Strategies To Increase Your Commercial Bank Sales & Profitability

By henry sheykin, resources on commercial bank.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

Introduction

Welcome to this blog post on strategies to increase your commercial bank sales and profitability. In an increasingly competitive market, it is vital for banks to adopt effective strategies that can drive growth and improve the bottom line. According to the latest statistical information, the commercial banking industry is experiencing steady growth, making it an opportune time to implement innovative approaches. In this article, we will explore some of the most impactful strategies that will help you boost sales and enhance profitability in your commercial banking operations. So, let’s delve into the details and uncover the strategies that can propel your bank to new heights.

Target Niche Markets

When it comes to increasing sales and profitability for your commercial bank, one strategy that can have a significant impact is targeting niche markets. Rather than trying to serve a broad customer base, focusing on specific customer segments allows you to tailor your products and services to meet their unique needs and preferences.

Tips and Tricks:

- Conduct market research to identify niche markets that are underserved or have specific banking needs.

- Develop customized products and services that cater to the requirements of your target niche markets.

- Invest in targeted marketing campaigns to reach and attract customers from these niche markets.

- Build partnerships and collaborations with organizations or influencers that have a strong presence in your target niche markets.

This strategic approach can have a significant impact on your sales and profitability. By focusing on niche markets, you position your bank as a specialized provider that understands and meets the unique needs of your target customers. This can result in higher customer satisfaction and loyalty, leading to increased sales and profitability.

For example, let's consider targeting the niche market of small business owners in the fashion industry. By understanding the specific financial challenges and requirements of fashion entrepreneurs, you can develop tailored banking solutions such as specialized business loans or cash flow management tools. By positioning your bank as the go-to financial partner for fashion businesses, you can attract a loyal customer base and increase sales.

Example Calculation:

Assume that by targeting the niche market of small business owners in the fashion industry, you are able to acquire 500 new customers within the first year, each with an average annual revenue of $100,000. If you offer a comprehensive range of banking solutions that generate an average fee income of 1% of their revenue, your projected additional fee income would be:

Total Additional Fee Income = 500 customers x $100,000 x 1% = $500,000 per year

This additional fee income directly contributes to the profitability of your bank and demonstrates the financial impact of successfully targeting niche markets.

Establish Strategic Partnerships

Strategic partnerships play a crucial role in the success of businesses, especially in the competitive commercial banking industry. By collaborating with complementary companies or organizations, Luminous Bank can unlock new opportunities, enhance its offerings, and ultimately drive sales and profitability. Here are some tips and tricks to establish effective strategic partnerships:

- Identify Mutual Benefits: Before approaching potential partners, it is essential to identify the mutual benefits that can be gained from the collaboration. Consider how partnering with another organization can enhance Luminous Bank's product offerings, reach a wider customer base, or improve operational efficiencies.

- Research and Select Criteria: Conduct thorough research to identify potential partners that align with Luminous Bank's goals and values. Consider factors such as their reputation, expertise, customer base, and existing partnerships. Establish clear criteria for selecting partners to ensure compatibility and maximize the chances of success.

- Nurture Relationships: Building and nurturing relationships with potential partners is crucial in establishing strong strategic partnerships. Initiate conversations, attend industry events, and leverage networking opportunities to create meaningful connections. Demonstrate the value that Luminous Bank can bring to the partnership and showcase how collaboration can benefit both parties.

- Create Win-Win Agreements: When structuring partnership agreements, it is important to create win-win scenarios. Clearly define mutual goals, expectations, and responsibilities. Consider factors such as revenue sharing, resource allocation, and decision-making processes. The agreement should reflect the shared vision and ensure that both parties benefit from the partnership.

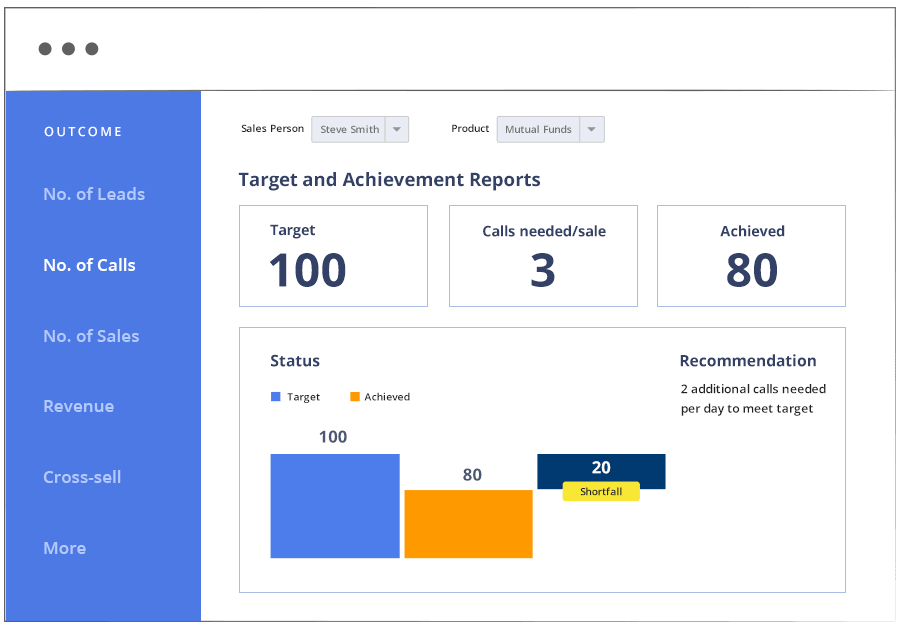

- Measure and Adapt: Once strategic partnerships are established, it is vital to continuously monitor and evaluate their impact on sales and profits. Establish key performance indicators (KPIs) and regularly assess the effectiveness of the collaboration. Adjust strategies and tactics as needed to optimize results and capitalize on new opportunities.

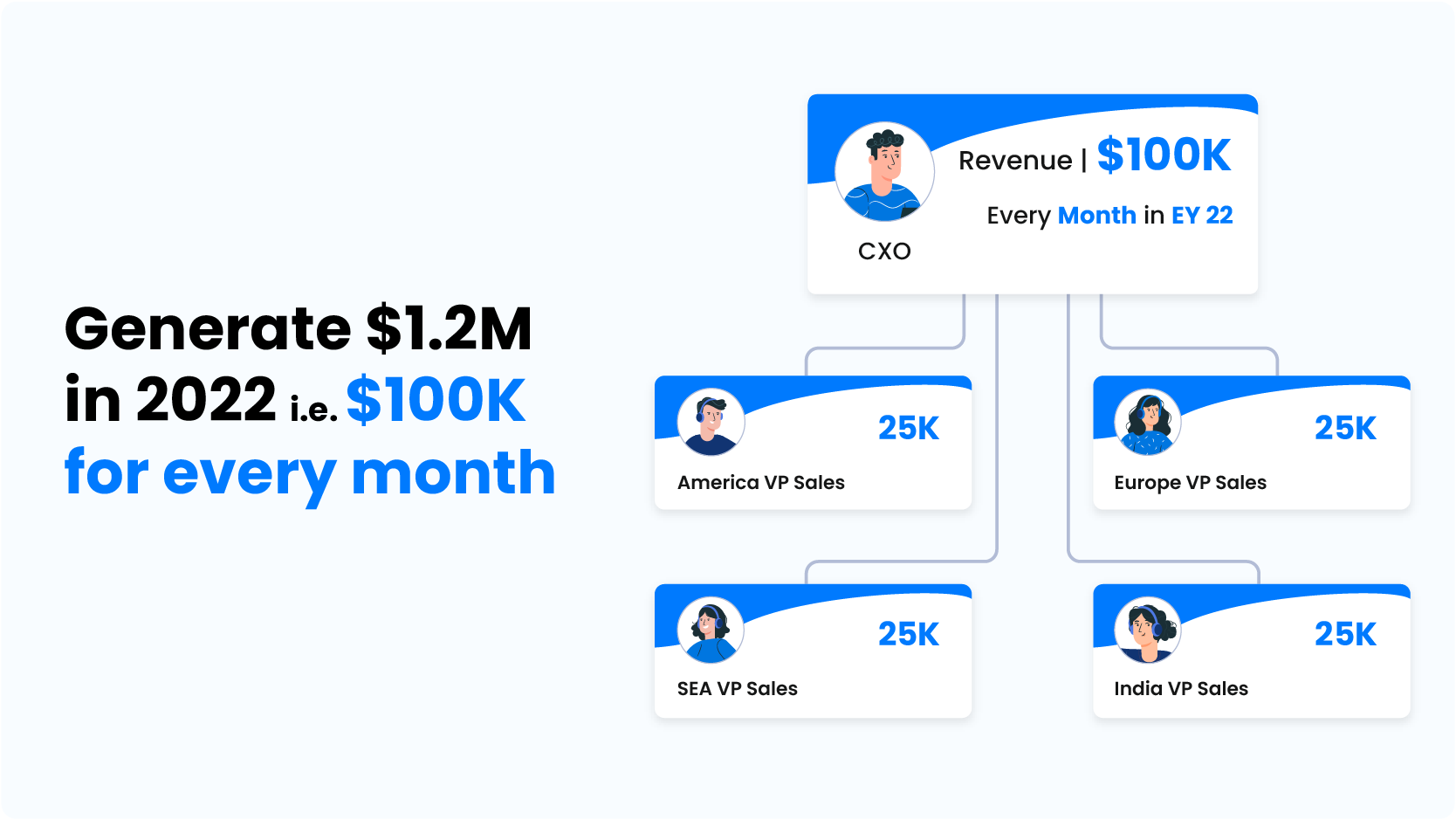

By establishing strategic partnerships, Luminous Bank can leverage the strengths and resources of its partners to enhance its product offerings, expand its customer base, and drive sales and profitability. Let's consider an example calculation to illustrate the potential impact:

Assuming Luminous Bank partners with a fintech company specializing in digital payment solutions, the collaboration can enable the bank to offer innovative payment methods to its customers. Let's say this partnership results in attracting an additional 10,000 customers in the first year, each having an average transaction volume of $1,000 per month. This would result in an additional $120 million in transaction volumes annually.

Considering a conservative transaction fee of 1% charged by Luminous Bank, the partnership could generate an estimated $1.2 million in additional transaction fee revenue per year. Moreover, the enhanced customer experience and expanded offerings may lead to increased customer loyalty and cross-selling opportunities, further boosting overall sales and profitability.

In conclusion, establishing strategic partnerships can significantly impact Luminous Bank's sales and profitability by expanding its offerings, reaching a broader customer base, and unlocking new revenue streams. By following the tips and tricks mentioned above, Luminous Bank can foster successful collaborations that pave the way for sustainable growth and success in the commercial banking industry.

Enhance customer experience

In today's competitive banking industry, providing an exceptional customer experience is crucial to the success and profitability of any bank, including Luminous Bank. By focusing on enhancing the customer experience, we can build long-term relationships, drive customer loyalty, and ultimately increase sales and profits.

- Personalized services: Offering personalized services tailored to the unique needs of our customers is a key strategy to enhance their experience. By understanding their financial goals and preferences, we can provide tailored solutions that meet their specific needs. This can include personalized investment advice, customized loan options, or targeted promotions based on their transaction history.

- Convenience: Providing convenience through various channels is another important aspect of enhancing the customer experience. This includes offering flexible banking hours, convenient branch locations, user-friendly online and mobile banking platforms, and quick and efficient customer service. By making banking easy and accessible, we can attract and retain customers.

- Security: Ensuring the security of our customers' financial information and transactions is paramount. Implementing robust security measures, such as multi-factor authentication, encryption, and fraud detection systems, will create a sense of trust and confidence among our customers.

- Continuous improvement: Regularly seeking customer feedback and actively engaging with our customers will enable us to identify areas for improvement and implement necessary changes. By continuously enhancing our products, services, and processes based on customer input, we can stay ahead of the competition and better meet the needs of our customers.

The strategy of enhancing the customer experience will have a direct impact on sales and profitability for Luminous Bank. By providing personalized services, convenience, and security, we will not only attract new customers but also retain existing ones, thereby increasing customer loyalty and satisfaction. Satisfied customers are more likely to utilize additional banking services, such as loans, credit cards, and investments, leading to increased revenue and profitability.

To illustrate the impact, let's consider the example calculation:

Suppose Luminous Bank successfully enhances its customer experience, resulting in a 10% increase in customer retention rate and a 15% increase in customer referrals. If the average customer brings in $1,000 in annual profit for the bank, and there are 10,000 customers, the calculation would be as follows:

Current annual profit: $1,000/customer x 10,000 customers = $10,000,000

Improved annual profit with enhanced customer experience:

New customer retention rate: 10% increase = 10000 customers x 10% = 1000 additional retained customers

New customer referrals: 15% increase = 10000 customers x 15% = 1500 additional referred customers

Total additional customers: 1000 + 1500 = 2500

Improved annual profit: ($1,000 x 2500) + $10,000,000 = $12,500,000

This calculation demonstrates that by enhancing the customer experience and increasing customer retention and referrals, Luminous Bank can achieve an increase in annual profit from $10,000,000 to $12,500,000.

Offer competitive interest rates

One effective strategy to increase sales and profitability for Luminous Bank is to offer competitive interest rates on our financial products, particularly on our savings accounts and loans. By providing rates that are higher than those offered by our competitors, we can attract more customers and encourage existing ones to choose us over other banks.

Impact on sales: When customers see that Luminous Bank offers higher interest rates on their savings accounts, they will be more inclined to deposit their money with us. This can lead to an increase in the number of account holders and subsequently, a rise in sales. Moreover, by offering better rates on loans, we can attract customers who are looking for affordable financing options. This can result in a boost in loan applications and approvals.

Impact on profitability: While offering competitive interest rates may seem like we are giving away profits, it actually has the potential to enhance our profitability in the long run. By attracting a larger customer base, we can increase the amount of funds held at Luminous Bank, allowing us to generate more interest income. Additionally, loan interest charges can contribute to our revenue stream. It's important, however, to carefully manage the balance between offering competitive rates and ensuring our profitability isn't compromised.

Example calculation:

- Assuming a savings account balance of $10,000

- Competitor A offers an interest rate of 0.5%

- Competitor B offers an interest rate of 0.75%

- Luminous Bank offers an interest rate of 1%

In this scenario, if a customer chooses Luminous Bank over competitors A and B, they would earn $100 in interest over a year, compared to $50 with competitor A and $75 with competitor B. This example illustrates the potential benefit of our competitive interest rates.

By strategically implementing competitive interest rates, Luminous Bank can attract more customers, increase sales, and ultimately drive profitability. By offering rates that outshine our competitors, we position ourselves as an attractive banking option for individuals and businesses, ensuring long-term growth and success for our venture.

Implement effective marketing campaigns

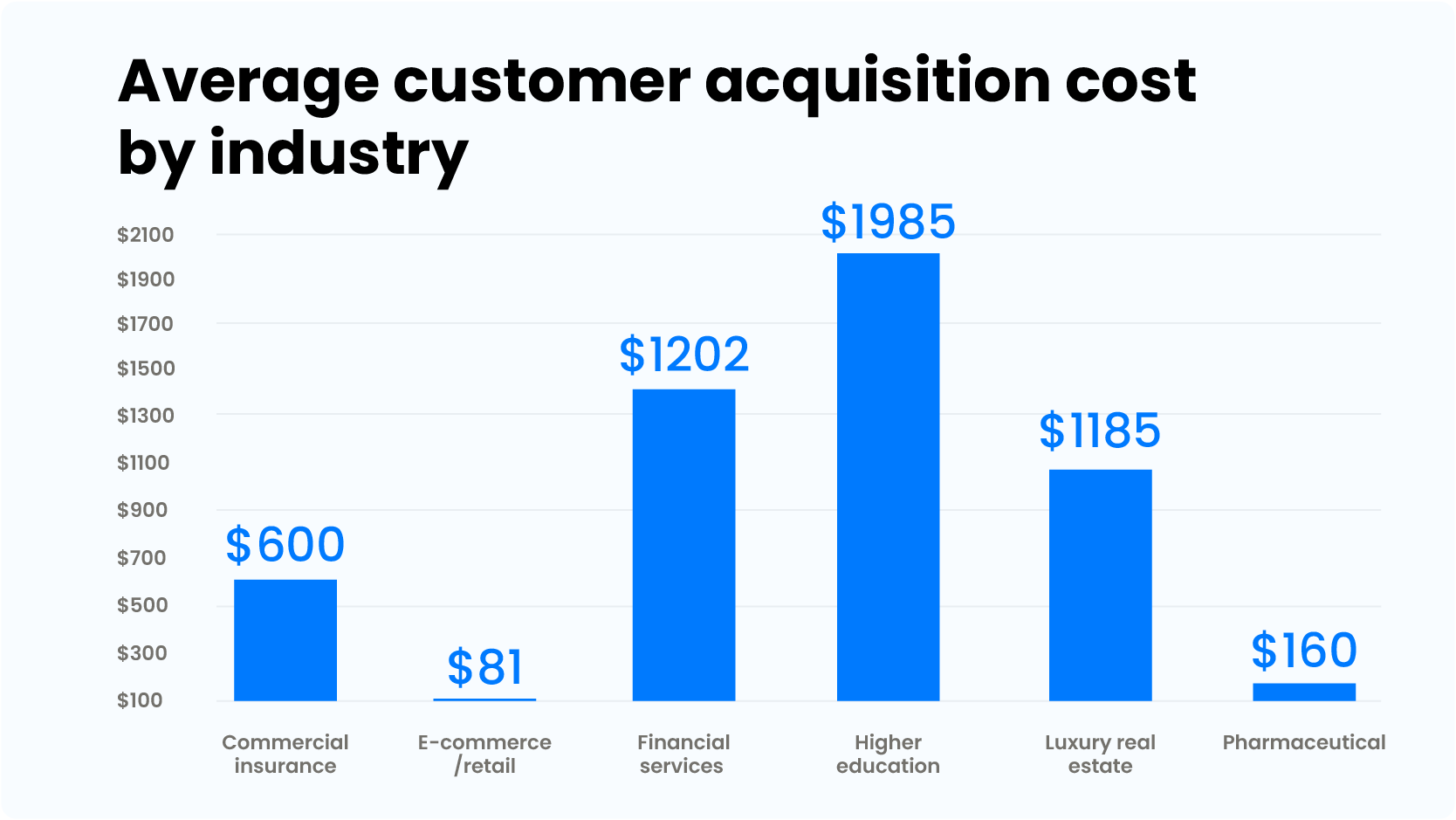

When it comes to increasing commercial bank sales and profitability, implementing effective marketing campaigns is crucial. Such campaigns not only help raise awareness about the bank's products and services, but they also drive customer acquisition and retention.

Here are some tips and tricks to make your marketing campaigns successful:

- Define your target audience: Before launching any campaign, it's essential to identify your target audience. Understanding the demographics, behaviors, and preferences of your potential customers will help tailor your marketing messages and strategies accordingly.

- Create compelling content: Engage your audience with well-crafted content that highlights the unique features and benefits of your bank's products and services. Use persuasive language and storytelling techniques to capture their attention and convince them to choose your bank over competitors.

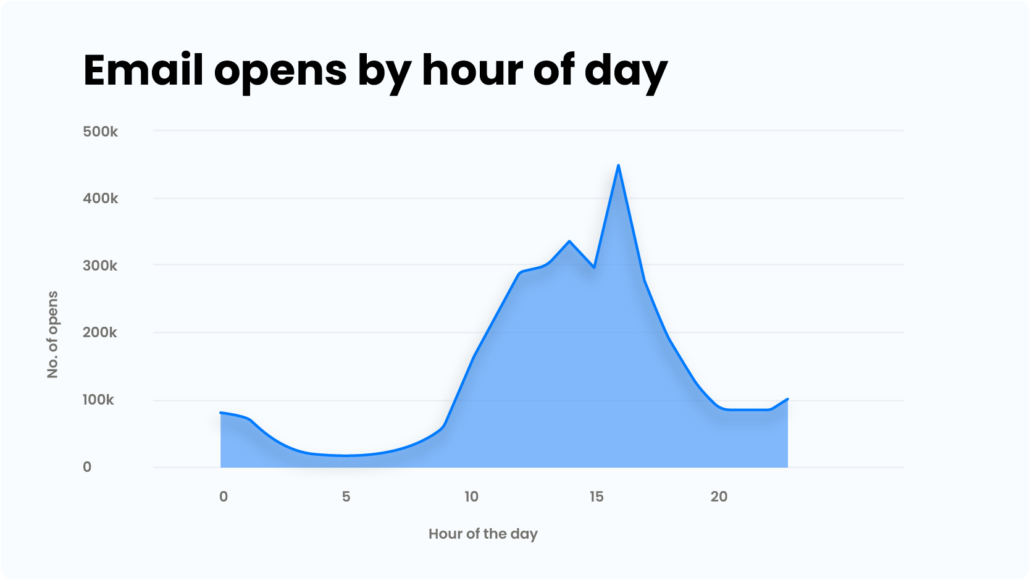

- Utilize various marketing channels: Don't limit yourself to a single marketing channel. In today's digital era, it's important to have a multi-channel approach. Explore online platforms such as social media, email marketing, search engine optimization, and content marketing to reach a wider audience and maximize your campaign's impact.

- Personalize your marketing: Tailor your marketing messages to resonate with different segments of your target audience. Utilize customer data to personalize your communication, offers, and promotions. This personalized approach enhances the customer experience and increases the chances of conversion.

- Measure and analyze campaign performance: Implement tracking mechanisms to measure the effectiveness of your marketing campaigns. Monitor key performance indicators such as click-through rates, conversion rates, and customer acquisition costs. This data will provide valuable insights into what's working and what needs improvement, enabling you to optimize your strategies accordingly.

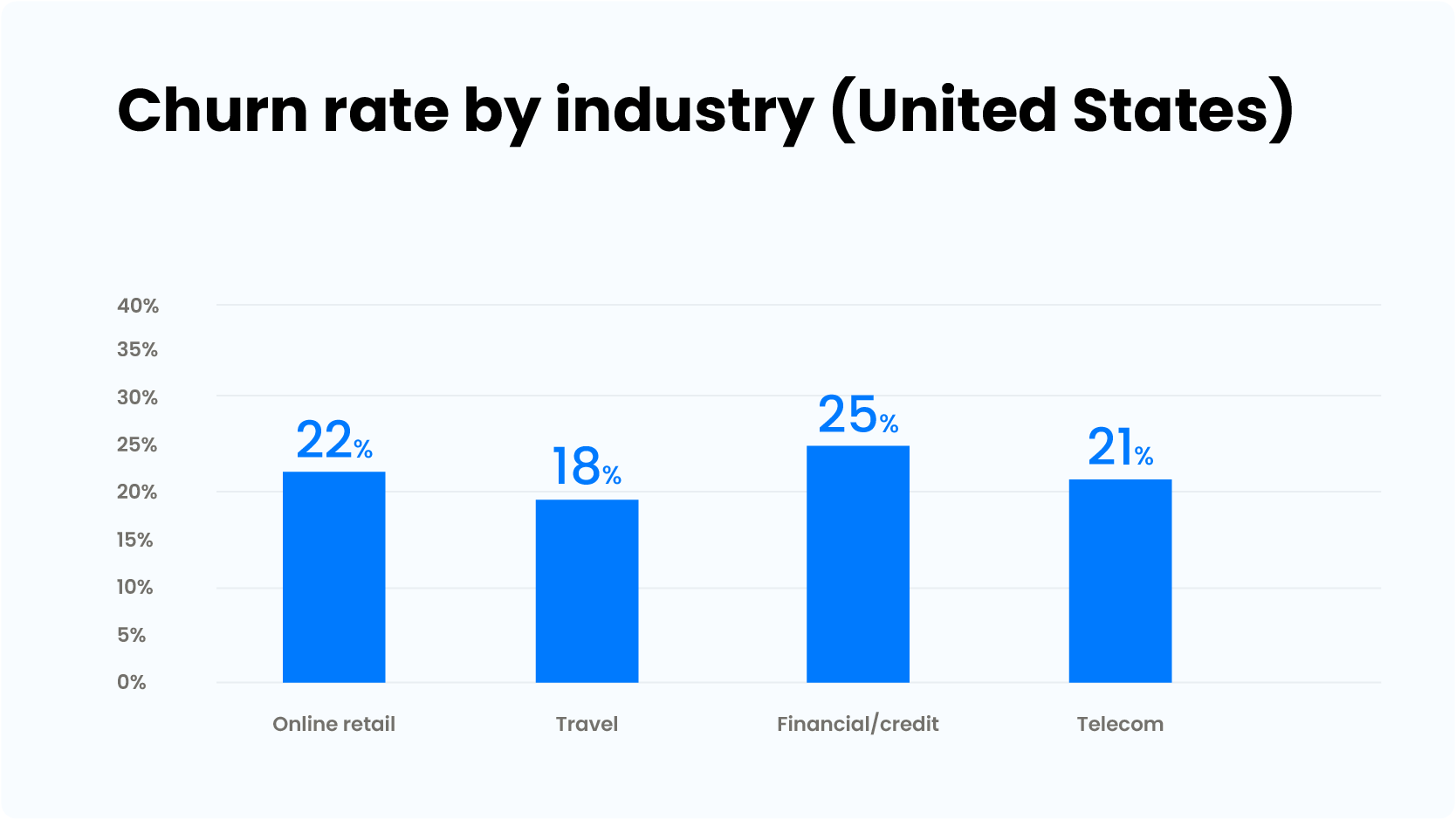

Implementing effective marketing campaigns has a significant impact on both sales and profitability. A well-executed campaign can lead to increased brand visibility, customer engagement, and ultimately, higher sales volumes. Additionally, it can drive customer loyalty and retention, reducing customer churn and increasing profitability through repeated business and cross-selling opportunities.

Let's take a hypothetical example to demonstrate the impact of a marketing campaign on sales and profits. Suppose Luminous Bank decides to launch a targeted social media campaign to promote its latest credit card offering. The campaign costs $50,000 and reaches a potential audience of 500,000 individuals. Due to the campaign's compelling messaging and personalized approach, 5% of the targeted audience converts and becomes new credit cardholders.

Considering an average annual spend of $5,000 per credit cardholder, the campaign successfully acquires 25,000 new customers. If the annual fee for the credit card is $50 and the variable costs per customer are $20, the bank would generate $1,250,000 in annual revenue ($50 x 25,000). Deducting the variable costs, the bank would still have a profit contribution of $750,000 ($30 x 25,000).

This example illustrates how an effective marketing campaign can lead to substantial sales growth and profitability, making it a crucial strategy for commercial banks seeking sustainable success.

Expand digital banking platforms

In today's rapidly advancing technological landscape, it is imperative for commercial banks to expand their digital banking platforms. With the increasing demand for convenience and accessibility, a robust online and mobile banking presence can significantly impact sales and profits.

Tips and tricks:

- Emphasize user-friendly interfaces: Ensure that the digital banking platforms are intuitive, easy to navigate, and provide a seamless user experience. Customers should be able to perform various banking tasks effortlessly, such as checking account balances, transferring funds, and making payments.

- Offer comprehensive features: Extend a wide range of features through the digital platforms to cater to diverse customer needs. Enable customers to open accounts, apply for loans, manage investments, and access financial advisory services online. This comprehensive approach enhances customer satisfaction and engagement.

- Implement strong security measures: Address customer concerns regarding data security by implementing stringent security protocols. Utilize encryption technologies, multi-factor authentication, and regular security audits to protect customer information and prevent unauthorized access.

- Personalize the digital experience: Leverage artificial intelligence and data analytics to offer personalized recommendations and tailored financial solutions. By understanding customer preferences and behavior, banks can enhance cross-selling opportunities and foster long-term relationships.

- Stay ahead with innovation: Continuously invest in research and development to remain at the forefront of technological advancements. Explore emerging trends such as voice-assisted banking, biometric authentication, and blockchain-based solutions to provide cutting-edge services and maintain a competitive edge.

Impact on sales and profits:

By expanding digital banking platforms, commercial banks can reach a broader customer base and cater to their evolving needs. Offering convenient and accessible banking services increases customer acquisition and retention rates. As customers choose digital channels for their financial transactions, it reduces the operational costs associated with maintaining physical branches. This cost reduction directly contributes to improved profitability.

Assume that a bank currently has 100,000 customers and expands its digital banking platforms, resulting in a 20% increase in customer acquisition and a 10% decrease in branch-related expenses. If the bank's average annual revenue per customer is $500, the impact on sales and profits can be calculated as follows:

Impact on sales:

Additional customers acquired = 100,000 * 0.20 = 20,000

Additional revenue from new customers = 20,000 * $500 = $10,000,000

Impact on profits:

Branch-related expense reduction = 10% of current expenses

Total cost reduction = Current branch-related expenses * 0.10

Additional profit = Total cost reduction

Adding this additional revenue and profit to the bank's financial projections will contribute to its overall growth and drive towards profitability.

Provide personalized financial solutions

At Luminous Bank, we understand the importance of providing personalized financial solutions to our clients. It is crucial to tailor our products and services to meet the unique needs and goals of each individual and business.

Here are some tips and tricks to effectively provide personalized financial solutions:

- 1. Understand the customer: Take the time to get to know your customers on a deeper level. Conduct thorough consultations, ask relevant questions, and actively listen to their needs and concerns. This will enable you to understand their financial situation, goals, and preferences.

- 2. Offer customized products and services: Based on the information gathered, tailor your offerings to match the specific requirements of each client. This could involve recommending suitable savings accounts, loan options, investment tools, or financial advisory services.

- 3. Provide expert guidance: Educate your clients about various financial options and guide them towards the best decisions for their circumstances. Be proactive in offering advice and updates that align with their financial goals.

- 4. Regularly review and reassess: Financial needs and circumstances can change over time. Regularly check in with your clients to ensure their financial solutions remain relevant and provide ongoing support and recommendations.

Implementing a strategy to provide personalized financial solutions has a significant impact on sales and profits. When clients feel understood and supported, they are more likely to remain loyal and entrust their financial needs to your bank. This can lead to increased customer retention, referrals, and ultimately, higher sales.

Additionally, personalized financial solutions create opportunities for cross-selling and up-selling of relevant products and services. By consistently meeting the individual needs of your clients, you can potentially increase their engagement and the revenue generated from their accounts.

For example: Let's consider a client who initially opens a basic savings account with Luminous Bank. As the client's financial situation evolves, a personalized financial solution may involve offering them investment options tailored to their risk tolerance and long-term goals. This not only increases the client's satisfaction but also leads to potential fees generated from managing their investments.

In conclusion, prioritizing personalized financial solutions is crucial for driving sales and profitability. By understanding and catering to the unique needs of your clients, you can establish strong relationships, increase customer loyalty, and generate revenue through enhanced product offerings.

Streamline Operational Processes

Streamlining operational processes is a vital strategy for improving sales and profitability in a commercial bank. By optimizing the efficiency and effectiveness of day-to-day operations, banks can reduce costs, enhance customer experience, and ultimately drive revenue growth.

- Automate Manual Tasks: Embracing automation technologies can significantly streamline operational processes. Tasks such as data entry, document verification, and transaction processing can be automated, minimizing errors and speeding up turnaround time.

- Implement Robust Workflow Systems: A well-designed workflow system ensures seamless communication and coordination between different departments. It enables smooth handoffs and eliminates bottlenecks, leading to faster and more efficient operations.

- Centralize Data Management: Inefficient data handling can hinder operational processes. By centralizing data management in a secure and accessible system, bank employees can retrieve and process information quickly, enabling faster decision-making and smoother transactions.

- Standardize Processes: Standardizing processes across branches and departments enhances consistency and reduces errors. Clear guidelines and protocols should be established, ensuring that tasks are performed in a uniform manner, regardless of the location or team involved.

- Invest in Training and Development: Well-trained employees are crucial for efficient operations. Providing regular training sessions and upskilling opportunities equips staff with the necessary knowledge and skills to perform tasks effectively and independently.

- Monitor and Analyze Performance: Continuous monitoring and analysis of operational performance enable the identification of bottlenecks, inefficiencies, and areas for improvement. By leveraging data analytics, banks can make data-driven decisions to refine processes and maximize productivity.

Streamlining operational processes impacts sales and profitability in several ways. Firstly, it reduces the time taken to complete tasks, allowing employees to focus on revenue-generating activities such as client acquisition and relationship management.

Moreover, streamlined processes enhance customer experience. Swift and error-free transactions increase customer satisfaction, fostering loyalty and potential referrals. A seamless operational experience also minimizes the risk of customer attrition, further bolstering sales and profitability.

Let's consider an example calculation to demonstrate the potential impact of streamlining operational processes:

Assume a commercial bank currently spends an average of 5 minutes on manual data entry for each customer transaction. With 10,000 transactions per month, this results in 50,000 minutes (or 833.33 hours) spent on data entry alone.

By implementing an automated system that reduces data entry time to just 1 minute per transaction, the bank can save 40,000 minutes (or 666.67 hours) per month. This time can then be reallocated to revenue-generating activities, resulting in increased sales and profitability.

Focus on customer retention and loyalty

In today's competitive banking industry, it is essential for Luminous Bank to focus on customer retention and loyalty. By implementing effective strategies to keep our existing customers satisfied and engaged, we can not only strengthen our relationships but also increase our sales and profitability.

Tips and tricks for customer retention:

- Provide exceptional customer service: Ensuring that our customers receive top-notch service at every touchpoint is crucial. This includes prompt responses to queries, personalized interactions, and proactive communication.

- Offer loyalty programs: Implementing a well-designed loyalty program can incentivize customers to continue using our services and remain loyal. Rewarding them for their continued business with exclusive benefits and discounts can create a sense of exclusivity and enhance their loyalty.

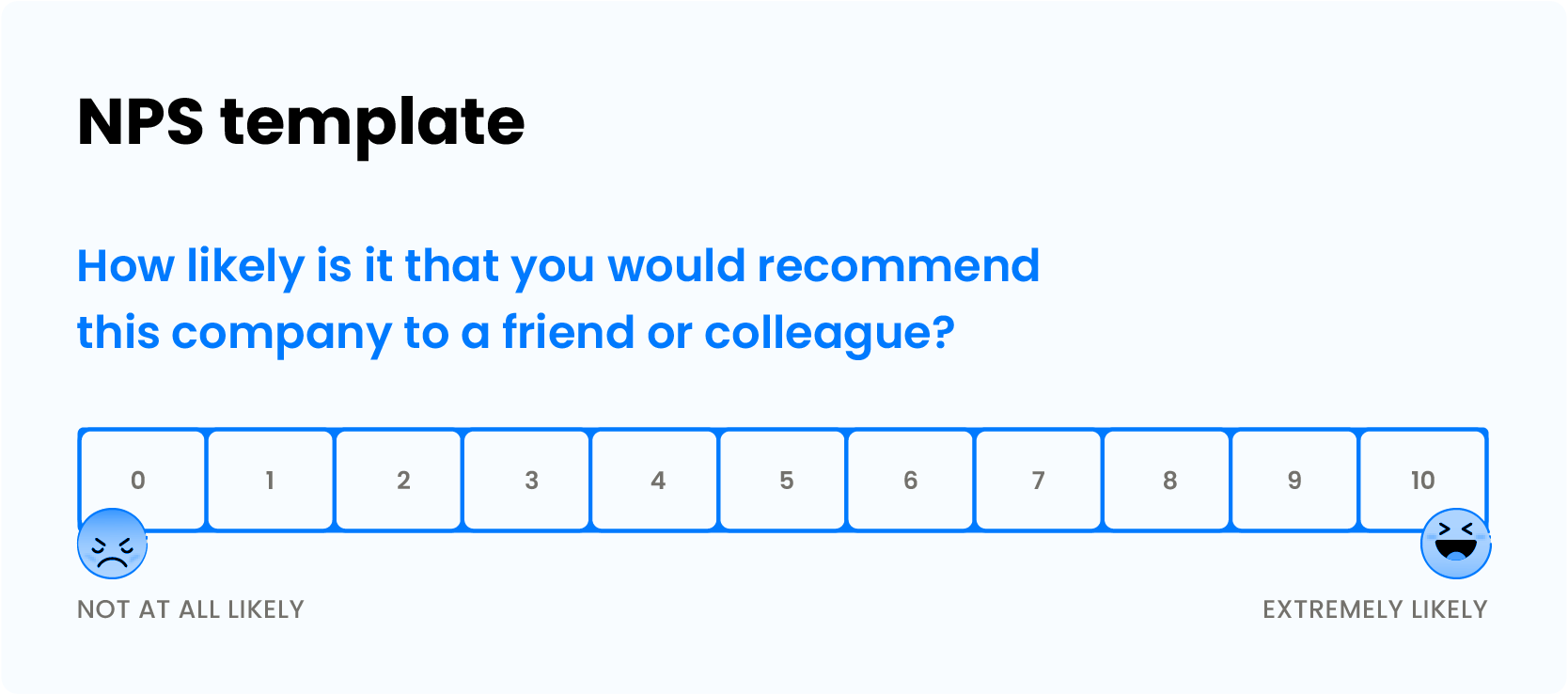

- Regularly solicit feedback: By actively seeking feedback from our customers, we can understand their needs and preferences better. This feedback can drive improvements to our products and services, making them more aligned with customer expectations.

- Provide tailored solutions: Understanding our customers' financial goals and offering personalized solutions can significantly enhance their satisfaction. By utilizing data analytics and customer profiling, we can anticipate their needs and tailor our offerings accordingly.

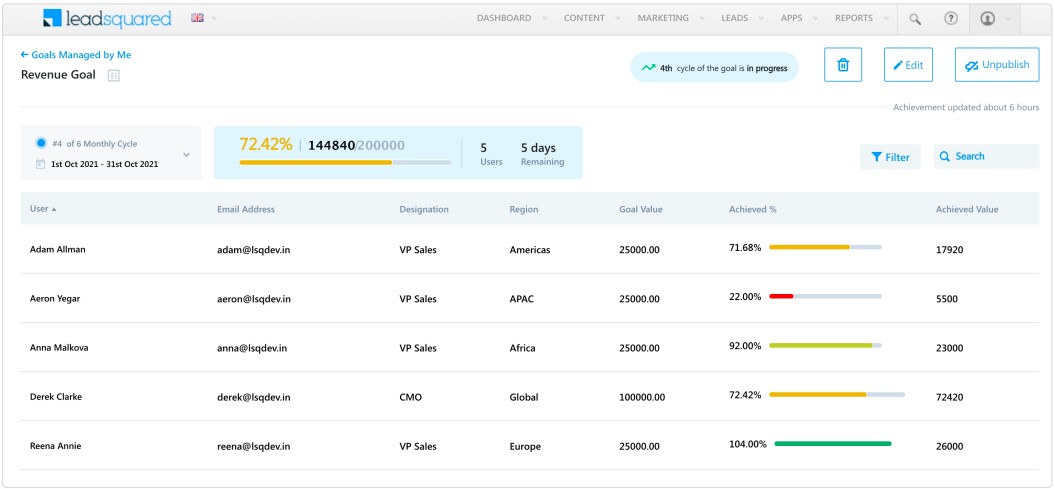

Investing in customer retention and loyalty can have a profound impact on our sales and profitability. Here's an example calculation to illustrate this:

Let's assume that acquiring a new customer costs $200, including marketing expenses and onboarding costs. On the other hand, retaining an existing customer costs only $50, considering ongoing relationship management activities.

If we aim to acquire 100 new customers and have 500 existing customers, the cost of acquiring new customers would amount to $20,000, while retaining existing customers would only cost $25,000.

Now, let's consider the average revenue generated per customer. Assuming each customer contributes $500 in revenue annually, the 100 new customers would generate $50,000 in revenue, while the 500 existing customers would contribute $250,000 in revenue.

By focusing on customer retention, we can save significant costs and generate a higher revenue per customer. This ultimately leads to increased sales and profitability.

In order to enhance commercial bank sales and profitability, it is essential to implement effective strategies. By leveraging technology, embracing customer-centric approaches, and optimizing cross-selling opportunities, banks can significantly improve their performance. Investing in digital solutions can result in a 20% increase in sales, while personalized customer experiences can help generate 5-8 times higher revenue. Furthermore, a strong focus on cross-selling can lead to a 20-30% uptick in profitability. By adopting these key strategies, commercial banks can achieve sustainable growth and drive long-term success in a highly competitive industry.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Rising Capital

- Valuing a Business

- Writing Business Plan

- Buy a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

9 Banking Sales Strategies to Increase Profits

To succeed in banking, it’s crucial to have a strong sales strategy in place. Sales strategies are how a bank can increase its profits by acquiring new customers and growing business from current customers.

Here are nine banking sales strategies that can help your business grow.

1. Develop a Banking Niche

Focus on a specific banking niche and develop sales strategies specifically for that market. This could be businesses in a specific industry, individuals with certain professions, or customers with particular financial needs.

By understanding the needs of your target market, you can better tailor your products and services to them, making it more likely that they’ll do business with you.

2. Sell Banking Products and Services Online

In today’s digital world, it’s essential to have an online presence where potential customers can learn about your products and services. Many people research banking options online before deciding, so your bank must be visible in this space. You can sell banking products and services directly on your website or through online marketplaces.

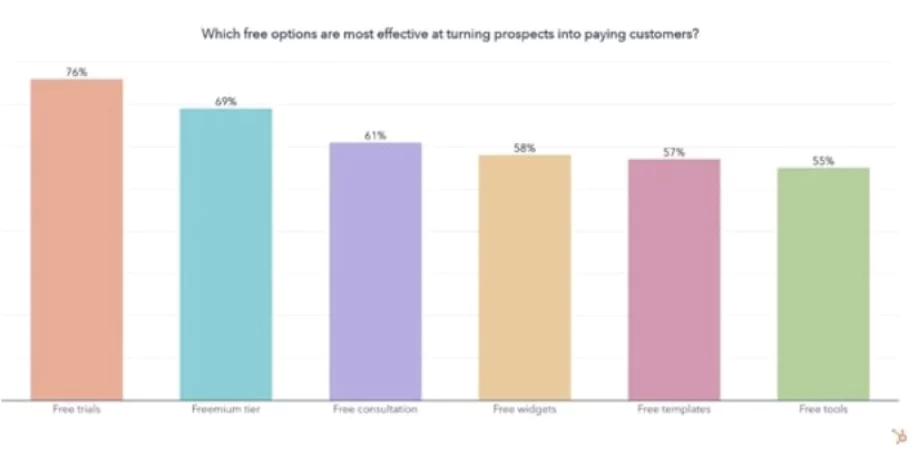

3. Offer Free Banking Consultations

Offer potential customers a free consultation to discuss their banking needs. This is a great way to build trust and rapport with potential customers. During the consultation, you can get to know their needs better and identify their pain points with their current banking situation. You can then offer solutions that address their specific needs.

4. Use Banking Software to Automate Processes

Use banking software to automate repetitive tasks like customer onboarding or loan processing. This will free up your time to focus on selling and acquiring new customers. Automation can also help improve the accuracy of your banking records and make it easier to track sales metrics.

5. Provide Personalized Banking Services

Take the time to get to know your customers on a personal level. This could involve taking them out for coffee, getting lunch together, or simply conversing about their lives outside of banking. Building relationships with your customers will make them more likely to do business with you and recommend you to others.

6. Offer Unique Banking Products and Services

Stand out from the competition by offering unique banking products and services that cater to your target market’s needs. This could include special financing for businesses in a certain industry, custom debit cards, or exclusive access to certain banking products. By offering something that other banks don’t, you’ll make it more likely that customers will choose to do business with you.

7. Invest in Banking Technology

Stay ahead of the curve by investing in cutting-edge banking technology. This could include mobile banking apps, contactless payment solutions, or artificial intelligence-powered customer service chatbots. By investing in new technologies, you’ll be able to offer a better experience to your customers and stay ahead of your competition.

8. Focus on Customer Retention

Acquiring new customers is important, but it’s also essential to focus on retaining your existing customer base. This can be done by providing exceptional customer service, offering loyalty rewards, and regularly running promotions. Keeping your current customers happy will make them more likely to do business with you in the future and refer new customers to you.

9. Promote Banking Products and Services through Social Media

Use social media to promote your banking products and services to a wider audience. This could involve creating informative blog posts, sharing helpful infographics, or running social media ads. You can also use social media to engage with potential customers and build relationships with them.

Increase Profits as a Bank

Following these banking sales strategies can increase your chances of acquiring new customers and boosting your bank’s profits. Keep in mind that building relationships with potential customers takes time, so stay focused on your goals and continue working hard to provide the best banking experience for your customers.

Other Helpful Articles

Banking Services to Offer Your Customers

- Team/Partners

- Differentiate

- Bank Merger Marketing

- System Conversion Communications

- Thought Leadership

- Blog + Insights

- Net Zero Now

- In the News

- Marketing Guides + Reports

- Videos + Best Practices

- Bank M&A Newsletters

- LET'S CONNECT

Featured Article

Enhance Your Bank's Sales and Marketing Initiatives: 5 Tips

Part three of a three part observation series

In my last post we examined a few ways that banks can elevate the role of data in their marketing programs to begin the process of gaining better alignment to overall strategy. This post will focus on the sales aspect of sales and marketing campaigns – what can be referred to the execution channel. But a word of caution: sales and sales people are no longer synonymous.

As with our data post , you will find five areas of focus for bank marketers to enhance sales activities. Since we emphasized the critical nature of list development driven by strategy, we would be remiss if we now veered back to traditional sales activities to execute the program. Modern marketing programs should create buyers - not just serve as a ‘warm lead sheet’ for field staff.

[5] Tips to Enhance Your Bank's Sales and Marketing Initiatives

1. assess your sales channel capabilities and capacity (honestly).

The pressures on marketers to maximize the opportunities for bank sales channels to deliver positive results are significant. Let’s face it, the number of internal business units lined up to leverage every possible sales channel within any given bank often requires an air traffic controller to manage. While we primarily think of bank sales channels as branches and business development officers – supported with direct mail, digital marketing or other messaging platforms - the increasing use of call centers and outsourcing firms are also gaining greater demand for their services.

As marketing investment returns continue to be heavily scrutinized, it is time to look at all of your sales channels and honestly assess both the capability and the capacity for all of them. Branches serve as an effective channel for many activities due to staffing models and periodic downtime to facilitate campaigns, but they shouldn’t be used to support every initiative – for a variety of reasons. Nor should a dedicated sales force be the only source through which a business unit should promote its offerings – it is more expensive and requires differentiated segment expertise to be effective.

Emerging technology has enabled greater levels of channel diversity to support a bank’s sales and marketing campaigns – knowing how effective and available these channels are should create a more dynamic set of "selling" tools for you to use that can better align with your target segments. Taking advantage of these channels allows you to push your sales messages out to the market with less conflict and noise.

As an aside, I recently read an interesting piece from the UK highlighting the preferences for SME’s for sales and service. No matter the geography, it is never a good idea to assume that you and your customers assign the same value to what your institution offers.

2. Measure the value of each channel in your omnichannel programs

Yes, I realize a key marketing buzzword had to make it into this post. While a daunting term, omnichannel ( click here to read a very academic definition of omnichannel if you are not already familiar with the topic) has become a marketing darling lately with the introduction of so many devices and access points for customers to interact with their financial institution. As one who is very interested in the topic of payments, I am sensitive to not only the advancement in device and technology capabilities but also the fluid nature of how the market finds new ways use them that may not have been intended by the provider or the bank.

It is a stretch to ask that a full blown omnichannel approach finds its way into every bank’s strategy - but the aspiration of the topic - and expectations of your target audience - cannot be ignored. At a minimum, begin to develop a digital strategy for your institution – starting with your web presence. If you can market an offer online, shouldn’t your customers be able to take advantage of the offer online? Seems pretty simple but those that have thought through and delivered on this alignment are differentiating themselves in the market, particularly with business segments. Maybe you don’t call it omnichannel – call it whatever you like – but you have to have a plan for it because at some level isn’t a branch just another device?

3. Invest (more) in sales and onboarding automation

Despite the title, many banks appear to be heading in two different directions with respect to technology investments to support sales activities. On one hand, the piggy bank has been smashed open to fund KYC/BSA/AML initiatives over the past five years. On the other, investments into leveraging that investment into a better customer experience seem rare, if not nonexistent.

It is fascinating that while blank checks have been written to support the ever changing world of compliance – believe me when I say that essentially no two banks have the same interpretation of the same commentary on the same day – banks don’t seem to realize that most of the current compliance language was written before any of the current technology existed and aren’t really consistent with today’s technological benefits.

Rather than succumbing to the ongoing maintenance of antiquated processes to address these compliance issues, why not look to leverage your bank’s investment into this robust set of tools to enhance your sales and onboarding process. There is no reason that I have read that you cannot undertake this effort - and the robust nature of these tools (such as real-time predictive transaction reporting and behavioral modeling) can truly differentiate your customer experience from the frustrating process it is for many today.

4. Stop just selling banking products...sell your brand

If there is one mantra that I have held close for years for bank marketing, it is this: stop just selling products! For most institutions, almost everything you offer is a commodity. While some may argue that their features and benefits or prices may be subtly different, you are still providing a highly commoditized set of financial products. But we all still do it, don’t we? Why? Primarily because focusing on products seems to work - with an emphasis on seems here. We outlined a number of data driven themes in our previous post which would on the surface seem to support more granular capability to target offers to prospects – all true.

I am not naïve thinking that this will change anytime soon. But what I do hope is that your selling efforts are able to transcend this. Focus on what your institution can offer that your competitors cannot – true competitive differentiation . Besides your location and name – apologies to all of the First Banks out there – what do you have that customers and prospects cannot get anywhere else? Most likely your answer is not much. Bank marketers don’t help matters by continually reinforcing messages that are based on features and benefits that customers can find anywhere (and expect) - starting with service.

Note: I have worked with both the largest banks in the U.S. and very small Credit Unions and truth be told, you can receive outstanding service from big banks and lousy service from small Credit Unions. There is no universal ownership of service culture in smaller institutions. Let’s take a page out of the consumer packaged goods playbook and start to sell your brand first; the products are a given.

5. Incent sales on more than widgets

The topic of incentive in sales has been long lamented and hashed and rehashed. We don’t mean to do it again on this post but it would be irresponsible to not highlight the recurring challenges for how sales is evaluated. As the final item to recommend for an honest assessment, it is past time to measure sales effectiveness - regardless of channel or channels used - based on widgets.

Every banker knows that the value of each customer is not the same, and multiple product relationships are certainly stickier than single relationships. So what is the value of an unutilized line of credit or a low transaction account that meets minimums and generates no fees? If you look at some of the scorecards we have seen over the years, you would think they are all worth the same. Not to mention, fully loaded some banks are paying out incentives for these dormant relationships because a widget is a widget. If you haven’t taken on this topic recently, please begin to do so. If you have invested in a strategy and chosen to align your data activities to that strategy, this should be fairly easy.

If you like selling stories, click here to read one of my favorites from a recent BKM prospect meeting.

Bank Marketing , Financial Marketing , Community Banks

YOU MIGHT ALSO LIKE

SUBMIT YOUR COMMENT

EXPERIENCE A DIFFERENT LEVEL OF PARTNERSHIP WITH SEASONED DIRECT MARKETING EXPERTS.

75 SGT. WILLIAM B. TERRY DRIVE SUITE 2035 HINGHAM MA 02043 781-741-8005 [email protected]

USEFUL LINKS

- Direct Marketing

- Let's Connect

BANK MERGERS & ACQUISITIONS

- PLANNING. STRATEGY. COMMUNICATION. INTEGRATION.

- BANK MERGER MARKETING by BKM

©2024. ALL RIGHTS RESERVED PRIVACY POLICY

- Magazine Archive

- Newsletter Archive

- Sponsored Archive

- Podcast Archive

- Commercial Lending

- Community Banking

- Compliance and Risk

- Cybersecurity

- Human Resources

- Mutual Funds

- Retail and Marketing

- Tax and Accounting

- Wealth Management

Successful Sales in Five Simple Steps

Let’s get the basics out of the way. Why does the staff at your bank need to be able to sell? It’s pretty simple. The majority of jobs in the financial industry require sales skills. The bad news is that there are a lot of financial institutions trying to sell, and if you are going to be successful, your bank needs to be at the top of that list.

But there is good news. Preparing your team for a successful sales call is simple—critical, but simple.

Pass along these steps to branch employees to use on every call, every time.

Step 1: Master your merchandise.

You are the expert on your products, services and solutions. Aren’t you? After all, clients come to your branch for more than the cookies and popcorn. Financial solutions can be scary to potential clients—don’t let clients smell fear on you. Before you sell anything, you need to know the benefits as well as the restrictions of every solution in your arsenal. Genuine confidence, the kind that closes the sale, can only come from a full understanding of your product or service. Anything less appears phony and that doubt will adversely affect either the client’s opinion of you, or your solution.

What tools are available to you? Make sure you know exactly what is written on any brochure or disclosure you will be sharing with your audience. If the client has a question about a product or service, who do you think they are going to ask? So, attend product trainings, stay current on changes and updates, work with your teammates and your marketing departments to ensure you are the expert you need to be.

Step 2: Aim directly for the audience.

For some banks, this one should be easy. Financial institutions with rural branches, for example, have the advantage of employing local salespeople. Then the challenge is simply to recognize the opportunity to engage a potential client.

Imagine this: you are in line at the grocery store picking up a few things for dinner. You recognize the gentleman who is trying to pay for his groceries in front of you—of course you do—your kids have gone to school together for years. He is struggling to use the point-of-sale terminal—certainly either the card or the terminal is not working properly. Do you hear the terminal beeping at him? That is opportunity knocking. You spring into action, “Hi Sam, looks like you are having some trouble with your card, you should come see me at ABC branch in the morning, I could get you set up with one of our accounts that comes with a reliable card and could probably even save you a few bucks in fees each month.” And, since you are on a roll, you say to the cashier, “Alicia, here is my business card, why don’t you have Ellen (the store manager that you used to cut grass for in high school) give me a call, we offer a very competitive merchant service and we can set you up with a terminal that won’t give you so much trouble.”

If you don’t know a lot about this potential client (or customer who does not use the branch), review the information available to you, from every resource. No doubt, your financial institution has invested significantly in tools and systems to capture everything you need to know about this customer. This is why!

For larger banks and larger communities, you may have to take other steps to learn about your current customers. What stage of life are they in? What assets and tools do they have to work with? What problems are you helping clients solve? How is that problem impacting their lives or something they care about? What are their priorities?

Step 3: Know your show.

Planning your approach is key to a smooth sale.

You knew Sam would welcome a solution to his frustrations with his debit card at the grocery store. You know he has a busy schedule would appreciate something reliable. Your quick solution presentation was exactly what he would want to hear. Straight to the point and of course, it never hurts to remind a busy father of exactly where to find you.

You also know that the same short and sweet approach would not have been impactful with the new business owner you met at the PTA meeting last night. He will be looking to set up a line of credit for working capital. Now that you know the details of your small business lending suite, ask for the meeting.

Knowing what you are going to say and why makes the difference between an uncomfortable sales call, and a successful solution presentation. What key points do you need the client to hear about the solution? About your institution? What points will matter to him/her? What questions do you anticipate he/she will have? And as you are the expert, make sure you also think about and prepare the answers to those questions.

Step 4: Look the part.

This seems like an obvious one, but take the time to apply what you know about your audience.

Will you be presenting your solution in a business meeting? Then suit up. Will you be discussing the solution in a barn? Then boots it is. Even conducting your meeting over the phone, you should have an appropriate greeting and a smile on your face. Always be the professional, there is no need for slang, dust off your manners, put your phone away, and give the potential client your full attention.

Yes , you talked to Sam at the grocery store while you had on your coat and boots, but when he comes to your office, he will need to see a confident, well put together, reliable professional. You are a direct reflection of your solution. He expects nothing less, don’t disappoint.

Step 5: Rewind, review and follow through.

Okay, so you helped Sam with a new account and debit card. You were even able to get the grocery store to sign up for your merchant service (good ol’ Ellen). Now what? How do you get good at selling? How do you form successful sales habits? By taking some time to mentally replay the meeting afterwards to identify what worked and what did not.

What went well? Did the audience respond well to a particular point? If so, write it down. Use it again. And again. Did you successfully squelch a potential objection? Nice job. How did you do it? How did your response mitigate the client’s concern?

What could have gone better? How better could you have responded or been prepared? Taking the time to formulate a better response will keep you from making the same mistakes next time. Turn this review into notes for next time. During your preparation for your next sale, review these notes. Really, do it. You will be glad you did.

One more critical item, the follow through: Don’t forget to follow up on any questions or promises you made during your conversations. Did the audience ask a question you didn’t have an answer for? Hopefully, you said that you would look into it and get back to him/her. So, do it. Do you owe the client an answer to something? Making sure you address any lingering questions or requests is key to solidifying the client’s trust in you and your solution.

Don’t get discouraged; it may take more than one follow-up call to make it happen. Be respectful but persistent.

Beth M. Miller has 12 years of experience in the financial industry, with a focus on employee and sales training, product and project management. She has also worked with a variety of relationship management systems and client needs and satisfaction surveys. LinkedIn .

Collaborating on this article was The Verdi Group, creator of the Needs to Leads program that helps financial institutions engage their customers and increase relationship depth.

Related Posts

CFPB warns against deceptive marketing in remittance transfer services

Remittance transfer providers may be held liable for deceptive marketing if they misrepresent to consumers the speed and cost of...

The Points Guy says no thanks to the Credit Card Competition Act

‘Would you like to spend every single time you make a purchase begging to do it on the network that...

The roles of the branch: Why design, placement and merchandising are critical to branch success

Banks can maximize every aspect of the site, and every floor and wall surface of the building, including signage, for...

Marketing Money Podcast: Public speaking mastery, prep, delivery and impactful slides

Bank marketers who speak before audiences know the value of preparation, with some tips about how effective slides are always...

Integrating sales and marketing to optimize core deposit growth

Successful approaches leverage all bank marketing, sales, service and distribution capabilities to focus resources on high priority opportunities.

Marketing Money Podcast: The hurdles of bank marketing

The value of sponsorships and how community involvement works best when it is aligned with business goals.

Federal court pauses CRA rule implementation following ABA lawsuit

Proposed changes delayed to national flood insurance program renewal policies, aba op-ed: banks could also be the benefactors of cfpb’s data sharing plan, aba data bank: recession risks decline as inflation continues to moderate, personal income increased in february, recent news from treasury’s office of foreign assets control: march 28, sponsored content.

The Federal Reserve’s Nick Stanescu shares what’s next for the FedNow® Service

AI Compliance and Regulation: What Financial Institutions Need to Know

Gain Efficiencies and Other Timely Benefits with Data Analytics

The Impact of AI-Generated Synthetic Fraud on Finance

American Bankers Association 1333 New Hampshire Ave NW Washington, DC 20036 1-800-BANKERS (800-226-5377) www.aba.com About ABA Contact ABA

About ABA Banking Journal Privacy Policy Advertising Subscribe

© 2024 American Bankers Association. All rights reserved.

- Change of Address

- Back Issues

Current Issue

1st Quarter 2024

- Online Training Series

- Board Performance Survey

- Exclusive Content

- Board Structure Guidelines

- Glossary of Terms

- New Director Onboarding

- Continuing Education

- Director Certification Application

- Advisory Services

- In-Person Events

- Webinars & Online

- Past In-Person Events

- Past Webinars & Online

- Compensation

- Partner With Us

- Join Our Team

Login to Bank Services

Enter your email address and password below to gain access.

How to Create a Sales Culture and Process at Your Bank

Brought to you by ignite sales.

SHARE THIS ARTICLE

But times are changing. Customers are taking greater control of their banking relationships. They are switching banks, changing their behavior and demanding improvements. Faced with unprecedented competition from non-banking competitors, new regulations that limit their ability to generate fee income, and shrinking net interest income, banks are challenged to find new sources of revenue if they want to grow.

Outside the banking industry, at the core of any growing company is its ability to connect, nurture and satisfy customers. Although customer service is engrained into the banking culture, a sales culture is not. It is the combination of the proper sales culture, sales skill sets and sales enablement tools that are largely missing from retail banks.

Banks have been focused for several years on cost-cutting measures such as reducing headcount and offshoring, which has been good from an expense standpoint. But in order to grow, they must implement a measureable sales process once and for all.

Take these steps to get the process started:

- Focus on the buying process at the point of sale. When the first account is opened, it often falls far short of revenue potential. Most business customers are eligible for up to seven income generating products, however only one is typically sold at the initial point of sale. Once this happens, the opportunity for additional sales is lost indefinitely. The best opportunity to sell add-ons is immediate.

- Think about merchandising. Merchandising is the cornerstone of a best-practice sales process. Retail banking is the only industry known as retail that doesn’t also have merchandisers. Merchandising is simply presenting the right product, to the right customer, at the right time—this is done best at the point-of-sale when customers are already inclined to purchase.

- Make all channels equal. Whether the customer is online using a computer or mobile device, on the phone with a customer service representative or in the branch, the customer experience should be the same. Based on their needs, the advice and products offered to them should be consistent in all channels.

- Automate product recommendations. With more than 100 retail banking products on average at their disposal, is it reasonable to expect employees to understand them all in detail? By using a digital playbook, your bank’s representatives can interact with the customer via automated, guided selling. This enables them to automatically find the best products for the customer and engage them in a consultative manner. Guided selling also takes away the complexity of learning every product detail and ever changing regulations so that customer service representatives can focus on engaging customers and developing long-term relationships.

- Empower employees to create customer loyalty. Give your branch and customer service employees the framework, the tools and the flexibility to use their creativity to provide exceptional customer service.

- Enact measurement tools. Unless you have in place the sales analytics tools for measuring performance, there is no way to know if you are meeting your objectives. Use sales analytics to track recommendations and openings to ensure your investments are paying off.

- Create in-the-moment feedback mechanisms. You can’t expect improvement from employees if you haven’t let them know how they are progressing. Don’t wait for review time for your staff to provide feedback. Ensure feedback is being provided on the spot. That way, proper action can be taken to improve performance.

- Coach them. Without making anyone feel inferior, develop your low performing employees in the branch and call center by coaching them on tried and true tactics used by the higher performing members of the team. Identify and incorporate those tactics and strategies into your digital playbook to ensure you are winning customers.

In retail banks, most sales organizations are underdeveloped. There are few processes in place and as result, fewer measurement tools to make sales accountable. Banks need to implement proven sales processes, use technology to help merchandise income-generating products, and apply both consistently to drive successful sales outcomes.

And last, but not least, the most successful sales programs are spearheaded, promoted or at the very least, approved and supported by the CEO. Sales cannot be successful if the CEO is not on board.

Mitchell Orlowsky

Increasing Efficiencies

How to improve bank branch performance & streamline branch operations processes.

The last two years have called for undeniable change in the financial industry. They’ve called for forced branch closures, highlighted the importance of contact centers, and accelerated adoption of digital channels. They’ve shined a spotlight on the need for banks and credit unions to have technology in place that will improve branch performance so they can offer the service their accountholders deserve.

By improving branch performance, you can be there for your accountholders where they need you to be – whether that’s at the branch, on the phone, or through a digital channel. After all, branch support doesn’t stop at the branch doors.

To streamline your branch operations and enhance accountholder service through the speed, accuracy, and convenience that comes with automation, start by:

- Improving staff mobility and accountholder convenience.

- Empowering contact center agents to provide high quality service.

- Optimizing your core and complementary solutions to enhance accountholder service, convenience, and loyalty.

Improve Staff Mobility & Accountholder Convenience

“In an industry built on having human connection at branches, the coronavirus pandemic has and will continue to change the way [people] interact with their bank or credit union,” said Connie Hancock, Technical Product Manager at Jack Henry SM . By offering branch employees a modern mobile application that has seamless integrations to multiple back-end systems, they’ll be able to offer the technology, speed, and convenience accountholders have become accustomed to in their everyday lives – during and even before the pandemic.

What if you or your employees could walk up to a branch visitor and help them open an account using a tablet? Or meet them down the street to discuss a home or business loan? (With a connection to your core system in hand.) How much easier would it be for your employees? How much more convenient would it be for your customers and members?

When your employees can support sales and operational processes from anywhere with real-time accountholder information at their fingertips in the branch or remotely, these digitally empowered employees can respond to requests in a more personable way – taking the conversation to the branch lobby, to a coffee shop, or over a Zoom call. “Having the ability to engage with the [accountholder] from anywhere inside or outside the branch and build those relationships makes doing business more efficient and appealing.”

How to improve bank branch performance using this? Look for a solution that improves the mobility of your staff, allowing for personal service at the moment of need.

Empower Contact Center Agents to Provide High Quality Service

As its adoption and usage continues to grow in popularity, digital bankin g has become the new lobby. Banks and credit unions are fast-tracking transformation efforts and increasing investments in digital experience enhancements with a strong focus on service and engagement – looking for the optimal balance between self-service automation and high-touch personal service when and where the accountholder needs it. And where they need it is everywhere: a consumer expectations survey published found that when it comes to user engagement, 82% of consumers reach out by phone (making it crucial for banks and credit unions to offer live phone support even outside of regular business hours), 62% contact via email, and 43% use live chat.

As the role of traditional banks and credit unions continue to evolve, improving digital agility and maintaining your ability to create authentic connections will require improved integration of contact center and branch channels with a holistic digital-first strategy. That’s why you’ll see traditional call centers evolving into true contact centers – with banks and credit unions upskilling their agents and empowering them with the tools they need (quick and easy access to information, single logins, and authentication – to name a few) to improve the service they deliver.

How to improve bank branch performance using this? Be proactive when it comes to accountholder engagement by implement ing solutions with deep digital capabilities, covering channels like phone support, online and mobile, and live chat.

Optimize Your Technology Platform to Enhance Accountholder Service, Convenience & Loyalty

Your core platform is the heart of your service, innovation, efficiency, and future. And when paired with automated, accountholder- and employee-friendly complementary solutions like payments and lending, it stands to be the difference between accountholders who leave and ones who stay for life. Because at the end of the day, when branches offer automated solutions for repetitive processes, there’s more time for financial counseling, relationship development, and learning about real accountholder needs.

All systems require some type of regular investment, and this is particularly true for your core. Whether you’re on a cloud-based platform or in-house, it’s important to stay up to date. Things are changing at a hurried pace in the industry and it’s paramount that you stay at the forefront. To maximize your most significant investment, regularly review it, keep it clean, keep it in the know, and keep it up to date.

How to improve bank branch performance using this? Make sure your core processes are functioning at their optimum levels to best support your accountholders and your employees. Consider partnering with a consulting service that knows your core and can help you increase its efficiency, implement automation, and assist with planning, design, or re-engineering of your banking processes.

Why Streamlining Branch Operations Processes Is Key

When it comes to streamlining branch operations and improving branch performance, the right technology in the hands of your branch employees can provide more than automated workflows and processes. Without multiple logins, lengthy information searches, or being confined to a desk, tellers and advisors can offer faster service – creating a more satisfying experience for everyone involved.

Related Tags

Related content.

6 Questions to Consider When Performing a Data Conversion

6 Tips For Planning Stress Free Data Conversions

Subscribe to our blog.

Stay up to date with the latest people-inspired innovation at Jack Henry.

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

- Credit Unions

- De Novo Banks

How We Help

- Empower Accountholder Financial Health

- Attract and Grow Commercial Accountholders

- Operate More Efficiently

- Overcome Revenue Challenges

- Reduce Risk and Fraud

- Improve the Accountholder Experience

What We Offer

- Digital Banking

- Information Security & Technology

- Financial Crimes & Fraud Risk

- Commercial Banking

- Customer & Member Relationships

- Financial Health Solutions

- Investor Relations

- Resource Hub

- For Developers

- For Designers

- For Vendors

- Manage Subscriptions

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Training and Development

- Beginner Guides

Blog Training and Development

What is an Action Plan & How to Write One [With Examples]

By Danesh Ramuthi , Oct 26, 2023

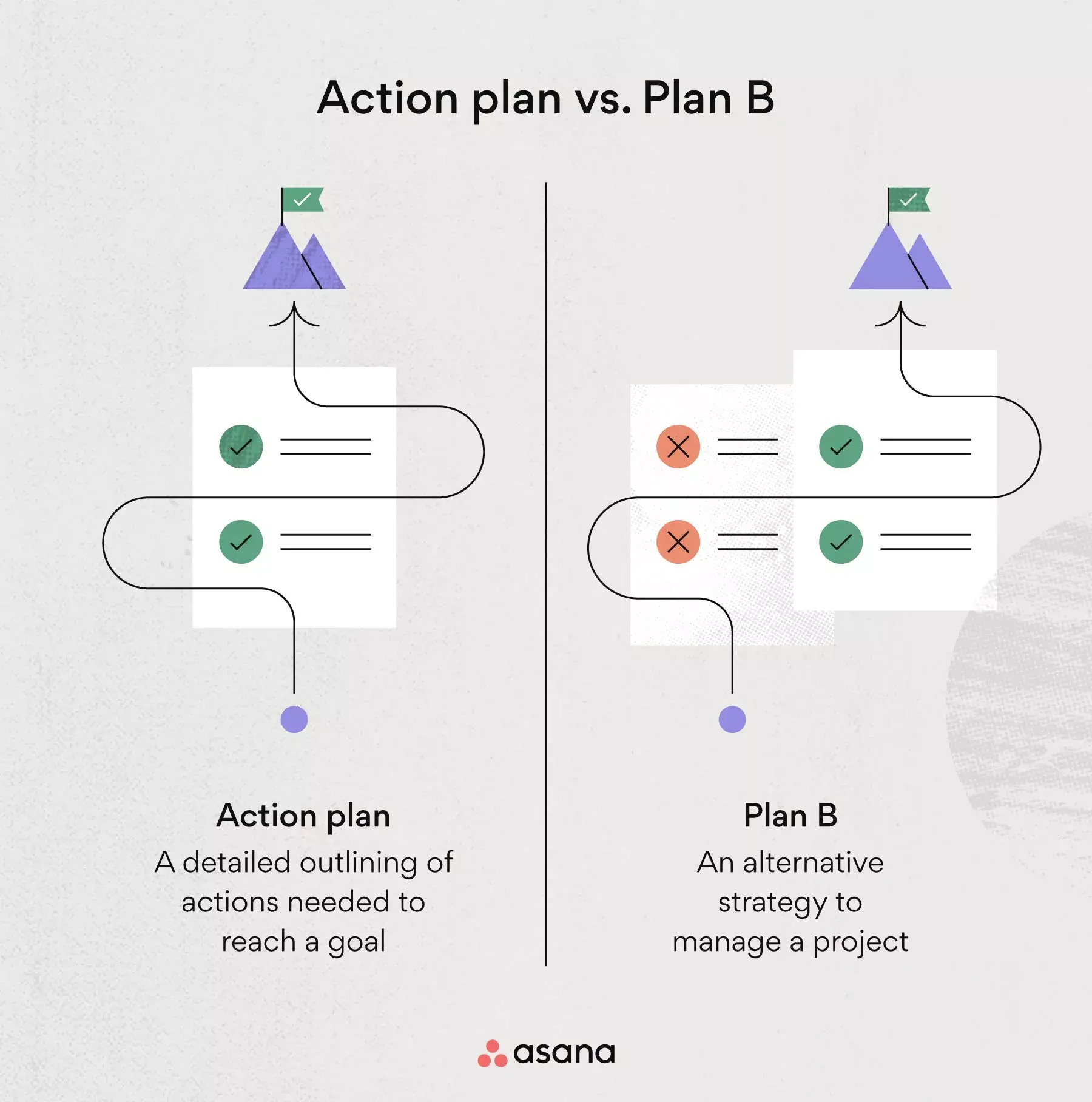

An action plan is a meticulously structured strategy that pinpoints specific steps, tasks and resources vital to turning a goal into reality. It is extremely useful in any project management.

Crafting an action plan is like plotting a route for a cross-country journey. It’s the strategic map that outlines every step, decision and pitstop needed to reach your ultimate destination.

With a well-thought-out action plan, you’re not just shooting in the dark; you’re making informed, purposeful strides towards your goals. Dive deep with our guide and witness real-world examples that will inspire and guide you.

Need a tool to kickstart your planning? Try out the Venngage business plan maker and explore their extensive collection of action plan templates .

Click to jump ahead:

What is the purpose of an action plan?

When to develop an action plan, 7 components of a actions plan, 15 action plan examples.

- How to Write an action plan?

Final thoughts

An action plan serves as a strategic tool designed to outline specific steps, tasks and goals necessary to achieve a particular objective.

Its primary purpose is to provide a clear roadmap and direction for individuals, teams or organizations to follow in order to efficiently and effectively accomplish their goals.

Action plans break down complex projects into manageable, actionable components, making it easier to track progress and stay on course.

Moreover, action plans play a crucial role in fostering accountability and coordination among team members. By assigning responsibilities and deadlines for each task or milestone, they ensure that everyone involved is aware of their roles and the overall timeline, reducing confusion and enhancing teamwork.

Additionally, action plans help in resource allocation, budgeting and risk management by enabling stakeholders to identify potential challenges and plan for contingencies.

Overall, the purpose of an action plan is to transform abstract goals into concrete actions, making them more achievable and measurable while ensuring that the resources and efforts are aligned with the desired outcomes.

Developing an action plan is crucial when you’re looking to achieve a specific goal or outcome. Here are instances when you should consider developing an action plan:

- Start of an organization : Ideally, an action plan should be developed within the first six months to one year of the start of an organization. This initial plan lays the groundwork for the future direction and growth of the entity.

- Project initiation : At the start of any project, an action plan helps to clearly define the tasks, responsibilities, and timelines.

- Goal setting : Whenever you or your organization sets a new goal. Action plans transform these goals from abstract ideas into concrete steps.

- Strategic planning : For long-term visions and missions, action plans break down the journey into manageable pieces, each with its timeline and responsible parties.

- Performance improvement : If there are areas where performance is lacking, whether it’s personal or organizational, an action plan can outline the steps needed to elevate performance.

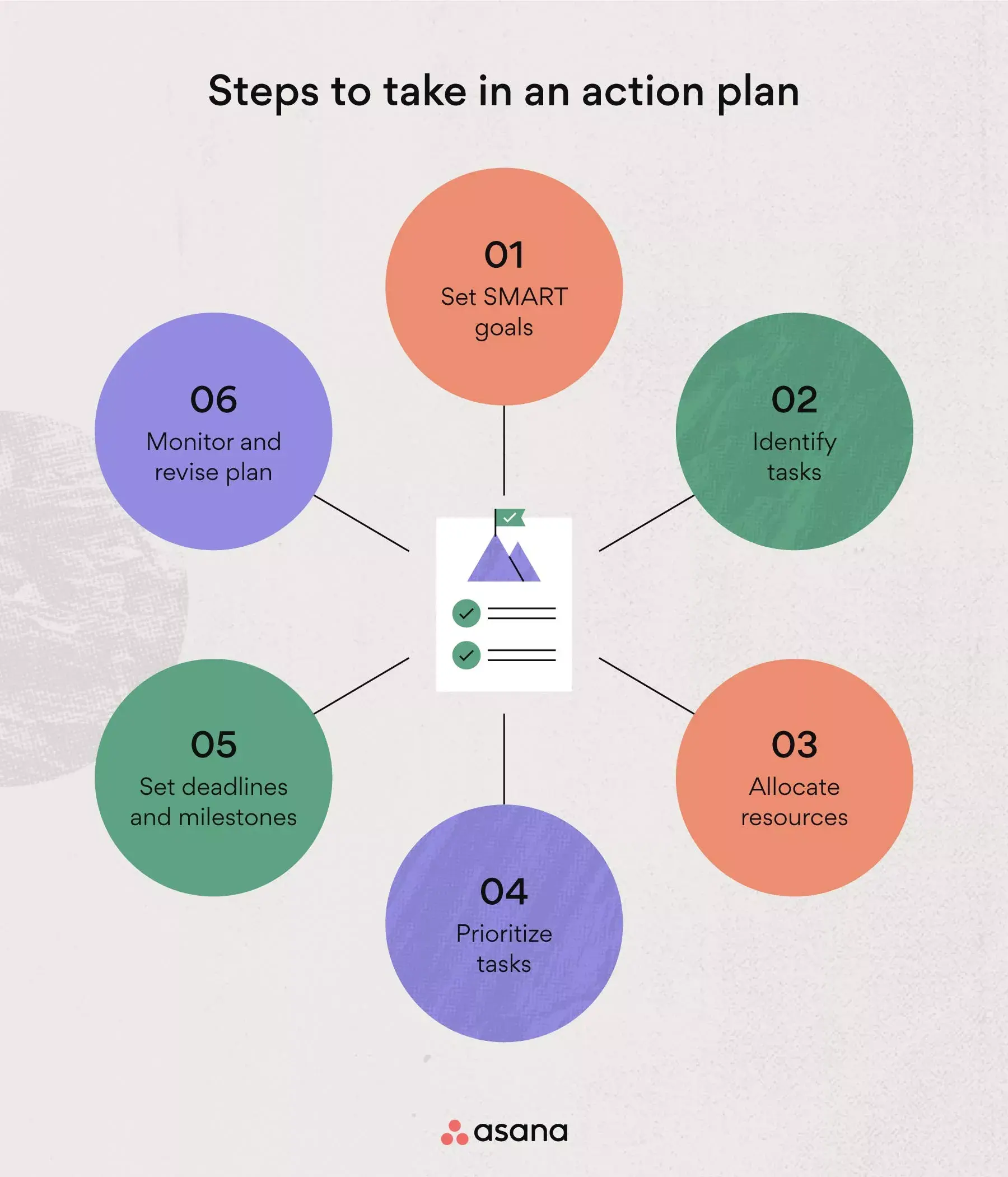

An action plan is a detailed outline that breaks down the steps necessary to achieve a specific goal. Here are the typical components of an action plan.

1. Objective or Goal

The cornerstone of your action plan is the objective or goal. This should be a clear and concise statement outlining the desired outcome or result. Having a well-defined objective provides a direction and purpose to the entire plan, ensuring all tasks and actions are aligned towards achieving this singular aim.

2. Tasks or Actions

Once the objective is set, the next step is to list down the specific tasks or actions required to achieve this goal. These tasks should be broken down into detailed steps, ensuring no essential activity is overlooked. The granularity of these tasks can vary based on the complexity of the goal.

3. Set deadline

For each task or action, set a realistic and achievable deadline. This timeline ensures that the plan stays on track and that momentum is maintained throughout the execution. It also allows for monitoring progress and identifying potential delays early.

4. Resources needed to complete the project

It’s crucial to recognize and list the resources you’ll need to complete the tasks. This can encompass financial resources, human resources, equipment, technological tools or any other assets. Identifying these early ensures that there are no bottlenecks during execution due to a lack of necessary resources.

5. Person responsible

Assign a person or a team for each task. This designation ensures accountability and clarity. When individuals are aware of their responsibilities, it reduces overlap, confusion and ensures that every task has someone overseeing its completion.

6. Potential barriers or challenges

Every plan will face challenges. By anticipating potential barriers or obstacles, you can be better prepared to address them. This proactive approach ensures smoother execution and less reactionary problem-solving.

7. Measurement of key performance indicators (KPIs)

Determine how you’ll measure the success of each task or the plan overall. KPIs are tangible metrics that allow you to gauge progress and determine whether you’re moving closer to your goals and objectives. They offer a quantifiable means to evaluate success.

Action plans serve as blueprints, guiding the steps and resources needed to achieve a specific goal.

They come in various formats, tailored to different scenarios and objectives. Here, we present a range of action plan examples that cater to diverse purposes and situations.

From business strategies to simple task lists, these examples illustrate the versatility and importance of well-structured planning.

Business action plan example

A business action plan is essentially a strategy roadmap, meticulously tailored for realizing broader business objectives. By crafting a solid action plan, businesses can channel their resources, manpower and strategies in a direction that harmonizes with their larger vision.

Key to this plan is the identification and alignment of steps that resonate with the company’s comprehensive strategy, ambitions of growth and aspirations for operational enhancements.

While this might entail a myriad of specific steps based on unique business goals, some common elements include setting clear key performance indicators (KPIs), undertaking a thorough SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to grasp the current business landscape and establishing a timeline to keep track of progress.

Furthermore, allocating responsibilities to team members or individuals ensures that every aspect of the strategy has a dedicated focus. Budgeting, essential to the success of the action plan, ensures that every initiative is financially viable and sustainable.

Regular reviews and iterations based on feedback and changing market dynamics keep the action plan agile and relevant.

Related: 5 Steps to Create an Actionable Employee Development Plan [with Templates & Examples]

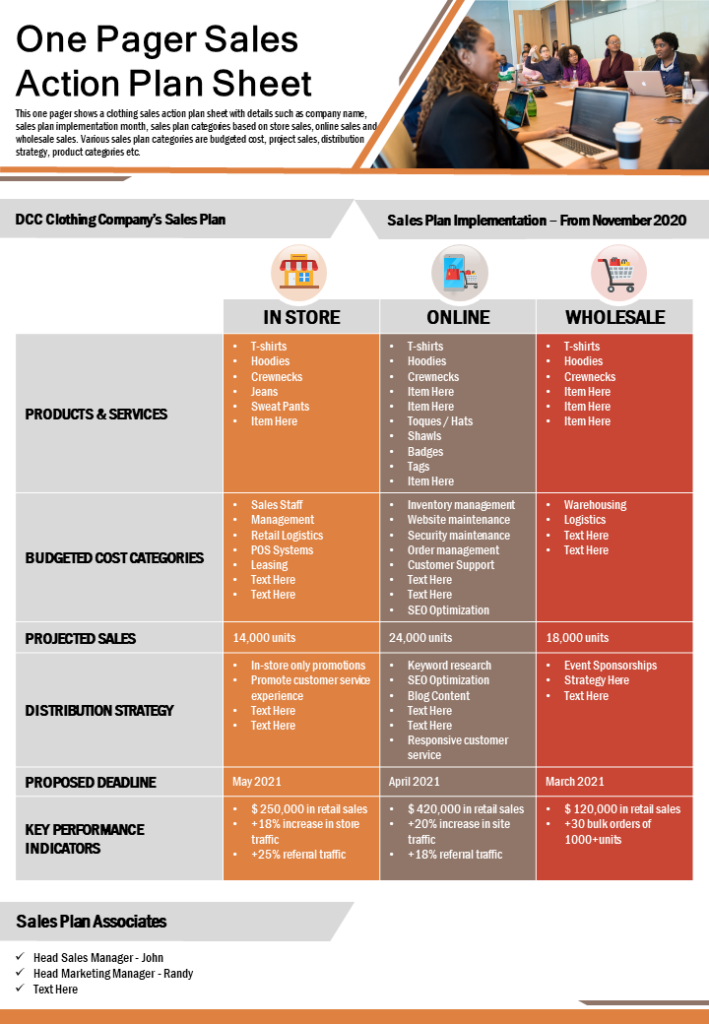

Company action plan example

A comprehensive company action plan serves as the strategic linchpin, ensuring a coherent and coordinated approach to realizing organizational goals. Central to this plan is the incorporation of rigorous market research and analysis, which provides insights into consumer behaviors, market trends and potential opportunities.

Equally vital is the focus on product development and procurement, ensuring that the offerings align with market demands and stand out in terms of quality and relevance.

Alongside, adept legal and financial management safeguards the company’s interests, ensuring compliance with regulations and prudent fiscal oversight.

Moreover, the essence of any successful company action plan lies in its sales and marketing strategies. These define how the products or services are positioned and promoted in the market, ensuring visibility and engagement with the target audience.

However, while acquisition is crucial, retention plays an equally significant role. Hence, impeccable customer service and nurturing relationships become indispensable components, fostering loyalty and ensuring that clients remain ambassadors for the brand long after the initial transaction.

Related: 30+ Project Plan Examples to Visualize Your Strategy (2023)

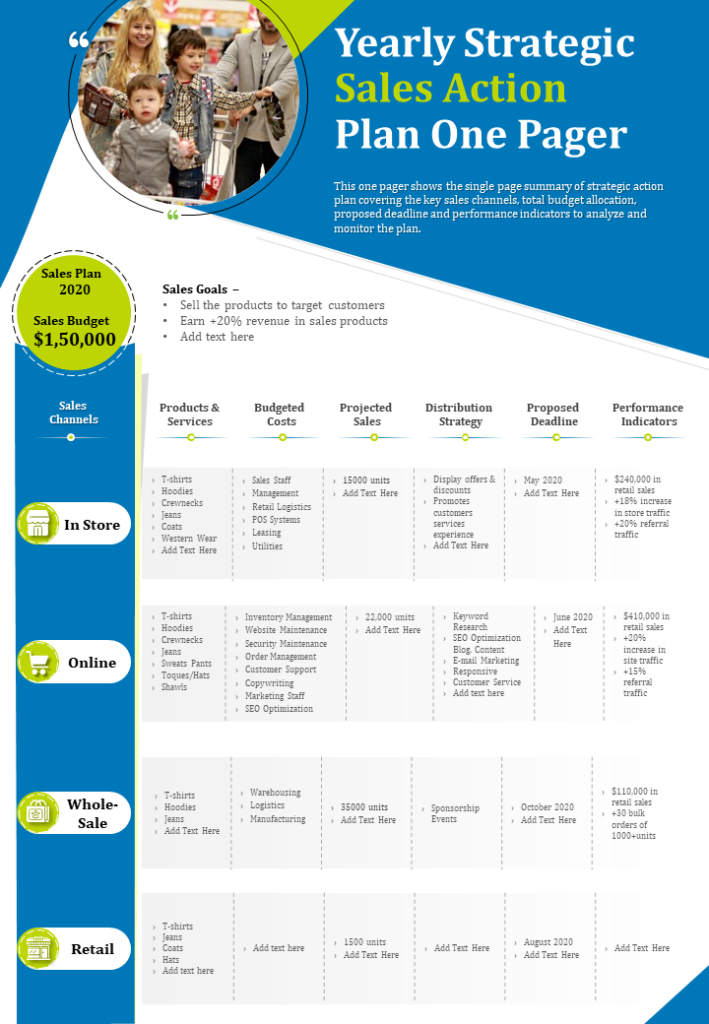

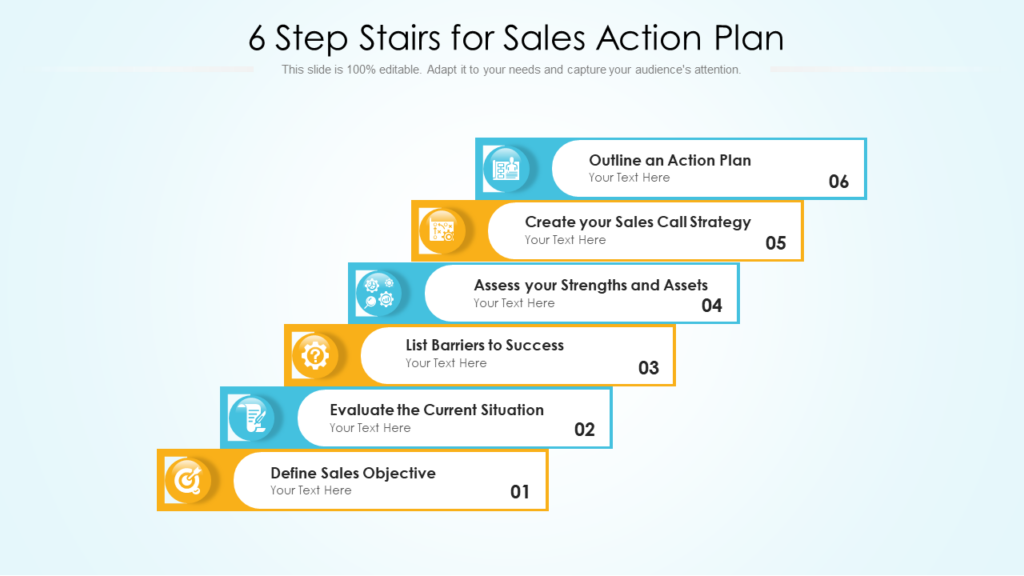

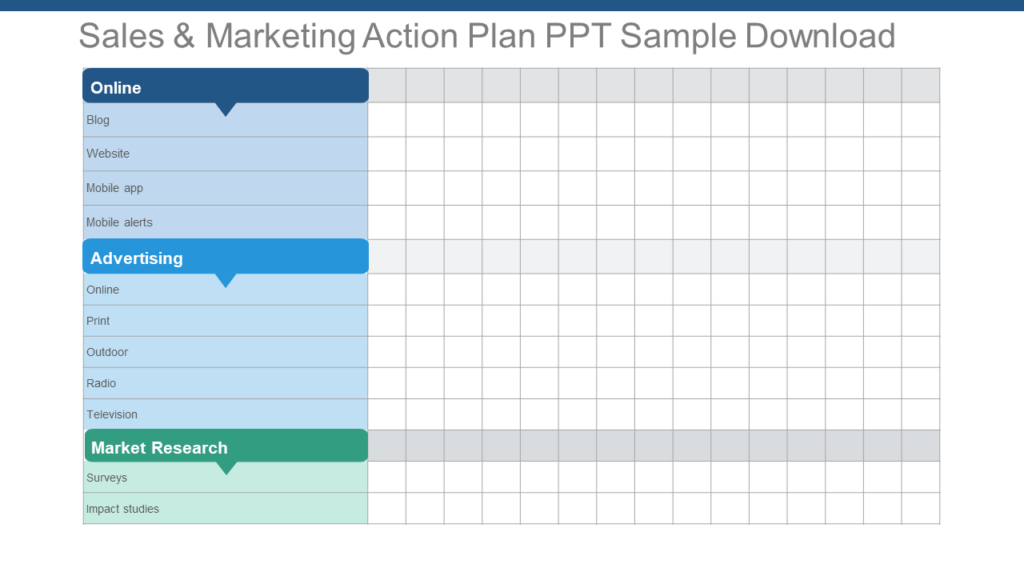

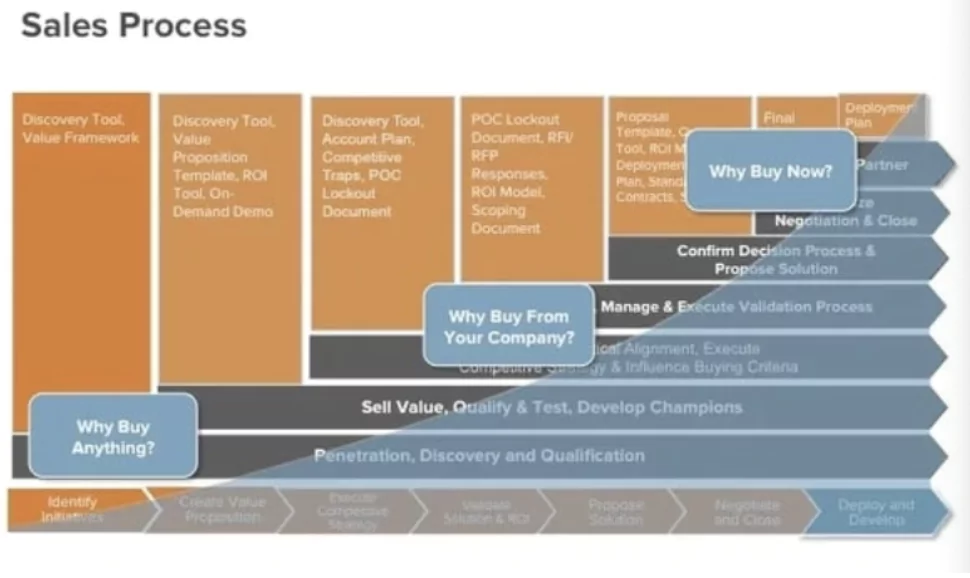

Sales action plan example

A well-structured sales action plan serves as the backbone for systematic and efficient progress. Central to this plan is the identification and utilization of the most effective sales channels, whether they are direct, online or through third-party avenues.

Clarity on the products and services on offer, combined with their unique selling propositions, facilitates tailored and resonant sales pitches.

Budget considerations ensure that resources are judiciously allocated, balancing the act between expenditures and potential returns. This financial prudence is complemented by setting realistic sales projections, which act as both a motivational target and a yardstick for success.

Timelines, or proposed deadlines, infuse the process with a sense of urgency, ensuring that the momentum of the sales drive is maintained.

However, the true measure of the action plan’s efficacy lies in its key performance indicators (KPIs). These metrics, be it lead conversion rates or customer retention figures, serve as tangible markers, highlighting the plan’s strengths and signaling areas that might require recalibration to increase sales.

Corrective action plan example

The essence of a corrective action plan lies in its meticulous structure, tailored to address and rectify deviations or inefficiencies identified within an organization. At its core, each action item serves as a focal point, detailing specific areas or processes that require intervention.

Accompanying each action item is a clear description that provides a comprehensive understanding of the issue at hand.

However, merely identifying a problem isn’t enough; delving deep into its origins through root cause analysis ensures that solutions target the fundamental issues, rather than just addressing superficial symptoms.

This analysis then paves the way for defining the corrective action, a tangible step or series of steps designed to mitigate the identified problem and prevent its recurrence.

Besides, to ensure the plan’s effectiveness, assigning a responsible person to each action item is paramount. This individual or team is entrusted with the task’s execution, ensuring accountability and focus.

The status of each action keeps stakeholders informed about the progress, be it in the planning phase, ongoing, or completed.

Lastly, setting a due date for each corrective action introduces a sense of urgency and purpose, ensuring that issues are addressed in a timely manner, minimizing disruptions and maximizing operational efficiency.

Simple action plan example

A simple action plan strips away the layers of complexity, offering a concise and direct approach to achieving a goal or addressing an issue. This type of plan is characterized by its straightforward structure, devoid of extraneous details, yet powerfully effective in its clarity.

It is specifically designed for tasks or objectives that don’t necessitate elaborate strategies or multi-layered approaches.

The core components of a simple action plan usually include a clear statement of the task or objective at hand, followed by a sequence of actions or steps to be taken.