated Plan writer for business that creates a business plan for you. Just follow the instructions and add your information in each section. You can see sample content in each field by checking a box. There’s also a financial information section.

You can also use business plan software, although Scotiabank’s tool might get you the same result for free. If you’re interested, visit business .org to read about their top 5 picks for business plan software.

What do banks want to see in a business plan?

If you’re going to convince an investor or a bank to give you funding, you need to know your numbers. OK, so maybe you’re no financial analyst, or worse, you hate math and numbers altogether. Unfortunately, if you own and operate a business, you need to understand the basic numbers that matter. A lot of companies go out of business because they run out of cash. And that includes businesses with revenues and customers.

Don’t run out of cash ! To launch a business, you need to understand and properly estimate the amount of cash you’ll burn through before your business is profitable enough to sustain itself and pay you also. Unless you’re extremely frugal and disciplined, you’ll probably need more cash for a longer period. Your financial forecast should show what happens if revenue is only 50% or a third of what you expected.

If you aren’t good with numbers, you could ask an accountant for advice or talk to a business owner you know who’s been there, done that. You could also call your bank and ask to meet with a small business advisor before you prepare your business plan. They should be able to tell you what to expect, and maybe even give you specific advice and sample small business plans and templates.

But no matter how much collateral you have, if you want to get a bank loan or a line of credit for a new business, you’ll need a solid business plan that’s realistic and based on good research.

Money, money, money mo–ney! Small businesses often rely on the owners’ savings and loans from family members to get off the ground. If your business has no revenue yet, a bank won’t lend to you unless put your assets up as collateral. That usually means using your home or retirement savings to guarantee the loan.

If you can’t pay it back for some reason, the lender will sell your assets to repay what you owe. Not a pretty situation! Make sure your business plan is solid, because even if you have collateral, banks won’t be lining up to lend you money. Why? Because selling your assets at auction isn’t a good outcome for anyone. You lose all your possessions and the lender has to liquidate your assets to recover their capital, which can take a long time.

You need to impress the bank with your business chops and business plan if you want to borrow. “I’ve always wanted to own a pet shop and I love dogs” isn’t good enough.

The same applies to investors who give you money in exchange for part ownership of a company. If you only need a few thousand dollars from close relatives, you can probably skip the PowerPoint presentation. But if a seasoned investor is considering a large cash infusion, a great business plan will be critical to attract them.

About the author

The Microsoft 365 team is focused on sharing resources to help you start, run, and grow your business.

Get started with Microsoft 365

It’s the Office you know, plus the tools to help you work better together, so you can get more done—anytime, anywhere.

5 reasons to consolidate your cloud apps

A guide to creating a facebook business page for your sme, what’s a marketing strategy and why does my business need one, reputation management for small businesses.

Business Insights and Ideas does not constitute professional tax or financial advice. You should contact your own tax or financial professional to discuss your situation..

Create Your Business Plan

Your business plan is a document that should grow with your business. It should undergo constant revisions as your business evolves and expands.

Navigation:

- What Your Business Plan Will Do For You

- Sample Business Plans

- General Business Planning Help

What Your Business Plan Will Do For You

- Be a reality check! It will force you to identify your business strengths and weaknesses.

- Help you figure out your budget.

- Provide a clear direction, which can keep you focused and help eliminate stress.

- Be your timetable for operations

- Help you coordinate all the diverse activities that go into running your business.

- Serve as a resume when you seek lenders, suppliers, investors or partners.

- Ensure you evaluate the market for your product or services and size up the competition.

- Provide a clear starting point for future business planning.

Sample Business Plans

Bplans.com This site offers a selection of free sample business plans, as well as articles on business planning. Bplans.com also sells business planning software.

Business Plans Handbook, Gale Publishing This is a database of actual business plans written by North American entrepreneurs seeking financing for their businesses. Includes examples of many start-up business ideas. Access is available through many BC public libraries, made possible by a generous donation from the Sutherland Foundation. Affiliates of UBC can start here .

Center for Business Planning The MOOT CORP® Competition simulated the experience of entrepreneurs pitching investors for funding. Although the competition is no longer held, the business plans presented by MBAs from the best business schools in the world can still be found on the Internet Archive's Wayback Machine.

Templates

Futurpreneur - Business Plan Writer An interactive, online, tool that allows you to customize your business plan. Includes tips & tricks and can be downloaded to a word, excel or PDF file.

Business Development Canada (BDC) - Business Plan Template This is one of the best downloadable business plan templates. The business plan contains 2 sections, with a glossary and user guide.

Canada Business Site An excellent source for financing, permit, and business planning information. Includes a complete list of useful templates.

SCORE SCORE is a non profit association helping small businesses. Their library includes templates for business plans, SWOT analysis, financial projections and more.

General Business Planning Help

Small Business BC (SBBC) SBBC is a great place to start for information on BC specific regulations and guidelines, for whatever stage you are in your business development. This is a great post on the topic.

GoForthInstitute An excellent collection of free resources for entrepreneurs on diverse subjects. Of particular interest are the How-To Guides, templates and samples, and business calculators. They also offer low-cost video training.

Small Business Planner, the US Small Business Administration (SBA) This website includes information and resources that will help you at any stage of the business lifecycle. Watch their series of business planning videos here .

Need information on business research as you write your business plan? Check out our Beginner's Guide to Business Research , or go to our collection of 100+ Industry Guides for industry-specific research help.

Find a Branch

- Call 1-800-769-2511

Create a Business Plan

Think of it as a playbook for your goals, priorities and growth opportunities., how to write a business plan.

Creating a business plan can feel like a huge undertaking when you are starting a new business . And while developing one does require careful thought, studies show that entrepreneurs who have a formal plan are often more successful than those who don’t. Keep reading to see how a business plan benefits you and the details you should include.

Prefer to just get started? Start creating your business plan with the RBC Business Plan Builder.

Content in this Article

What is a business plan? Benefits of writing a business plan Information to include in your business plan Create your plan with the RBC Business Plan Builder

What is a Business Plan?

Put simply, a business plan is a document that explains to others your vision for your business, the gap in the market your business will fill and the steps you will take to succeed. Creating a business plan is a crucial task for any business, and one which requires you to be thoughtful about the direction of your business, consider the goals most important to you, and how you will go about achieving them. A solid business plan will give you the confidence that you will find success, and may even reveal some gaps and risks. In fact, studies show entrepreneurs who start with a written business plan are more successful than those who don’t. Whether you’re creating a roadmap to follow as a new business owner, need a pitch to attract investors or a document to engage stakeholders, a business plan is a living document you’ll want to update regularly as your business, goals and circumstances evolve. While some business owners consider writing a business plan an overwhelming step, it doesn’t have to be. Creating the best business plan ever is a matter of breaking it down into individual steps — and then taking them one at a time.

Benefits of Writing a Business Plan

Writing a business plan can help you in several ways—here are just a few of the biggest benefits:

- Provides a roadmap. A business plan requires you to be thoughtful about the direction of your business, consider the goals most important to you and how you will achieve them. Think of it as your step-by-step guide for success!

- Reveals gaps or risks you need to address. By looking at your business critically, you’ll be able to identify your strengths as well as areas where you may be vulnerable.

- Shows potential investors, stakeholders or lenders that you’re serious. Attract and engage those who may be interested in your business with all the important information they need to know.

Information to Include in Your Business Plan

Create an executive summary Describe the current business environment Outline your marketing and pricing strategies Describe how your business will operate Detail your financing and cash flow needs Describe your team (even if it’s just you) Identify risks and how you’ll protect your business Write a conclusion Include your contact information

Create an Executive Summary

After your cover page and table of contents, include an executive summary. Since this is the first thing readers will see, it should be clear, grab their attention and identify what your business does.

What to include:

- Your industry, target market and how your business is different from the competition

- Your business structure (sole proprietorship, corporation, etc.)

- What stage your business is in

- Your experience and credentials, as well as your team’s, if applicable

- Financial projections for the business (or performance to date, if you’re already operating)

Tip: Write your executive summary last and keep it to one page. While it’s structurally the first section, it will summarize everything else in your plan.

Describe the Current Business Environment

This should be a detailed history and summary of your business, identifying the product(s) or service(s) you’re offering and how you will solve a problem or need in the market. Be sure to include any pre-market research or testing you’ve conducted that speaks to the viability of your idea.

When you’re starting a business , your bank and potential investors don’t have historical data to review. Your plan must clearly convey your strategy, competencies and the reasons your venture will succeed. (If your business is already established, you’ll want to cover where you started and how you got here.)

- Where you want your business to go—and how you’ll get there. What are your goals? How will you generate sales?

- What your business does. What needs does your business fulfill? Where will you sell your products or services?

- Your business set up. How is your business structured ? Are there other owners or shareholders?

- How you know your business will work. What market research or testing have you done? Are there trends?

Tip: Revisit your business idea by asking yourself these 7 key questions or use our business idea checklist to see the steps you may need to take to get to opening day.

Outline Your Marketing and Pricing Strategies

This is your opportunity to explain how you’re going to get customers to buy your products or services. This section involves identifying your ideal customers, your pricing strategy and more.

- Your products, service and unique selling proposition. What are the features of your product or service and what makes it unique compared to what your competitors offer? How will you draw customers away from competitors?

Tip: Completing a strengths, weaknesses, opportunities and threats (SWOT) analysis may help you write this section. Download a FREE SWOT Analysis Template

- Your pricing strategy. How will your pricing be competitive, but still allow you to make a profit? See our factsheet: Pricing and Costing Accurately

- Your sales and delivery strategy. How will you will generate sales? Will you sell directly to customers or through other businesses? How much will it cost to produce and ship your product?

- Advertising and promotion strategy. Which advertising and promotion tactics (website, digital marketing, social media, email) will reach your audience most effectively?

Tip: Choose a few channels to do well instead of pursuing all of them at once. That way, you’ll be better able to direct your focus and monitor your progress.

Describe How Your Business Will Operate

The operations section of your business plan should describe what’s physically necessary for your business, as well as any partners who help keep things running smoothly.

This section contains four main categories:

- Your stage of development. This should highlight what you’ve done to date to get the business operational, then follow up with an explanation of what still needs to be done.

- The production process. This lays out the details of your day-to-day operations, manufacturing details, inventory, costs, outsourcing and more.

- Getting products and services to customers. What is your supply chain and distribution strategy?

- Partners and allies. Who are the people and organizations that support you? Who are key suppliers and vendors?

Third-party groups may be able to help you in your journey. For example, Futurpreneur serves entrepreneurs age 18-39 who want access to business resources, financing and mentoring.

Detail Your Financing and Cash Flow Needs

Use this section to determine how strong your business is financially. Be realistic about expenses and projected income so you can properly assess your financial health early on and make sure you have enough cash for the first year.

- Startup costs. What are your one-time and ongoing expenses? How will you cover the costs? Learn more with our factsheet: Deciding How Much Money You Need to Start or use our Startup Costs Calculator .

- Profit margin and break-even point. How will you make a profit and calculate margins? What is your break-even point? Suggested reading: The Difference Between Cash Flow and Profit

- Balance sheet. What assets, liabilities and capital do you have at this point in time?

- Financing. What are your sources of financing —savings, loans, grants? What are your repayment terms, if any?

- Cash flow forecast. What is your 12-month cash flow forecast? Estimate it now: Cash Flow Forecast Template

Describe Your Team (Even if It’s Just You)

This section should describe your current team as well as anyone you might need to hire to round out your company.

- Skills and strengths. What skills do you and/or your team have that are critical to the business?

- Management style and structure. How will you manage your team? Who will employees report to?

Identify Risks and How You’ll Protect Your Business

Every business comes with some risk, so it’s better to be prepared for them now rather than be surprised later. Use this section to explore potential risks and how you’ll protect your business.

- Obstacles your business may face. How could the economy, your competition, supply chain or another circumstance affect your business? How do you plan to minimize and handle these and other risks?

- How you’ll protect against losing market share (new competition). Do you have any agreements or vendors you’ll rely on?

- How you’ll prevent critical data loss. Outline what you will do to reduce the impact of data loss, such as backing up all computer data regularly, using cloud providers, employee rules on installing software and other policies.

- How you’ll protect intellectual assets. Will employees sign confidentiality agreements to protect processes, trade secrets and other intellectual property? See How Intellectual Property (IP) in Canada Works .

- Compliance requirements. What rules, regulations and licenses will you need to comply with to operate?

- Insurance needs. Does your industry require specific coverage, such as professional liability or other insurance?

Write a Conclusion

This is the last thing readers will see, so you want it to be strong. Use your conclusion to reinforce your goals and objectives. If you need financing, clearly state the amount you need and how it will be used. As with your executive summary, your conclusion should be succinct, clear and leave a positive impression.

Include Your Contact Information

Potential investors and lenders need to know how to reach you. Don’t forget to include your business name, contact information, website and social media presence in your plan.

Create Your Plan with the RBC Business Plan Template

This comprehensive template will guide you through a series of questions, resources and tips to help you write your plan. Best of all, you can go at your own pace and come back to work on it anytime.

Want to Talk Business?

Get help clarifying your goals, setting up, opening an account and more.

We look forward to meeting with you! Here’s how to get in touch:

Call us 24/7: 1-800-769-2511

Thanks for stopping by. We’re here to help when you’re ready. In the meantime:

Use our FREE step-by-step guide to help make your dream of starting a business a reality.

Stay up-to-date on the latest resources, money-saving offers and business advice.

See How an Advisor Can Help You

RBC business advisors can help your company at every stage—from starting up to simplifying operations and funding growth. An RBC business advisor will work with you to:

- Understand your vision and business goals

- Set up the right financial products and solutions

- Explore options to effectively manage cash flow, pay employees and get paid

- Connect you to a suite of business advice and solutions that go beyond traditional banking

View Legal Disclaimers Hide Legal Disclaimers

- Small Business

- English Selected

Create a business plan

Explore the ways tailored advice from TD can help your business, today.

Starting a Business in Canada

Starting a business can be a challenging and rewarding endeavour. With the right planning, resources, and groundwork you'll enjoy a better chance of success.

Find out if your business idea will work

Clarify your idea and get it in writing

Find the money and manage your cashflow

Think about the legal stuff

TD Business Accounts, lines of credit, and more

Write a Business Plan

Clarify your idea and get it in writing.

There's a lot of work involved in writing a business plan but it prepares you for the even bigger task of starting a business.

It will help refine your idea, outline goals, and make it easier to explain what you hope to accomplish. This comes in handy when you're looking for money.

Download our business plan template which addresses product and service information, competitive analyses, the financial feasibility of starting up, and more.

Why You Need a Plan

If you're pitching your idea to banks or other financial institutions for a loan, you'll need a business plan because people want to see that you've put serious thought into your idea.

Thinking about the details will help you make decisions about your business, and will open you up to new ideas or approaches you might not have considered.

Writing out a business plan will give you an action plan to work with, but if you need help getting started use our interactive checklist .

Why You Need a Unique Selling Point

One of the most important aspects to consider when writing your business plan is asking why customers would buy your product or service .

Will it be better quality? Better price? Is it backed by a guarantee? Will it have more features? Will you be able to provide outstanding customer service?

Once you establish what differentiates you from the competition, it's essential to communicate it consistently when you go to market.

Use our interactive checklist to define your unique selling point.

Determine Demand & Profit Potential

Once you know (or are reasonably sure) that customers are likely to buy your product or service, figure out if you'll be able to make a profit.

Determine what you need in sales to cover costs plus a profit margin. Also ensure you have capacity - the physical ability to work a certain number of hours in a week or produce the required amount of product.

Use our interactive checklist for more ideas on determining demand and profit including ways to research, test marketing, and future trends.

Tools & Calculators

Download our business plan template.

Download our start-up costs template.

Figure out your income vs expenses.

Determine your monthly interest and payments.

Products and services to help get you started

Small business bank accounts.

Discover the benefits of a TD Small Business Bank Account to meet your business needs.

See our accounts

- Business Credit Cards

Choose the cash back, travel rewards, or low interest rate credit card that fits your business needs.

See all cards

Receiving & Making Payments

Keep your cash flow moving successfully and stay on top of things.

Articles on Starting Your Business

Four Steps to Find Out if Your New Idea Will Work

Research, validate, talk to industry insiders, and test your idea to ensure it has what it takes to succeed.

Selling Online and Other Ways to Expand Your Business

Marketplaces, subscription models, drop-shipping, and freemium offers are four ways to expand your business online.

Sources of Small Business Funding

Ways to fund your business include: self-financing, partnering with another business, angel investors, grants.

Breaking Barriers — A series on women entrepreneurs

Get inspired with our first article in a series highlighting successful women entrepreneurs who have overcome challenges to build successful businesses.

Breaking barriers — Spotlighting female entrepreneurs

Get inspired with our latest article in a series highlighting successful women entrepreneurs.

Celebrate Pride with Florence Gagnon

Her journey was so inspirational it was adapted to the silver screen, but it started with a focus on her local community.

Spotlighting Female Entrepreneurs — Gloria Kim, Gloryous Productions

A series of articles that highlight various successful women entrepreneurs who bank with TD Small Business Banking. Discover their success.

Get in touch

Contact an account manager.

Talk to an Account Manager Small Business (AMSB) to discuss your business needs.

Talk to a Small Business Specialist at our Small Business Advice Centre.

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan Miles

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Saving and Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking?

- TD Bank Small Business Banking?

- TD Bank Commercial Banking?

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

- Small Business

- Ways to Bank

- More Scotiabank Sites

- English selected

- Scotia OnLine Mobile

- ScotiaConnect

- Cash & Coin Service

- Advice Centre

Need a business plan? Try our template.

Invest in the future of your business by taking the time to create or update your business plan using our free template.

The importance of your business plan

Perhaps the most important document for any new business is a business plan. Yet too many business owners fail to sit down and prepare or update one.

A business without a plan is adrift. Decisions are made reactively based on the owner’s emotions, rather than prudent research. Employees, vendors, investors and other stakeholders (as well as the owner) are unclear about the direction of the company. That lack of focus results in wasted dollars, energies and resources as the company zigzags along instead of following a well-planned straight line to its goals.

Writing a business plan can seem a daunting task. Many entrepreneurs simply don’t have the time, inclination or the proper tools.

Business planning template

We have developed a template that makes creating your Business Plan easy. And it’s free !

This template guides you through all of the steps required to complete a proper business plan. It has explanations of the terms and definitions. It lets you add your own thoughts and comments.

Once you’ve completed the steps, you’ll have a business plan complete with cover page, contact information, financial tables, product descriptions and marketing details. You can save and print the plan, or send it electronically to anyone.

Use your plan to move your business forward with confidence, to motive your team, or to present to investors or lenders.

Depending on how much research and preparation you’ve already completed, creating your plan won’t consume much time at all. While it’s very easy, don’t worry if you get stuck because help is available throughout the process.

Take your plan to the bank

Once you’ve completed your business plan, you may take it to a Scotiabank Small Business Advisor . The advisor can review your plan, supply feedback, and, if requested, help you to explore your financing options.

Get feedback on your plan

Asking people to review your plan will make it stronger because you’ll receive valuable feedback. Share it with your accountant, lawyer, financial advisor and trusted businesspeople so they can offer their suggestions to improve your plan. If you are really worried about someone reading your secrets, consider attaching a Non-Disclosure Agreement (NDA) to the plan. An NDA is a legal document that prevents others from sharing your information with unauthorized parties.

Try our free business plan template

Related articles

Is your business taking advantage of the low canadian dollar.

Now may be a good time for you to explore introducing your business to potential customers south of the border.

A business plan is key to your success

Business plans are an important tool for all businesses, no matter how big or small.

Path to Impact 2023: Resilient Small Business Owners optimistic for the future despite headwinds

The challenges and opportunities that lie ahead for small businesses in 2024 are not one-size-fits-all.

KPMG Personalization

Canadian business leaders want better R&D support to strengthen innovation

81 per cent would conduct more R&D if a patent box model existed, finds a recent KPMG in Canada survey

- 1000 Save this article to my library

- Home ›

- Newsroom ›

- News releases ›

- Canadian business leaders want better R&D support to strengthen innovation

The vast majority of Canadian business leaders want the federal government to support a wider range of research and development (R&D) activities and provide tax relief for Canadian intellectual property (IP) to make their companies and, in turn, the economy more productive, finds a KPMG in Canada survey.

Amid high demand for the Scientific Research and Experimental Development (SR&ED) program across the country, more than eight in 10 leaders ( 84 per cent ) would like the program to be simplified and expanded to encourage more investment in the innovations that create economic prosperity.

"Canada's lack of domestic research and development is a key factor in the country's lagging productivity, relative to other industrialized countries," says David Durst, Partner-in-Charge, Tax Incentive Practice, KPMG in Canada. "Canadian businesses have faced challenges transforming ideas and innovations into viable, profitable ventures that spur economic growth and lead to a higher standard of living for Canadians. Currently, there are tax incentives for early-stage R&D; however, widely available support to transition the resulting knowledge into commercialized patents is missing in Canada's approach."

Key survey findings:

- 84 per cent of 534 business leaders at small- and medium-sized companies across Canada believe the process of applying for and receiving SR&ED tax credits needs to be simplified

- 74 per cent say the amount of the SR&ED tax incentive/refund is not sufficient to warrant their investment

- 78 per cent say they would conduct their own R&D if the investment tax credit (ITC) rate was higher than 35 per cent

- 82 per cent believe SR&ED should be expanded to cover a broader range of activities and expenses, such as equipment and the commercialization of research, even if the program had a lower ITC

- 86 per cent prefer to see federal government policies and tax relief that support business growth, innovation and productivity, over personal tax credits

SR&ED is the single-largest R&D support program in Canada, providing Canadian-controlled private companies with an enhanced 35 per cent refundable tax credit on their first $3 million of qualified R&D-related expenses, and public and foreign companies with a 15 per cent non-refundable credit for R&D conducted within Canada.

The survey reveals that business leaders view the current definitions of research activities and expenditures under the SR&ED program as too narrow, covering only scientific research and experimental development. Seventy-eight per cent acknowledged that the R&D their business performs is currently not eligible for SR&ED.

"Business leaders also want more routine R&D that yields productivity improvements for their company to be made eligible under SR&ED, even if the tax credit rate is lower," adds Mr. Durst. "The question becomes whether the federal government's review of innovation programs will support a broader range of R&D in Canada that may not be patentable, but directly improves business productivity."

Support for a Canadian patent box regime

The Department of Finance is currently undertaking public consultations until April 15 to modernize the $3.5 billion SR&ED program on a cost-neutral basis. Finance has also requested public input on a "patent box" regime, which would offer tax breaks to encourage companies to develop and keep IP in Canada.

Eight in 10 ( 81 per cent ) of leaders say they would conduct more R&D if the government introduced a patent box model, which would provide a lower corporate tax rate on revenues derived from Canadian IP.

The government's stated objective in proposing a patent box regime would be to encourage new and existing Canadian businesses to conduct their R&D in Canada by providing a preferential tax rate for the income generated from the IP resulting from that R&D. In addition to providing direct support for initial R&D activity, other countries provide incentives to help ensure that the benefits of locally-developed IP stays within their economies to create jobs and other social and economic benefits, says Brian Ernewein, Senior Advisor, National Tax Centre, KPMG in Canada.

"Generally, the income tax system should be neutral in its treatment of business income to avoid distorting the allocation of investment capital and impairing competitiveness" says Mr. Ernewein. "However, there is a case for a well-designed, preferential intellectual property tax regime, under which the qualifying income is derived from R&D conducted in Canada. The additional support for R&D performed here could ease the path toward commercialization and reduce the pressure to locate patents and other IP outside Canada in order to benefit from lower tax rates elsewhere."

Read more about the upcoming federal budget.

How new measures announced in this year’s budget may impact Canadians and businesses

About the KPMG Business Survey - Federal Budget 2024 Edition

KPMG in Canada surveyed 534 Canadian companies between February 3 and February 27, 2024, using Sago's Methodify online research platform. All respondents are business owners or executive-level decision makers. Thirty-one per cent helm companies with $500 million to $1 billion in annual gross revenue; 14 per cent, between $300 million to $499 million; 35 per cent, between $100 million and $299 million; 19 per cent, between $99 million to $10 million and the remaining one per cent, nine million or less. Seventy-five per cent of the companies are privately held and 25 per cent are publicly traded. Forty-two per cent are family-owned businesses.

About KPMG in Canada

KPMG LLP, a limited liability partnership, is a full-service Audit, Tax and Advisory firm owned and operated by Canadians. For over 150 years, our professionals have provided consulting, accounting, auditing, and tax services to Canadians, inspiring confidence, empowering change, and driving innovation. Guided by our core values of Integrity, Excellence, Courage, Together, For Better, KPMG employs more than 10,000 people in over 40 locations across Canada, serving private- and public-sector clients. KPMG is consistently ranked one of Canada's top employers and one of the best places to work in the country.

The firm is established under the laws of Ontario and is a member of KPMG's global organization of independent member firms affiliated with KPMG International, a private English company limited by guarantee. Each KPMG firm is a legally distinct and separate entity and describes itself as such. For more information, see kpmg.com/ca .

For media inquiries, please contact:

Nancy White National Communications & Media Relations KPMG in Canada (416) 876-1400 [email protected]

Viewpoints from KPMG’s leaders and subject matter experts

Welcome to the KPMG newsroom. Explore current news, opinions and insights for KPMG in Canada.

Welcome to the KPMG newsroom. Here you will find KPMG news and media contacts.

- Share full article

Advertisement

Supported by

Robert MacNeil, Earnest News Anchor for PBS, Dies at 93

With his longtime co-host Jim Lehrer, he delivered thoughtful reports that stood in stark contrast to the commercial networks’ ever more sensational newscasts.

By Elizabeth Jensen

Robert MacNeil, the Canadian-born journalist who delivered sober evening newscasts for more than two decades on PBS as the co-anchor of “The MacNeil/Lehrer Report,” later expanded as “The MacNeil/Lehrer NewsHour,” died early Friday in Manhattan. He was 93.

His death, at NewYork–Presbyterian Hospital, was confirmed by his daughter Alison MacNeil.

Mr. MacNeil spent time at NBC News early in his career and was a reporter for the network in Dallas on the day President John F. Kennedy was assassinated. But he came to reject the flashier style of the commercial American networks, and in 1971 he joined the fledgling Public Broadcasting Service.

He brought with him a news sensibility honed at the BBC, where he had worked in the interim, and became a key figure in shaping U.S. public television’s in-depth and evenhanded approach to news coverage.

A pairing with Jim Lehrer in 1973 to cover the Senate Watergate hearings for PBS was unpopular with the operators of many local public stations, who thought the prime-time broadcasts weren’t appropriate evening fare. But the two men’s serious demeanor was a hit with viewers, and the broadcasts won an Emmy Award and eventually launched an enduring collaboration.

In October 1975, some major public stations began carrying the “The Robert MacNeil Report,” a half-hour of Mr. MacNeil’s design that examined a single issue each night and shunned showy production values. Within a year the program was renamed “The MacNeil/Lehrer Report.” It was expanded again in 1983 to become “The MacNeil/Lehrer NewsHour,” a multitopic program that was the nation’s first full hour of evening news.

The program offered a stark counterpoint to the ever-frothier newscasts on the commercial networks’ local affiliates and was honored with every major broadcast journalism award.

Intensely private in public, Mr. MacNeil was known to friends as engaging and wickedly funny. He was proud of his no-nonsense style on air, which critics called boring but which he called civilized discourse in the public interest. One memorable example was his hourlong interview in 1985 with Fidel Castro, in which Mr. Castro reluctantly defended the Soviet invasion of Afghanistan in 1979, in part because he would never “be on the side of the United States.’’

Mr. MacNeil defended his interviewing style and his program’s unsensational approach to weighty topics. “I cannot stand the theatrical, prosecutorial interview, the interview designed to draw attention to the interviewer, full of either mawkish, false sentiment or theatrically belligerent questioning,” he told The New York Times in 1995, when he retired from the daily newscast.

“Every journalist in this country has a stake in the democratic system working, and I think institutions of democracy are worth taking seriously,” he added. “It’s a very old-fashioned, corny view, but Jim and I both feel that strongly, which is one of the reasons our show is the way it is.”

Robert Breckenridge Ware MacNeil, known as Robin, was born on Jan. 19, 1931, in Montreal and raised in the port city of Halifax, Nova Scotia. His father, Robert A.S. MacNeil, served in the Royal Canadian Navy during World War II, commanding convoy escort ships, and later joined the Royal Canadian Mounted Police. His mother Margaret (Oxner) MacNeil, was left to raise her children alone for several years while her husband was at war.

While Mr. MacNeil was attending Dalhousie University in Halifax, a producer for the Canadian Broadcasting Corp. saw him in a school production of “Othello,” and he was hired to act in CBC radio productions and eventually a daily radio soap opera.

He soon dropped out of college to try his hand full time at stage acting, but decided that he was better suited to be a playwright and returned to school, this time at Carleton University in Ottawa. While still a student he worked as a national radio announcer for the CBC and then for the CBC’s new television service, where he also hosted a children’s program.

After graduating, he moved to England to write plays, but quickly turned to journalism to make money. He told The Times in 1995, “I had one of those golden careers; it just floated.”

In 1960, after five years at the Reuters news agency in London, Mr. MacNeil joined NBC News, eventually replacing John Chancellor as a wide-ranging foreign correspondent, covering wars in Africa and the Cuban missile crisis. (For about a week after that October 1962 episode, he and five other journalists were held under house arrest in a Havana hotel by the Castro government.) He was present at the construction of the Berlin Wall and later covered its dismantling in 1989.

Mr. MacNeil was assigned to cover Washington in 1963 and was on his first presidential trip on Nov. 22 when President Kennedy was assassinated in Dallas. While his work covering the killing was overshadowed by that of his NBC News colleagues, he may have had his own brush with the drama of that day.

After the shots were fired in Dealey Plaza, Mr. MacNeil made his way to the nearest building, the Texas School Book Depository — the building from which the fatal shots had been fired. There, he asked a man who was leaving and another in the lobby where the nearest telephone was. Kennedy’s accused assassin, Lee Harvey Oswald, later told the Dallas police that he had encountered a Secret Service agent at the building. The historian William Manchester concluded in his 1967 book, “The Death of a President,” that the man in the suit, crew cut and press badge was, in fact, Mr. MacNeil.

In his autobiography, “The Right Place at the Right Time” (1982), Mr. MacNeil wrote that “it was possible, but I had no way of confirming that either of the young men I had spoken to was Oswald.”

In 1965, Mr. MacNeil became the co-anchor, with Ray Scherer, of NBC’s half-hour weekend news broadcast, “The Scherer-MacNeil Report.” But two years later he returned to London, reporting for the BBC’s “Panorama” program, before joining PBS in 1971.

Mr. MacNeil, who had homes in Manhattan and Nova Scotia, became an American citizen in 1997 and was made an officer in the Order of Canada the same year. He reflected on his life as a dual citizen in a 2003 memoir, “Looking for My Country: Finding Myself in America.”

His wife, Donna MacNeil, died in 2015 . His first marriage, to Rosemarie Coopland, ended in divorce, as did his second marriage, to Jane Doherty.

He is survived by two children from his first marriage, Ian MacNeil, a theatrical set designer who won a Tony in 2009 for his work on the musical “Billy Elliott,” and Cathy MacNeil; two children from his second marriage, Alison and Will MacNeil; and five grandchildren.

After retiring from the daily newscast, Mr. MacNeil continued to work with PBS, including hosting the “America at a Crossroads” series of documentaries in 2007, which examined the nation’s challenges in the post-9/11 world. With Mr. Lehrer, his close friend, he remained a partner in MacNeil/Lehrer Productions, which produced their newscast until 2014, when WETA, the Washington, D.C., public media station where the “NewsHour” is based, assumed ownership. Mr. Lehrer died in 2020 at 85.

Mr. MacNeil found himself at the center of controversy in 2011 when, returning to “NewsHour” for a six-part series on autism, he featured the story of his grandson Nick. He was criticized for allowing his daughter Alison to question whether her son’s autism was linked to vaccines. (He did qualify her comments by noting that “public health authorities say there is no scientifically valid evidence that vaccines cause autism.”)

Mr. MacNeil chaired the board of the MacDowell Colony (now known as MacDowell), the retreat for artists, writers and musicians in Peterborough, N.H., from 1993 to 2010. After leaving the “NewsHour,” he returned to his first love, writing. He was the author of “The People Machine” (1968), about the relationship between television and politics; three memoirs; and four novels — “Burden of Desire” (1992), “The Voyage” (1995), “Breaking News” (1998) and “Portrait of Julia” (2013).

He was a co-author of “The Story of English,” a companion volume to the 1986 BBC-PBS television series that he hosted, and he wrote its 2005 sequel, “Do You Speak American?”

Mr. MacNeil remained proud of his early evening newscast. In interviews for the Archive of American Television in 2000 and 2001, he was asked how he wanted to be remembered.

“Television has changed journalism, utterly, not just for television, but for print and everybody else,” he said. “It’s changed the whole culture and ethos of journalism. And to have been able hold the line — perhaps Canute-like — against a tide that’s going to engulf us all in the end, for a few years, has been a source of gratification to me.”

Sofia Poznansky contributed reporting

Language selection

- Français fr

Summary of the Corporate Business Plan

The Summary of the Corporate Business Plan provides an overview of the CRA 's objectives, strategies, performance expectations and financial projections.

The report is available in HTML format, or in a print-ready .pdf version by selecting the links below:

2023–24 to 2025–26

- Summary of the Corporate Business Plan 2023–24 with perspectives to 2025–26 (HTML)

- Summary of the Corporate Business Plan 2023–24 with perspectives to 2025–26 (PDF 1.27 MB)

2022–23 to 2024–25

- Summary of the Corporate Business Plan 2022–23 with perspectives to 2024–25 (HTML)

- Summary of the Corporate Business Plan 2022–23 with perspectives to 2024–25 (PDF 942 KB)

2021–22 to 2023–24

- Summary of the Corporate Business Plan 2021–22 with perspectives to 2023–24 (HTML)

- Summary of the Corporate Business Plan 2021–22 with perspectives to 2023–24 (PDF 727 KB)

2020–21 to 2022–23

- Summary of the Corporate Business Plan 2020–21 with perspectives to 2022–23 (HTML)

- Summary of the Corporate Business Plan 2020–21 with perspectives to 2022–23 (PDF 1.5 MB)

2019-2020 to 2021-2022

- Summary of the Corporate Business Plan 2019-2020 with perspectives to 2021-2022 (HTML)

- Summary of the Corporate Business Plan 2019-2020 with perspectives to 2021-2022 (PDF 2.1 MB)

2018-2019 to 2020-2021

- Summary of the Corporate Business Plan 2018-2019 to 2020-2021 (HTML)

- Summary of the Corporate Business Plan 2018-2019 to 2020-2021 (PDF – 1.98 MB)

2017-2018 to 2019-2020

- Summary of the Corporate Business Plan 2017-2018 to 2019-2020 (HTML)

- Summary of the Corporate Business Plan 2017-2018 to 2019-2020 (PDF – 2.02 MB)

If you require prior year reports from 1999-2000 to 2001-2002 and 2016-2017 to 2018-2019, they are provided as a downloadable PDF file. Please send an email to the Service, Innovation and Integration Branch.

Page details

Trudeau announces AI spending plan to bolster Canadian infrastructure, computing capacity and safety

The federal government will spend $2.4-billion to bolster access to critical artificial intelligence infrastructure, build domestic computing capacity and create safeguards against the potential downsides of AI technology, Prime Minister Justin Trudeau announced on Sunday.

The reveal was the latest in a series of near-daily pre-budget announcements, in which the government has been unveiling its spending plans ahead of the release of the full federal budget on April 16.

Canada is home to world-leading AI researchers, but in recent years the country has fallen behind in providing the infrastructure needed for the growing field, particularly the advanced computer chips crucial for building and running AI models. The shift has led many to call for more government intervention.

Although Mr. Trudeau offered few details at his announcement, which he made during a news conference in Montreal, many in the industry celebrated the promised investment. Others said past experience with government spending announcements had left them skeptical of Ottawa ’s ability to execute on the new promises.

Money to build and make accessible more computing power will make up the most significant portion of the new spending.

In a news release, the government said $2-billion will be shared between two new initiatives. One of them, an AI Compute Access Fund, is intended to give “near-term support” to the industry and researchers. The government provided no further details, but one way of providing this support could be by facilitating access to computing power from foreign tech giants. The other initiative, a Canadian AI Sovereign Compute Strategy, is intended to speed up the development of Canadian-owned and located AI infrastructure.

“Access to computational power and capital are two of the largest barriers to developing new AI models or applications,” Mr. Trudeau said.

The government did not specify how much of the $2-billion would go to access and how much would go to building domestic computing power.

A Finance Department official told The Globe and Mail the money would be spent over five years, and that more details would be released in the budget next week. The Globe is not identifying the official because they were not permitted to discuss detailed spending plans.

Mr. Trudeau’s announcement on AI spending follows more than a week of other funding announcements in areas including child care and housing, totalling tens of billions of dollars in new federal loans and spending. Until the budget is released next week, it will remain unclear how the new spending will affect the federal government’s bottom line.

Without accounting for the new spending announced so far, last year’s budget projected that the federal deficit for 2024-25 would be $35-billion. At his news conference, Mr. Trudeau was asked about his government’s spending and about Conservative Leader Pierre Poilievre’s call for the government to find a dollar of cuts for every new dollar spent.

“We’re investing responsibly,” Mr. Trudeau said, adding in French that “a confident country invests in itself, invests in its citizens, and that’s exactly what we’re doing today.”

The government’s news release said it will also spend $200-million to help accelerate AI adoption in critical sectors and help startups bring new AI technologies to market. Another $100-million will help small and medium-sized businesses scale up and increase productivity through AI, the government said, while an additional $50-million will provide new skills training for workers displaced by AI.

A further $50-million will create a new Canadian AI Safety Institute, and $5.1-million will be set aside for the enforcement of the Artificial Intelligence and Data Act, legislation aimed at regulating AI that was tabled in 2022 and has not yet passed the House of Commons.